Lou Simpson Goes 2 for 2 in 3rd Quarter

- By James Li

Lou Simpson (Trades, Portfolio), manager of SQ Advisors LLC, eliminated his positions in Valeant Pharmaceuticals International Inc. (VRX) and U.S. Bancorp (USB) during the third quarter. With the proceeds from these two transactions, Simpson invested in Axalta Coating Systems Ltd. (AXTA) and Sensata Technologies Holding N. V. (ST). These transactions align with the guru's investing strategy of investing in understandable companies.

Warning! GuruFocus has detected 2 Warning Sign with VRX. Click here to check it out.

The intrinsic value of VRX

Brief investor introduction

Before he managed a $4 billion portfolio of company stocks, Simpson worked as chief investment officer for Geico, a subsidiary of Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway Inc. (BRK-A) (BRK-B). Simpson generally outperformed the Standard & Poor's 500 index benchmark: the guru averaged an annual return of 20.3% from 1980 to 2004. The Berkshire Hathaway CEO lauded Simpson's returns, claiming that the SQ Advisors manager should be inducted to the Investment Hall of Fame.

While Simpson generally shared investing ideas with Buffett, the SQ Advisors manager generates long-term capital appreciation through an "eclectic" investing approach involving conversations with competitors and top management instead of Wall Street-generated research. Simpson peruses company filings with the Securities and Exchange Commission as part of his deep company research.

Guru takes stake in two growing companies

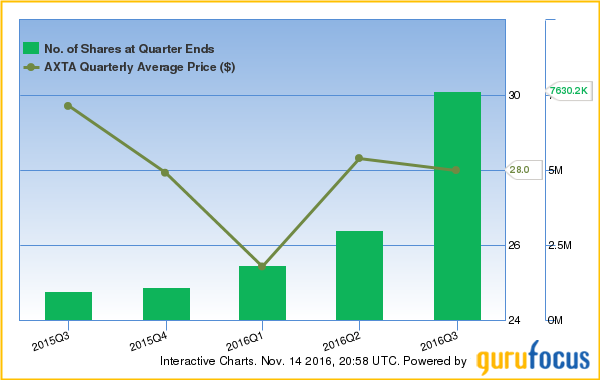

Simpson purchased 5,286,522 shares of Axalta Coating Systems, resulting in a portfolio increase of 5.95%. The specialty chemicals company averaged $28 per share during the third quarter.

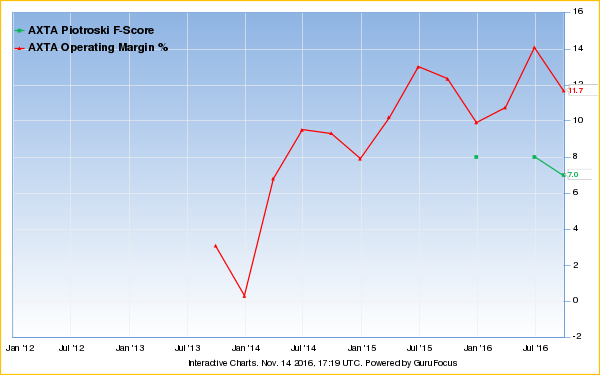

Even though the company has a modest financial strength rank of 4, Axalta Coating has strong Piotroski F-scores and operating margins. During the past two years, the company's operating margin increased quarter over quarter. Additionally, Axalta Coating's minimum F-score is a high 7 out of 9.

The management of Axalta Coating discussed the company's strong performance in its third-quarter 10-Q filing with the SEC. The "leading global manufacturer" of high performance coating systems reported net income of $71.2 million during the first nine months of 2016, outperforming the net income for the first nine months of 2015 by about $12 million. The increases in net income were likely due to a net sales growth of 2.5% during the third quarter.

The company's third-quarter earnings report further details the company's strong performance: even though the company reported a net loss of $10.7 million, the company's constant currency net sales increased 4.4% compared to the prior year's third-quarter net sales. CEO Charles W. Shaver lauded the company's strong top line and adjusted EBITDA performance, primarily due to strong operating profitability and business developments.

As the company expects high growth potential, several gurus invested in Axalta Coating. Chris Davis (Trades, Portfolio) and Barrow, Hanley, Mewhinney & Strauss both took a stake in the chemical company, with the latter purchasing 2,603,030 shares. Additionally, Diamond Hill Capital (Trades, Portfolio) added 154.24% to its stake.

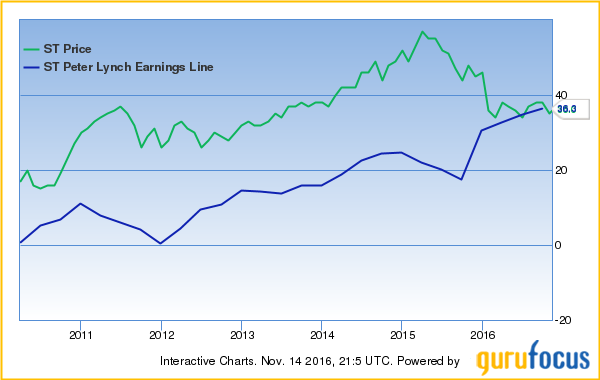

Simpson also invested in 2,284,420 shares of Sensata Technologies, increasing his portfolio by 3.53%. The computer hardware company averaged $37.77 per share during the third quarter and currently trades slightly below its Peter Lynch earnings line.

Like Axalta Coating, Sensata Technologies also has a financial strength rank of 4. However, the industrial technology company has a profitability rank of 8, suggesting high and sustainable profitability in the short term. Sensata's operating margin and return on equity outperform 88% and 94% of global scientific and technological instruments companies respectively. Additionally, the company's return on invested capital outperforms its WACC, suggesting value creation.

Sensata's board of directors further discussed the company's strong third-quarter in the 10-Q SEC filing: total net revenues increased 8.6% from third-quarter 2015 to third-quarter 2016. The Sensing Solutions division revenues climbed over 36% while the Performance Sensing division revenues increased a modest 1.4%. Market stabilization in Europe and China mainly led to strong revenue growth in Sensing Solutions.

As the company presents high value potential, Glenn Greenburg also invested in Sensata Technologies. The portfolio manager at Brave Warrior Advisors LLC purchased 3,085,374 shares, increasing his portfolio 5.79%.

Guru exits from underperforming Valeant and regional U.S. bank

The manager at SQ Advisors eliminated his position in U.S. Bancorp and Valeant Pharmaceuticals. The former averaged $42.48 per share while the latter averaged $25.88 per share.

U.S. Bancorp has a poor Piotroski F-score of 3, suggesting a weak business operation. Although its profitability ranks 7 out of 10, the regional U.S. bank currently trades near a 10-year high and has a price-to-sales ratio near a five-year high. Additionally, U.S. Bancorp's three-year earnings per share growth underperforms 61% of regional U.S. banks.

With a financial strength rank of 3, Valeant Pharmaceuticals has a weaker financial outlook than does U.S. Bancorp. The company has negative operating margins and returns, underperforming over 75% of global specialty drug manufacturers.

Valeant reported a loss per share of $3.49 based on generally accepted accounting principles, which underperformed the loss per share for the previous two quarters. Likely due to declining product sales in their existing businesses, the pharmaceutical company's total revenues dropped 11% from third quarter 2015 to third quarter 2016. Goodwill impairment charges of $1.05 billion during the quarter most likely resulted in the weak earnings performance.

After Valeant's third-quarter earnings report came out Nov. 8, the company's stock price dropped to $14.98 per share. Valeant traded at $17.55 per share as of Nov. 14, which is still significantly lower than its price on Nov. 1.

Both Diamond Hill Capital (Trades, Portfolio) and Ruane Cuniff trimmed their position in Valeant during the third quarter.

See also

GuruFocus provides two types of guru picks: latest guru picks and real-time picks. Due to SEC regulations, the former is updated quarterly while the latter is reported within 10 business days. A real-time pick occurs when an investor owns more than 5% of a company and makes a transaction within that company. SEC requires the investor to report this trade in a Schedule 13D form. The standard 13F form reports the investor's quarterly portfolio holdings.

Premium members have access to all real-time stock picks and over 150 guru's portfolios. Additionally, the premium membership gives access to all value screeners, including the All-in-One Guru Screener that offers over 150 filters.

The premium plus membership gives further access, including backtesting for up to 10 years, the Manual of Stocks for all U.S. companies, and over 4000 institutional 13F and 13D filings. Please refer to the membership levels page for all member benefits. If you are not a member, we invite you to a free seven-day trial.

Disclosure: The author has no position in the stocks mentioned in this article.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 2 Warning Sign with VRX. Click here to check it out.

The intrinsic value of VRX