PowerShares Adds to Low Duration Lineup With Laddered Corporates ETF

Invesco’s (IVZ) PowerShares, the fourth largest U.S. issuer of exchange traded funds, today introduced the PowerShares LadderRite 0-5 Year Corporate Bond Portfolio (LDRI) .

LDRI, which qualifies as a strategic beta fixed income offering, could be a new option for investors concerned about rising interest rates to consider due to the ETF’s lower duration and laddering approach.

Only dollar-denominated bonds issued by companies in the U.S., Canada, Japan and Western Europe are eligible for inclusion in the NASDAQ LadderRite indices, according to NASDAQ. Bonds must have a minimum credit rating of BBB- to be included.

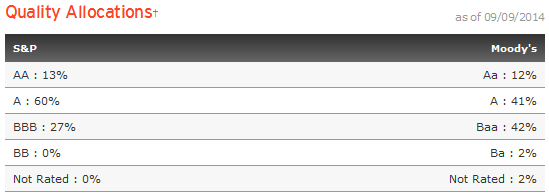

The new ETF has an effective duration of 2.22 years with a yield to maturity and yield to worst of 1.3%, according to PowerShares data. LDRI is an investment-grade offering with 87% of its portfolio allocated to issues rated A or BBB by Standard & Poor’s. The remaining 13% is rated AA.

“In today’s low-rate environment, investors continue to be wary of interest rate risk in their pursuit of investment income” said Dan Draper, Invesco PowerShares Global Head of ETFs, in a statement. ”LDRI provides what we view as a more intelligent solution to help investors address this ongoing challenge compared to many existing fixed income solutions in the marketplace.”

LDRI adds to PowerShares’ expanding lineup of low duration ETFs that includes the PowerShares Senior Loan Portfolio (BKLN) , Powershares Global Short Term High Yield Bond Portfolio (PGHY) and the PowerShares Variable Rate Preferred Portfolio Fund (VRP) . VRP, one of the newest preferred ETFs, debuted in May and already has $67.5 million in assets under management. With an effective duration of just four years, VRP has one of the lowest durations among preferred ETFs. [New Preferred ETF off to Solid Start]

LDRI’s “laddering methodology evenly staggers bond maturities so that they occur on regular intervals, providing an efficient balance between risk and return, which may help investors manage volatility during a period of rising interest rates,” said PowerShares in the statement.

LDRI holds 45 issues with 44.3% hailing from the financial services sector. The consumer staples and energy sectors also receive weights of north 8.3% in the ETF. LDRI charges just 0.22% per year.

LDRI Credit Quality

Table Courtesy: PowerShares

ETF Trends editorial team contributed to this post.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.