Mexico's Media Landscape is Changing, but Will it Affect Televisa's Profits?

The Mexican legislative landscape has been changing over the past few months, and last week President Enrique Pena Nieto proposed a bill to rein in the country's largest industry players, in order to reduce some of their concentrated market power. While Carlos Slim's America Movil SAB de CV (ADR) (AMX) will likely suffer the most from bill, prohibiting his firm to enter the TV industry until 2016, Grupo Televisa, S.A.B. (TV) will also have to pull back on its market expansion, in order to make room for new market entrants. However, many investment gurus like Pioneer Investments (Trades, Portfolio) and Howard Marks (Trades, Portfolio) remain confident that the TV giant will continue to do well in the future, thus leading them to buy Televisa shares this past quarter.

Superior market dominance will ensure growth

It's no surprise that the Mexican government is keen on reducing Televisa's market power in the future, given the firm's position as the largest media company in the Spanish-speaking world. Management has done an outstanding job in concentrating on its broadcast channels in Mexico, and today, the content generating empire owns a library of 77,000 hours of programming for its broadcast networks and 21 pay TV channels. Furthermore, its production of telenovelas has earned it a special popularity amongst Spanish speakers over the world, with subscribers reaching across North America, Asia, Europe, and Latin America. And while the company competes with TV Azteca in the broadcasting market, its programming and scale advantage have allowed it to sustain a 70% total audience share in Mexico, only 3% down from 2002 (which is unusual in the TV business).

But it is Televisa's opportunistic investments that have helped it expand and grow over the long term. The Mexican pay TV territory is covered by the company's ownership stakes in its satellite joint venture with DirecTV (DTV)'s Sky Television, and stakes in triple play (pay TV, voice, and data services) companies Cablevision Systems Corporation (CVC), Cablemas, and TVI. But the most significant expansion deal was struck in 2010, when the firm invested $1.2 billion in Univision, giving Televisa an initial 5% equity stake, along with 15-year debentures to be converted into another 30% stake. Not only will the company benefit in the long term from the 16% higher royalty rate that begins in 2018, but the distribution partner is the most important link to the Spanish speaking audience in the U.S. As the agreement is valid until 2025, investors can expect market share and revenue growth to remain solid in the long term, even with new market entrants on the horizon of Mexico's TV industry.

Valuation

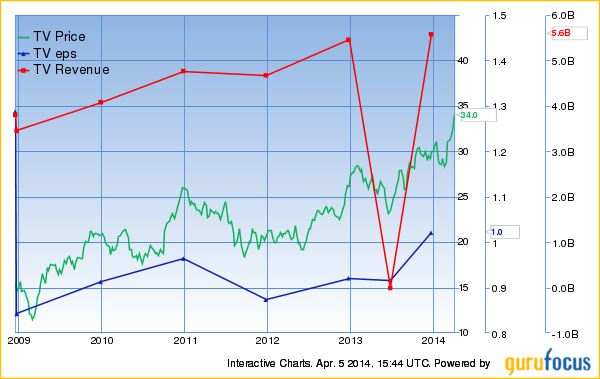

Looking forward, Televisa's programming prowess and scale advantage should allow revenue to continue its current 6.7% growth rate until 2017, hovering above 6% every year, due to 5% growth in its content segment, 9% growth in the Sky TV satellite business, and 7% increase in the cable and telecom segment. Also, while operating margins experienced a strong decline in 2012, fiscal 2013 showed a different picture, with values rebooting to 25.4% and EBITDA margin expansion expected at 38% for the following years.

Also, after sluggish earnings growth in the first half of 2013, Televisa managed to pick up its pace, sporting a 10.2% growth rate and closing the year with an EPS of $1.02, in addition to a healthy ROE of 11.3%. However, I would advise investors to hold off for the moment on buying the company's stock, as the current trading price of 39.9x trailing earnings is sporting a whopping 114% price premium relative to the industry average of 18.6x. But once Mexico's regulatory scenario is defined, I believe another look at this industry giant will be worthwhile.

Disclosure: Patricio Kehoe holds no position in any stocks mentioned.

This article first appeared on GuruFocus.