LEARN FOREX - Trading the Rate of Change Indicator

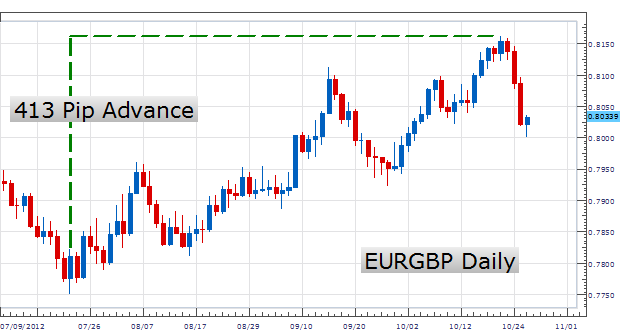

Finding and trading long term movements is the primary goal of Forex trend traders. However once a trend is found, it can be difficult to time an exact entry point for market orders. Below we can see an example of the EURGBP currency pair trending 413 pips higher over the past three months. How can traders plan their potential market entries? Today we will identify opportunities to trade the EURGBP trend using the Rate of Change indicator.

(Created using FXCM’s Marketscope 2.0 charts)

The Rate of Change indicator (ROC) can be extremely useful in pinpointing entries in the Forex market. Used as an oscillator, the ROC displays the amount a currency has changed over a designated period of time in reference to a zero line. A reading above the zero line indicates that the market price of the currency is greater than the start of the ROC period. A reading below is the opposite and contends that price is trading lower compared to the first ROC period. It is important to note that ROC is an unbound oscillator similar to CCIand that the higher or lower a reading is, the greater the previous change in price.

Taking the trend into consideration should always be primary when using ROC. Below we can see the EURGBP daily trend heading towards higher highs, meaning trend traders will look to buy the EURGBP. These new buy positions can be found using one of the most popular ROC signals, a zero line crossover. Traders in an uptrend will wait for the market to retrace, allowing the ROC oscillator to move below the zero line. As momentum returns with the trend buy signal may occur when ROC closes back above the zero line. Once a trade has been entered using ROC, risk can be managed by setting stops under a trendline or other area of support while setting up a positive risk/reward ratio.

Created using FXCM’s Marketscope 2.0 charts)

Using the ROC indicator, my preference is to buy the EURGBP on a new zero line crossover near .8030. Stops should be set under trendline support near .8000. First targets can look for a minimum 60 pips profit for a 1:2 Risk/Reward ratio.

Alternatives scenarios include the EURGBP breaking support and moving to lower lows.

---Written by Walker England, Trading Instructor

To contact Walker, email WEngland@FXCM.com . Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, send an email with the subject line “Distribution List” to WEngland@FXCM.com .

Want to learn more about trading RSI? Take our free RSI training course and learn new ways to trade with this versatile oscillator.Register HERE to start learning your next RSI strategy

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.