The Only Pure-Play SoCal Industrial REIT

On March 13, Citi Research initiated coverage on $885 million cap Rexford Industrial Realty Inc (NYSE: REXR) in a report titled: "Tyrannosaurus Rex-Ford Has a Big Appetite for SoCal Industrial."

Citi initiated Rexford at a Neutral rating -- while notably viewing REXR as an "overweight" in its REIT portfolio -- with a $17 price target, representing a 9.3 percent upside, including ~3 percent dividend yield.

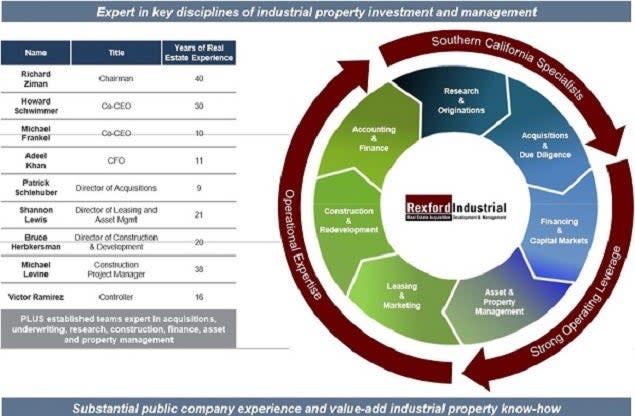

Source: Rexford Industrial presentation - data as of 9/30/14

Rexford currently owns a portfolio of 101 properties, containing ~10.5 million SF, which is concentrated in the infill markets of Southern California.

Tale Of The Tape

While Rexford has no true peer in the industrial REIT sector, there are several industrial REITs of similar size which also have geographically focused portfolios, and/or own portfolios with a concentrated tenant strategy.

Terreno Realty Corp. (NYSE: TRNO) - LA/Long Beach is one of six major port markets where TRNO is focused, with the balance of its portfolio in: Northern New Jersey/New York City, Miami, Seattle, San Francisco Bay Area and Washington D.C./Baltimore.

Monmouth REIC (NYSE: MNR) - Monmouth continues to grow primarily by acquiring new single-tenant build-to-suit industrial properties. Approximately 50 percent of MNR's rental income comes from a single tenant, FedEx. Monmouth has no West Coast assets.

STAG Industrial (NYSE: STAG) - STAG, or Single Tenant Acquisition Group, is uniquely focused on owning Class-B facilities leased to creditworthy tenants in secondary markets in the Midwest, Northeast and Southern U.S. markets. Another differentiator for Rexford is that it has a mixture of both single-tenant and multi-tenant properties.

Citi Rationale - Rexford Industrial: Neutral, $17 PT

Rexford Industrial benefits from the high barrier to entry and growth constrained markets where it operates as a "sharpshooter" tracking deals exclusively in the SoCal markets it knows best.

External Growth:

"Los Angeles County contributing 54% of annualized base rents, followed by San Diego County, Orange County, San Bernardino County, and Ventura County at 15%, 14%, 9%, and 8%, respectively."

Citi noted that Rexford had completed ~$433m of acquisitions in the last 24 months, with wide cap-rate spreads compared its cost of capital.

Citi sees opportunities for continued external growth in REXR's backyard markets which should be able to move the needle given its relatively small asset base.

Organic Growth:

Citi noted that while Rexford's portfolio occupancy is currently ~91 percent, management has guided upward to levels between 93 and 94 percent.

This should be an opportunity for Rexford to grow rents as leases roll, "as evidenced by average 11.8% GAAP releasing spreads" since the REXR $14 IPO in July 2013.

The small average tenant size is another plus for Rexford when it comes to growing its NOI organically.

Source: Rexford presentation

Citi noted that Rexford has in-house construction capabilities "to reposition assets that they have acquired or have been vacated." Currently, Rexford is redeveloping four projects with two slated for future work, and Citi anticipates that rent roll-overs will be at substantially increased rates for the vacant space.

Citi - Rexford Valuation Metrics

Citi's 2015 FFO is $0.84 and AFFO estimate is $0.71. (Rexford does not provide FFO per share guidance and analyst coverage of REXR is limited).

Citi's NAV estimate of ~$16.30 "is the result of applying a 5.5% cap rate to NOI and reflects the January follow-on offering."

Rexford shares are trading "at a 5.6% implied cap rate, a premium to peers," but Citi feels this is justified due to the high-demand infill SoCal markets.

Notably, Citi mentioned that while Rexford's 3 percent dividend yield is at the lower end of its peer group, it is well covered at only 67 percent of FFO, and could be increased.

Citi - Rexford Risk Factors

Citi noted that "given REXR's significant exposure to Southern California, any localized economic weakness or unforeseen events could disproportionately impact shares."

The SoCal industrial market is the largest in the U.S., containing approximately two billion square feet of space; packed into a densely populated region, in close proximity to the busy ports of LA/Long Beach.

However, seismic risks could make the Rexford's SoCal "pure-play" a bit of a dual-edged sword for investors to consider.

Latest Ratings for REXR

Mar 2015 | Citigroup | Initiates Coverage on | Neutral | |

Feb 2015 | Jefferies | Upgrades | Hold | Buy |

Oct 2014 | MLV & Co. | Initiates Coverage on | Buy |

View More Analyst Ratings for REXR

View the Latest Analyst Ratings

See more from Benzinga

Citi Weighs In On REIT Sector M&A Trends: Is Simon/Macerich Just The Start?

Jefferies Weighs In Oil Prices & REITs - Apartment Supply/Demand

© 2015 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.