An overlooked part of Amazon will be in the spotlight when the company reports earnings

(Reuters)

Amazon CEO Jeff Bezos.

Amazon investors got a nasty surprise last quarter when shipping costs spiked more than expected.

But they have also cheered the growth in Amazon's Prime membership business, which helps Amazon sell people more stuff.

The best way to get a read on both trends in Amazon's business is to look at the company's deferred revenue, which is made up mostly of Prime membership fees that aren't recognized all at once.

This typically overlooked bit of revenue will suddenly be in the investor spotlight when Amazon reports quarterly financial results on Thursday, with investors deeming it a proxy for the growth in Amazon's increasingly important Prime business.

An abnormal 'step up'

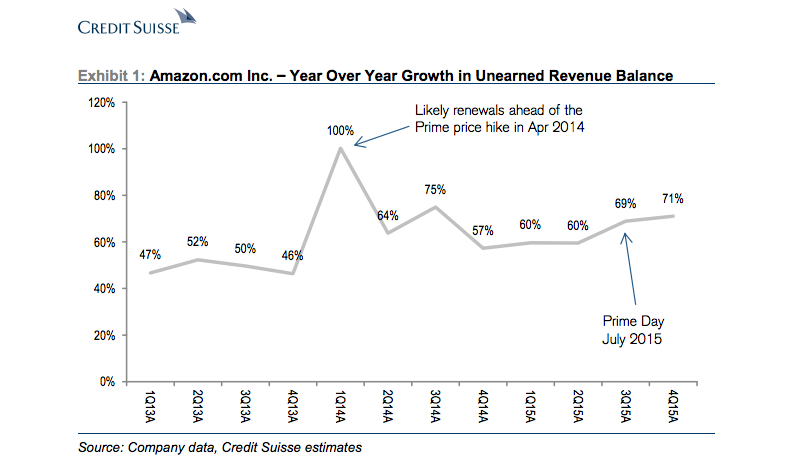

According to a note by Credit Suisse last week, Amazon's deferred, or "unearned," revenue growth picked up pace over the past two quarters. Unearned revenue represents the amount the company receives in advance of providing its service, and a fixed portion of it gets recognized as revenue as the service gets delivered.

Amazon's unearned revenue is made up mostly of the $99 Prime annual fee from both new and renewing subscribers. Amazon collects the annual fee upfront and then recognizes one-12th of the $99 fee every month as revenue.

As seen in this chart by Credit Suisse, Amazon's unearned revenue growth saw an increase both sequentially and annually last quarter, reaching a 71% growth rate, the highest in more than a year.

(Credit Suisse)

Credit Suisse analyst Stephen Ju points out that the sudden spike in this line item over the past two quarters indicates that Amazon Prime growth is accelerating. But as a result the company's shipping costs could have increased more than expected, thus pressuring its gross margins.

"Netnet, we believe the acceleration in growth of this line item in 3Q15 — likely as a result of Prime Day in July 2015 — and the continued strength in 4Q15 indicate that Amazon is more rapidly driving Prime adoption," Ju writes. "There is a near-term impact to gross margin due to a step-up in Prime shipping costs that we believe is often overlooked."

Ju describes it as an "abnormal step-up" in Prime adoption, noting that it might have partially caused Amazon to report lower-than-expected gross margins last quarter. Investors drove Amazon shares down more than 12% after earnings last quarter, in part because of concerns over rising shipping costs, which jumped 37% year-over-year.

Unearned revenue will draw more attention as Amazon reports its first-quarter earnings Thursday, as it could be a proxy for tracking growth in Prime, a key part of Amazon's overall business. Prime members are believed to be more loyal and higher-spenders than non-Prime members. It will also give a hint to how Amazon's shipping fee fluctuates this quarter.

Here is what analysts are expecting from Amazon's earnings, according to Yahoo Finance:

Q1 earnings per share (EPS): $0.58, up from a loss of $0.12 in Q1 2015.

Q1 Revenue: $27.99 billion, up about 23.2% from $22.72 billion in the year-ago period.

Long term, Ju believes unearned revenue growth is a positive because it will drive more transactions and better margins, especially as Amazon figures out a way to find less expensive and more efficient logistics solutions. In fact, Amazon is already rumored to be working on its own full-blown logistics network that would decrease shipping costs.

NOW WATCH: I found 9 years' worth of messages hidden in my secret Facebook inbox

More From Business Insider