Russia ETF Bulls Pay up to Hedge

Traders daring enough to confront geopolitical volatility to make long bets on the Market Vectors Russia ETF (RSX) are paying up to hedge those bets.

Highlighting the skittishness that is often associated with trading Russian stocks and ETFs like RSX from the long side, the cost of hedging those long position in RSX has jumped to a 17-month high, reports Natasha Doff for Bloomberg.

“Options hedging on RSX cost 5.9 points more than calls to buy, about 13 percent above the average cost of protection over the past year. The premium for puts over calls increased to a high of 8.1 points on Aug. 25,” according to Bloomberg.

The increased hedging costs on RSX comes as the largest and most heavily traded Russia ETF is rapidly gathering assets. Through Aug. 28, RSX has added nearly $213 million in assets this month, putting the ETF on pace for its best monthly inflows since March. [Russia ETFs Gain Cash]

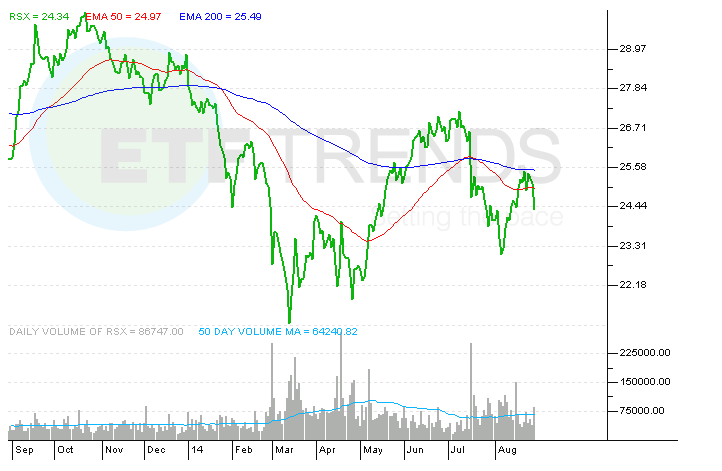

RSX was sporting a gain for this month until this week. Assuming Friday’s losses are not pared, RSX will close down at least 5.3% this week.

Even with the data that indicate some traders are willing to pay up to protect their long positions in RSX, other data suggest other traders are becoming increasingly aggressive with their bullish wagers on Russia ETFs.

For example, the Direxion Daily Russia Bull 3x Shares (RUSL) has added $27.7 million in new assets this month while volume has increased in that fund as well. Conversely, the Direxion Daily Russia Bear 3x Shares (RUSS) has seen modest outflows. [Getting Aggressive With Russia ETFs]

Since the start of August, the Market Vectors Russia Small-Cap ETF (RSXJ) has added $16.6 million of its $71 million in assets under management. Down almost 15% year-to-date, RSX is the worst performer of the four major single-country BRIC ETFs.

Market Vectors Russia ETF

ETF Trends editorial team contributed to this post.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.