The gloomy profits narrative underlying the stock market just got worse

Earnings growth for America’s biggest companies has been lackluster for a while. We’re currently getting confirmation that S&P 500 (^GSPC) earnings fell by around 4% year-over-year during the second quarter, which would reflect the fifth straight quarter of declines.

It has been the case that experts had forecast a sharp rebound in earnings growth during the second half of 2016 and accelerating in 2017. But even that story is deteriorating.

“This past week marked a change in the aggregate expectations of analysts from slight growth in year-over-year earnings (0.3%) for Q3 2016 to a slight decline in year-over-year earnings for Q3 2016 (-0.1%),” FactSet’s John Butters observed on Friday. “Expectations for earnings growth for Q3 2016 have been falling not just over the past few weeks, but over the past few months as well. On March 31, the estimated earnings growth rate for Q3 2016 was 3.3%. By June 30, the estimated growth rate had declined to 0.6%. Today, it stands at -0.1%.”

In other words, the gloomy profits narrative underlying the stock market just got renewed for another quarter.

This is troubling as earnings and expectations for earnings growth are the most important drivers of stock prices. And stock prices have only been going up lately. On Friday, the S&P 500 closed at a record 2,175.

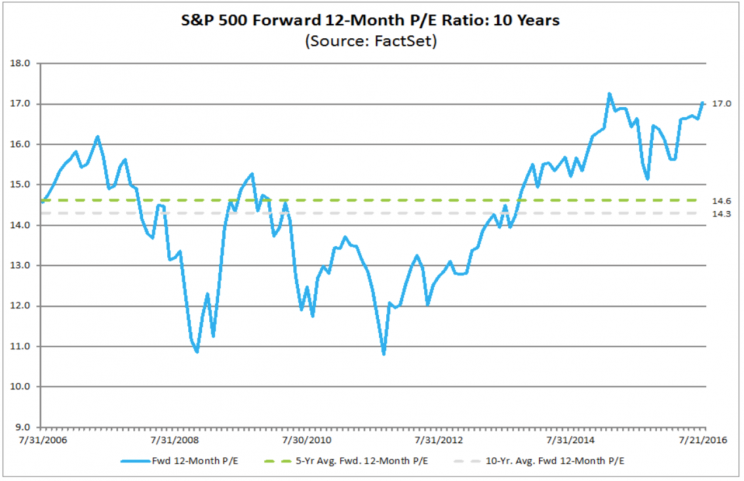

Rising stock prices and falling earnings expectations have caused stock market valuations — as measured by the price/earnings (P/E) ratio — to balloon. Currently, the forward 12-month P/E ratio is 17.0, which is well above the 5-year average of 14.6 and the 10-year average of 14.3.

There are a couple of things to think about. First, there is a decades-long history of earnings expectations initially being too optimistic and subsequently being revised down. Second, P/E ratios alone don’t do a great job of predicting what’s next for the stock market in the short-run. In fact, the current P/E ratio looks quite reasonable when you consider it in the context of inflation.

Nevertheless, this deteriorating outlook for profits growth is sure to weigh on the minds of investors, regardless of whether or not they actually decide to sell their stocks.

–

Sam Ro is managing editor at Yahoo Finance.

Read more:

A popular way of measuring stock market value is being misused

The most important question in the stock market right now

The dumbest math mistake investors make in the stock market

Here’s the depressing truth about the bull market

The gloomy profits narrative underlying the economy and markets just isn’t getting better