A Small but Powerful Semiconductor ETF

Assuming there is anything close to a perfect correlation between an exchange traded fund’s size and performance capabilities often proves to be a fool’s errand.

A look at the top-10 non-leveraged ETFs in 2014 proves as much. Just two of those ETFs – the Market Vectors Junior Gold Miners ETF (GDXJ) and the WisdomTree India Earnings Fund (EPI) – have over $1 billion in assets under management. Yet three members of that list have less than $100 million in AUM. [Big Things From Small ETFs]

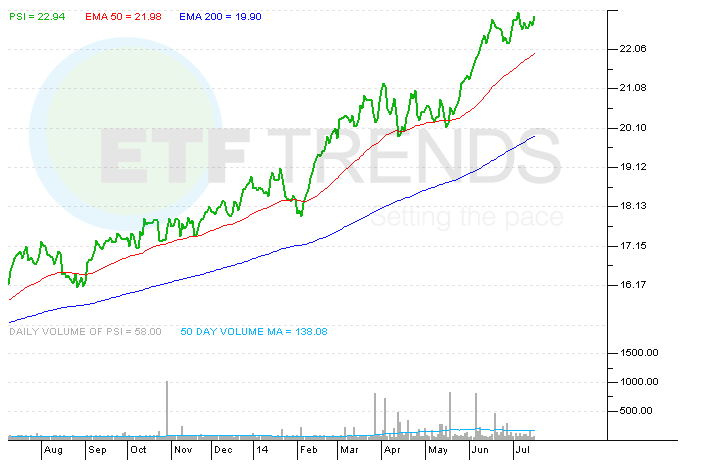

Up 23.3% year-to-date, the PowerShares Dynamic Semiconductors Portfolio (PSI) is knocking on the door of joining the top-10 ETF club, further affirming the notion that glossing over ETFs based on size is not a sound evaluation process. PSI has $23.8 million in AUM. That is smaller than its chip ETF rivals, but the PowerShares offering has also delivered 2014 gains on par with or in excess of comparable funds. [Big Week for This Chip ETF]

In a year in which semiconductor stocks have been tech sector leaders, PSI stands out because its 30 holdings are well spread across the three market capitalization spectrums. In fact, PSI, unlike some of its rival semiconductor ETFs, is not heavily dependent on the likes of Intel (INTC), Texas Instruments (TXN) and Qualcomm (QCOM) to drive its returns.

Those chip behemoths do combine for about 15% of PSI’s weight, but the ETF also allocates 31% of its weight to mid-caps and over 41% of its weight to small-caps. PSI’s robust mid- and small-cap exposure has proven efficacious this year as several chip stocks with those market capitalization designations have posted gains in excess of 50%. [A Surprising Tech ETF Leader]

That is not necessarily surprising as the Dynamic Semiconductor Intellidex Index, PSI’s underlying index, includes price momentum and earnings momentum among its selection criteria.

Of PSI’s top-10 holdings, a group that combines for over 47% of the ETF’s weight, nine are up year-to-date and two are up more than 20%. Over the past year, PSI’s underlying index has outpaced the S&P Semiconductor Index by over 700 basis points, according to PowerShares data.

PowerShares Dynamic Semiconductors Portfolio

Tom Lydon’s clients own shares of Intel.