Jobs week — What you need to know in markets this week

The first quarter has come to a close, and what a quarter it was.

When we started the quarter, Barack Obama was president, the Dow hadn’t cracked 20,000, and the markets were all about the “Trump trade.”

Now, Donald Trump is president, the Dow has broken 21,000, and markets are starting to drift away from the “Trump trade.”

In the first quarter, the S&P 500 rose more than 5%, the Dow was up just less than 5%, while the tech-heavy Nasdaq was up a whopping 10%. The small-cap Russell 2000, meanwhile, was a laggard, gaining just 2% during the quarter.

Meanwhile, the Fed raised rates again, the labor market continued to show strength, and the biggest macroeconomic story continues to be the strength of the U.S. consumer — albeit a highly divided one.

“Whichever way the confidence game breaks,” write analysts at Bespoke Investment Group, “markets continue to provide a fascinating lens on the world, though…current events aren’t always a recipe for a chaotic stock market.”

This week, we’ll get the latest check on the labor market with the Friday release of the latest jobs report, along with Wednesday’s private payrolls data from ADP. The government’s numbers are expected to show the economy added 180,000 jobs in March and the unemployment rate is expected to hold steady at 4.7%.

Elsewhere in the economy, we’ll get checks on the manufacturing sector, auto sales, and the minutes from the Fed’s latest monetary policy meeting.

Economic calendar

Monday: Markit manufacturing PMI, March (53.5 expected; 53.4 previously); ISM manufacturing PMI, March, (57.2 expected; 57.7 previously); Construction spending, February (+1% expected; -1% previously); Auto sales, March (17.3 million expected; 17.47 million previously)

Tuesday: Trade balance, February (-$44.7 billion expected; -$48.5 billion previously); Factory orders, February (+0.9% expected; +1.2% previously)

Wednesday: ADP private payrolls, March (+189,000 expected; +298,000 previously); Markit services PMI (52.9 previously); ISM non-manufacturing PMI (57.0 expected; 57.6 previously); FOMC minutes, March 14-15 meeting

Thursday: Initial jobless claims (250,000 expected; 258,000 previously)

Friday: Nonfarm payrolls, March (+180,000 expected; +227,000 previously); Unemployment rate, March (4.7% expected; 4.7% previously); Average hourly earnings, month-on-month, March (+0.3% expected; +0.2% previously); Average hourly earnings, year-on-year, March (+2.7% expected; +2.8% previously); Average weekly hours worked (34.4 expected; 34.4 previously); Consumer credit, February (+$12.5 billion expected; +$8.8 billion previously)

Great quarter, guys

Overall, the market started 2017 off with a bang, as most all sectors of the benchmark index were higher, long-term interest rates were ultimately little-changed, and the dollar was modestly weaker.

But if we run down the list of the best-performing stocks and sectors, what is noticeably, perhaps even glaringly absent, is any semblance of a “Trump trade.” In fact, anything that might’ve been resembling a bet on specific policies potentially set for proposal in the Trump era underperformed.

Following Donald Trump’s election win, hopes were pinned by many investors on lower taxes, looser regulations, and more infrastructure spending. Potential negative developments from trade also hang in the background of Trump’s economic plans.

A major winner after the election was financial stocks, which appeared set to benefit from both a combination of fewer regulations and lower tax rates, but in the second quarter the XLF ETF that tracks the sector gained a bit less than 3%. Since the election, XLF is still up about 18%.

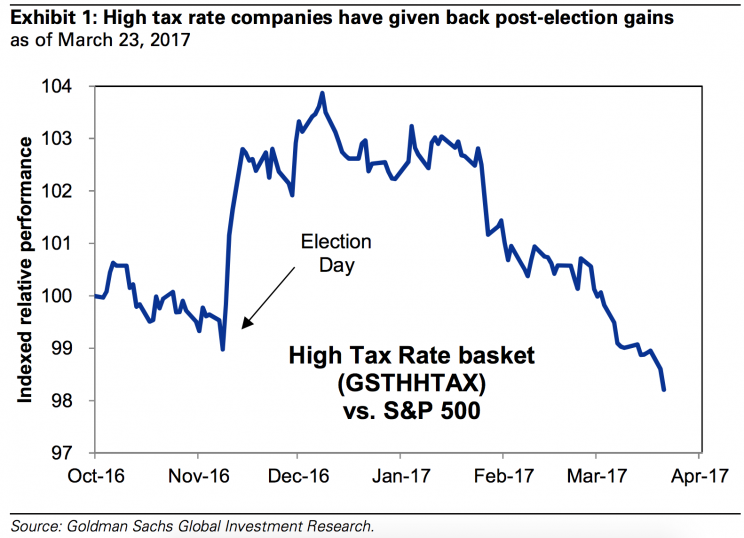

Data from Goldman Sachs put out earlier this week also shows that a basket of stocks tracked by the firm that should’ve been set to gain from lower taxes are now trading below where they were ahead of the election.

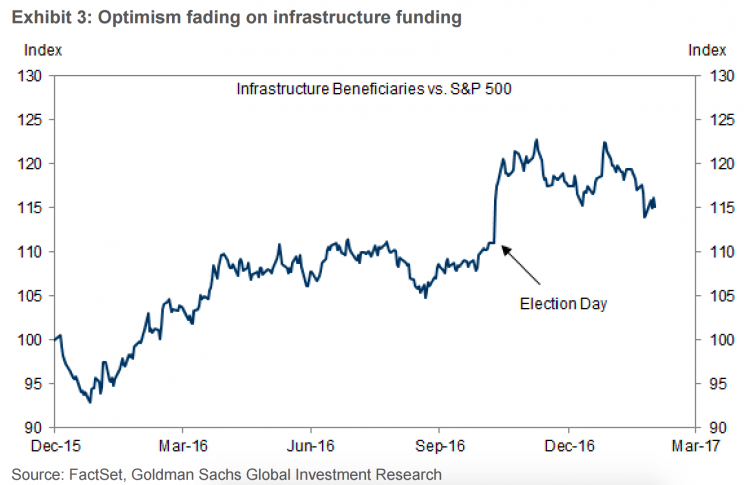

Meanwhile, stocks set to benefit from increased infrastructure spending have also lost steam.

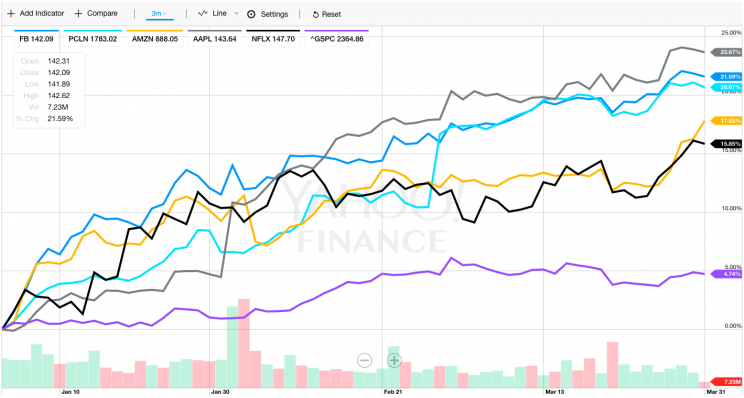

On the other side, we saw the emergence of something that perhaps was hiding in plain sight all along: big consumer tech names.

The S&P 500 tech sector gained over 10% during the quarter with Apple (AAPL) gaining 24%, Facebook (FB) adding 23%, Priceline (PCLN) gaining 21%, Amazon (AMZN), up about 18%, and Netflix (NFLX) adding 16%.

The first quarter, then, was when the idea of a “Trump trade” died.

And what emerged as winners were the companies powering our digital lives.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: