Here Are Several Predictions From Some Of The Most Followed Investors And Traders On StockTwits

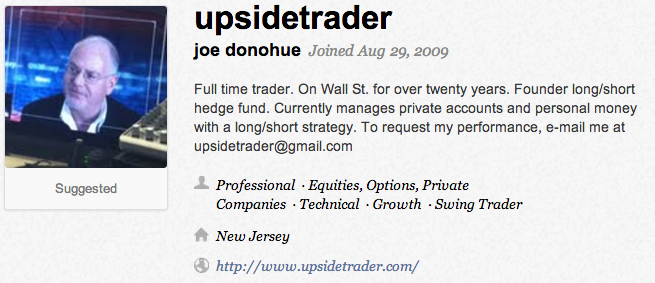

1.) @UpsideTrader says these key price targets will be hit:

EEM trades to $50+

EWW (Mexico) trades to $75-80

YCS ( short Yen) trades to $85 vicinity

NFLX 450-500

SPX target 2030

DJIA target 17,850

2.) @SKrisiloff breaks down each major sector:

Financials: The banking system will finally put the ghosts of 2008 to rest. There will be consolidation among small and mid cap banks.

Consumer: Consumers will continue to focus on quality of life. That means eating healthier, building relationships and taking time for leisure. Unfortunately for capitalists it doesn’t mean spending more. Millenials will get engaged, Baby Boomers will retire, and Gen X will whine that nobody cares about them (jk, love you guys).

Technology: Apple will release an iPhone with a bigger screen. More consumers will cut their cable subscriptions. More advertising dollars will be spent online. The PC market will stabilize.

Healthcare: Health insurance companies will pretend to have a tough year adjusting to Obamacare. But the transition will be smooth for healthcare providers. There will start to be a realization that genetic testing is crossing the chasm toward mass market relevance.

Energy/Materials: The shale oil boom will begin to slow output growth leading to higher oil prices. Farmers will plant less corn and unfavorable growing conditions will lead to higher food prices. Mining will stabilize but be far from prosperous.

Television will continue to destroy film in terms of quality of storytelling and entertainment value

3.) @TheBasisPoint predicts an increase in balance sheet lending:

Inversion of the jumbo/conforming rate spread that began 2Q2013 will prevail through 2014 as higher agency securitization fees and QE tapering drives conforming rates higher.

Increased emphasis on balance sheet lending and continued modest growth of non-agency MBS market keeps jumbo rates steadier.

This will also drive more consumer mortgage volume that would’ve otherwise been in agency product into non-agency product.

4.) @TheArmoTrader calls 2014 the year of the “Equity Widow-Maker”:

2014 will be the year of the “Equity Widow-Maker”. We’ve all probably heard of the “widow-maker” trade, which is the nickname given to the those who have tried shorting Japanese Government Bonds – which has ultimately proven to be financially fatal.

![Screen Shot 2013-12-28 at 8.53.21 AM]()

Screen Shot 2013-12-28 at 8.53.21 AM Well, we’re going to see that in the equity markets in 2014. I’m not expecting a major up-move in 2014 though. In fact, I think that while the year will ultimately be “bullish” (expecting a 5-10% gain – S&P to reach around 2000), volatility will be muted. There’s going to be a lot of range/choppy trading. We’ve seen 6 very interesting years since the 2007 S&P top.

2008 we had the major sell-off. 2009 was the bottom and reversal. 2010 had the flash crash. 2011 was the debt ceiling crisis which resulted in some of the biggest intraday swings ever. 2012 and 2013 we’re strong up-years (although, not unusual ones).

So I think we’re in store for a year of “rest”, where market’s don’t go down on “bad” news (like more Tapering) yet don’t really go up on good news (like a better-than-expected improving economy).

And this will drive shorts (bears), and even longs (bulls) crazy – hence, the “Equity Widow-Maker”.

5.) @CharlesSizemore is bullish on emerging markets:

With the uncertainty lifted, tapering will actually cause bond yields to fall.

U.S. stocks post positive but uninspiring returns.

European and emerging market shares vastly outperform U.S. shares.