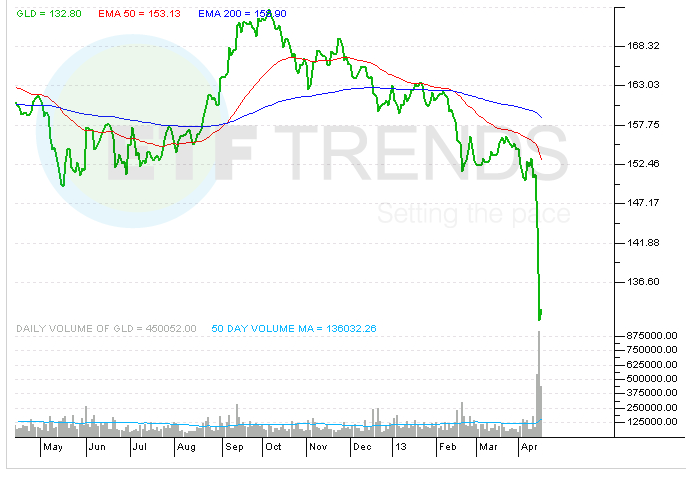

No Capitulation Selling in Gold ETF During Crash

SPDR Gold Shares (GLD) saw record trading volume of nearly 94 million shares during Monday’s violent drop in the precious metal’s price. However, the gold ETF experienced very little in the way of net outflows, suggesting many traders viewed Monday’s 9% decline as a buying opportunity.

The $51.2 billion ETF saw net redemptions of only $189 million on Monday after outflows of about $1.1 billion on Friday, according to IndexUniverse data.

Monday’s slight redemptions mean that buyers and sellers were fairly evenly matched in GLD. There was no sign that investors in the ETF were panicking or capitulating in the face of the plunge in gold prices. [Gold ETF Record Volume]

“GLD is simply the way in which many people have established their exposure to gold. The price of gold is a function of supply and demand,” said Chris Hempstead, director of ETF execution services, in a note Tuesday.

It’s difficult to quantify the impact that bullion-backed ETFs have had on gold’s price during the way up in the historic rally. The physical markets — demand for jewelry and gold coins and bars — are primarily what determine the metal’s price. [Gold ETFs: What's Behind the Drop and Will It Continue?]

But it’s hard to entirely dismiss the role that gold ETFs have played the past few years as the funds multiply in number and assets. After all, GLD would still rank high on the list of bullion holdings among the world’s central banks. There is no denying that ETFs have made it much easier to trade and invest in gold.

Now the question is if gold ETFs could speed a price decline if investors dump their holdings.

“So far this year, the $57 billion GLD has shed more than $15 billion in assets, a full 28% lower than where the fund started the year. The SPDR Gold … dropped 13% in value over the course of Friday and Monday, dropping to its lowest levels since 2011,” reports Chris Dietrich for WSJ.com MoneyBeat.

Still, Brendan Conway at Barron’s points out that Monday’s GLD outflows were “surprisingly small” in light of the metal’s 9% slump.

“Exchange-traded fund investors have a reputation as the ‘fast’ money. But the opposite is true in gold, where analysts use words like ‘sticky’ to describe their behavior,” Conway wrote. “With so many ETF holders standing pat, it sure looks like you can’t blame ETF investors — they were merely along for the ride.”

The bottom line is that Monday’s vicious price decline didn’t cause gold ETF investors to throw in the towel.

SPDR Gold Shares

Full disclosure: Tom Lydon’s clients own GLD.

The opinions and forecasts expressed herein are solely those of John Spence, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.