S&P 500’s Race Above 2,000 Lifts Cash for its ETFs

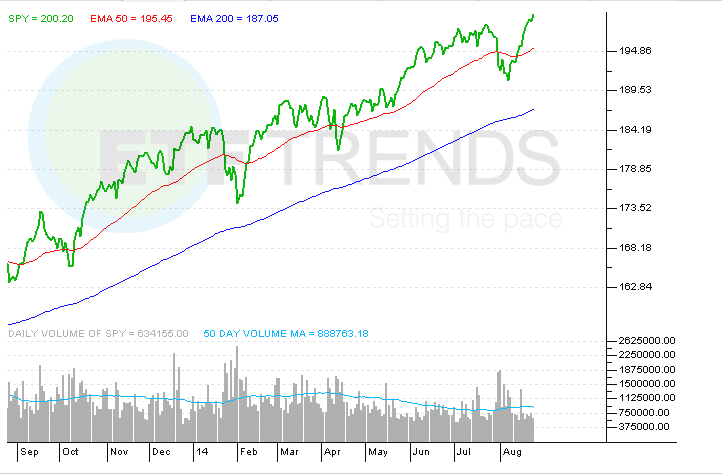

The S&P 500, the benchmark U.S. equity index, closed above 2,000 for the first time on Tuesday, about 16 and a half years after it first touched 1,000.

With Tuesday’s gain of 0.1%, the S&P 500 is up 1.1% over the past month, not a jaw-dropping performance but one that has been enough to stoke substantial inflows to S&P 500 tracking ETFs.

Amid the run to 2,000, investor poured over $3.4 billion into the SPDR S&P 500 ETF (SPY) in the week ended Aug. 25, the first day in which the S&P 500 traversed 2,000 before settling below that much ballyhooed level. SPY, the world’s largest ETF by assets, is still saddled with year-to-date, but data confirm that the S&P 500’s ascent to 2,000 is a boon for SPY and its rivals. [S&P 500 ETFs Hauling in Cash]

Over the same period, the iShares Core S&P 500 ETF (IVV) and the Vanguard S&P 500 ETF (VOO) added a combined $574 billion. VOO and IVV are two of the top-six asset-gathering ETFs this year.

In fact, no ETF has added more new assets this year than the $5.22 billion added by VOO. During the third quarter, only the iShares MSCI Emerging Markets ETF (EEM) has gained more assets than IVV. [Big ETFs Performing Well]

Gains for the S&P 500 are not just buoying traditional cap-weighted ETFs tracking the index. The Guggenheim S&P Equal Weight ETF (RSP) added $213 million for the week ended Aug. 25, or about $22 million more than was allocated to IVV. [Pay Attention to Equal-Weight S&P 500 ETF]

RSP has lived up to its reputation of outperforming the cap-weighted S&P 500 with a year-to-date gain that is 100 basis points ahead of the cap-weighted index.

Fun facts courtesy of S&P Dow Jones Indices:

The 2000.02 close surpassed the prior record high of 1997.92 set on [August 25, 2014]

Crossed the 2000 intra-day mark for the first time on August 25, 2014.

30 new record highs YTD

66 of the original 500 companies remain in the S&P 500 today

S&P 500 surpassed 1000 for the first time on February 2, 1998 when it closed at 1001.27

o 225 issues remain in the S&P 500 today

SPDR S&P 500 ETF

ETF Trends editorial team contributed to this post. Tom Lydon’s clients own shares of EEM, RSP and SPY.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.