Philippines ETF Shines in Emerging Asia

The Philippines exchange traded fund is one of the best performing emerging Asia market this year as the local economy flourishes and export activity picks up.

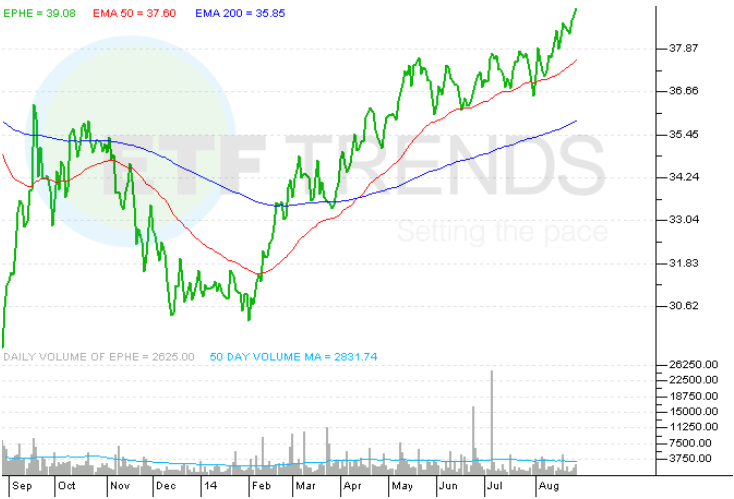

The iShares MSCI Philippines ETF (EPHE) has gained 24.6% year-to-date, while the broader iShares MSCI Emerging Markets ETF (EEM) is up 9.9% so far this year. [Time to Reconsider Emerging Markets ETFs, Says BlackRock]

The Philippine economy expanded 6.4% in the second quarter year-over-year, strengthening on increased spending on infrastructure, higher remittance from overseas workers and greater local consumption, which accounts for just under two-thirds of the economy, reports Chris Larano for the Wall Street Journal.

“The economy is really driven from within,” Luz Lorenzo, economist and market strategist at Maybank ATR-Kim Eng Securities, said in the article.

The consumer staples sector makes up 7.1% of EPHE’s underlying portfolio while consumer discretionary accounts for 5.2%.

Moreover, export growth has also strengthened the markets. The country has developed a competitive manufacturing industry and will continue benefit as low-end manufacturers leave China due to higher wages. Specifically, manufacturing increased 10.8% for the second quarter year-over-year.

Consequently, Credit Suisse projects the economy to grow at a healthy pace over the next few quarters on the improved outlook for the manufacturing and export industries.

Analysts expect the Philippine economy to grow 6% to 7% this year.

However, with inflation now at a three-year high, economists warn that the central bank could hike rates at its next meeting on September 11 to keep the economy from overheating. Higher rates would slow the rate of consumption in the months ahead. In comparison, other Asian central banks have been easing their monetary policies to stimulate their economies.

iShares MSCI Philippines ETF

For more information on the Philippines, visit our Philippines category.

Max Chen contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.