KBW, Nasdaq Partner on Financial Services Indexes

Nasdaq OMX (NDAQ) bolstered its indexing footprint today by unveiling a partnership with Keefe Bruyette & Woods (KBW). KBW, a unit of Stifel Financial (SF), specializes in financial services indexes, some of which are used as benchmarks for exchange traded funds.

Under the agreement, Nasdaq will assume responsibility for the calculation, dissemination and commercialization of these indexes, and will work closely with KBW to jointly promote the products and benchmarks to new market participants worldwide, according to a statement. Financial terms of the partnership were not disclosed.

The partnership with KBW helps Nasdaq expand an already lengthy partnership with Invesco’s (IVZ) PowerShares unit, the fourth-largest U.S. ETF issuer. Sectors targeted in the KBW/Nasdaq partnership banking, asset management, broker/dealer, insurance, equity REITs and mortgage finance.

KBW provides indexes for those market segments that are used by the following PowerShares ETFs: PowerShares KBW Bank Portfolio (KBWB) , PowerShares KBW Capital Markets Portfolio (KBWC) , PowerShares KBW Insurance Portfolio (KBWI) , PowerShares KBW Regional Bank Portfolio (KBWR) , PowerShares KBW Property & Casualty Insurance Portfolio (KBWP) , PowerShares KBW High Dividend Yield Financial Portfolio (KBWD) and the PowerShares KBW Premium Yield Equity REIT Portfolio (KBWY) .

Nasdaq is the index provider for two of the largest PowerShares ETFs, the PowerShares QQQ (QQQ) and the PowerShares Buyback Achievers Portfolio (PKW) , among other ETFs from the issuer. [A Preference for Nasdaq ETFs]

Nasdaq has been bolstering its indexing business in an effort to grab a larger slice of the booming ETF industry. Nasdaq intends to challenge rivals like S&P Dow Jones Indices, MSCI and FTSE Group that have capitalized on the quick growth in ETFs.

Earlier this year, Nasdaq paid $225 million Dorsey, Wright & Associates (DWA), an independent registered investment advisor that also provides indexes for an array of well-known ETFs. [Nasdaq Acquires Dorsey Wright]

There are 187 ETPs benchmarked to Nasdaq’s global indexes, currently, and in 2014 alone, 27 new ETPs began tracking Nasdaq Indexes. The ETPs represent $105 billion in assets under management, according to the statement.

The PowerShares ETFs affected by the Nasdq/KBW partnership have a combined $775 million in assets under management.

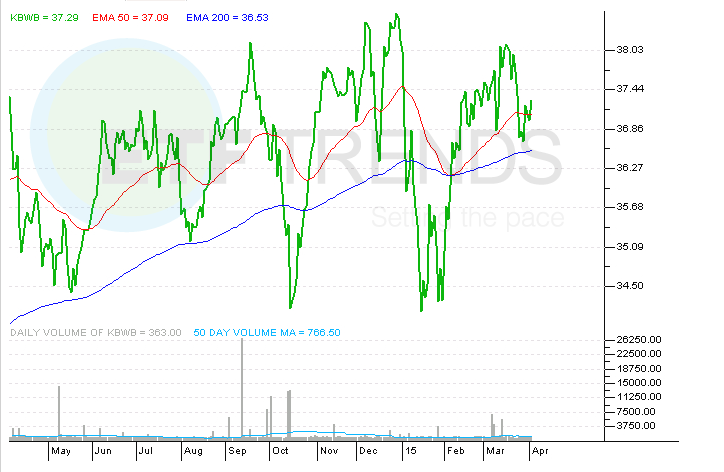

PowerShares KBW Bank Portfolio

ETF Trends editorial team contributed to this post. Tom Lydon’s clients own shares of QQQ.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.