Kronos Worldwide (KRO) Q1 Earnings, Sales Trump Estimates

Kronos Worldwide, Inc. KRO swung to a profit of $36.8 million or 32 cents per share in first-quarter 2017 from a loss of $3.8 million or 3 cents per share a year ago. Earnings per share topped the Zacks Consensus Estimate of 22 cents.

The results in the reported quarter were boosted by higher income from operations resulting from favorable impacts of improved selling prices, increased sales and production volumes and reduced raw materials and other production costs.

The chemical maker’s revenues climbed 16% year over year to $369.8 million in the quarter, driven by higher titanium dioxide (TiO2) selling prices and increased sales volumes. Sales also surpassed the Zacks Consensus Estimate of $350 million.

TiO2 segment profit was $56.5 million in the reported quarter, a significant increase from $3.8 million a year ago, aided by increased TiO2 selling prices and increased sales and production volumes.

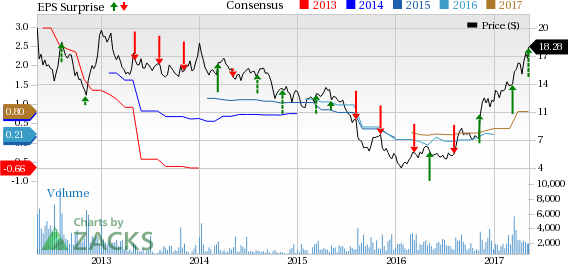

Kronos Worldwide Inc Price, Consensus and EPS Surprise

Kronos Worldwide Inc Price, Consensus and EPS Surprise | Kronos Worldwide Inc Quote

Volumes and Pricing

TiO2 sales volumes in first quarter rose 3% year over year on increased sales in the North American and export markets, partly masked by decreased sales in the European market.

TiO2 production volumes increased 10% year over year in the quarter. The company operated its production facilities at 100% of practical capacity in the quarter.

Average TiO2 selling prices went up 17% year over year in the reported quarter. Prices were also 4% higher compared with the end of 2016 with higher prices recorded across all key markets.

Balance Sheet

Kronos ended the quarter with cash and cash equivalents of $89.8 million, up around 62% year over year. Long-term debt was $360.9 million, up around 4% year over year. Cash flows from operating activities were $41.6 million for the reported quarter compared with cash used in operating activities of $15.3 million a year ago.

Outlook

Kronos expects its production volumes to be modestly higher in 2017 on a year over year basis as production rates this year will be favorably impacted by the implementation of certain productivity-enhancing improvement projects at some facilities.

The company also anticipated its sales volumes for 2017 to be comparable to 2016 levels assuming global economic conditions will not weaken further. It sees healthy demand for its TiO2 products across some of its primary markets.

Moreover, Kronos expects its cost of sales per metric ton of TiO2 sold for full-year 2017 will range from being comparable to modestly higher than the per metric ton cost in 2016.

Kronos also envisions income from operations in 2017 will be higher on a year over year basis, mainly due to an expected increase in average selling prices and the favorable impact of anticipated higher production volumes in 2017.

Price Performance

Kronos has significantly outperformed the Zacks categorized Chemicals-Diversified industry over a year. The company’s shares have rallied around 200% over this period compared with the industry’s gain of 18.2% over the same period.

Zacks Rank & Key Picks

Kronos is a Zacks Rank #1 (Strong Buy) stock.

Other well-placed companies in the chemical space include The Chemours Company CC, Huntsman Corporation HUN and Methanex Corporation MEOH, all holding a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Chemours has an expected long-term growth of 15.5%.

Huntsman has an expected long-term growth of 7.8%.

Methanex has an expected long-term growth of 15%.

Looking for Ideas with Even Greater Upside?

Today's investment ideas are short-term, directly based on our proven 1 to 3 month indicator. In addition, I invite you to consider our long-term opportunities. These rare trades look to start fast with strong Zacks Ranks, but carry through with double and triple-digit profit potential. Starting now, you can look inside our home run, value, and stocks under $10 portfolios, plus more. Click here for a peek at this private information >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Methanex Corporation (MEOH): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Huntsman Corporation (HUN): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research