Solar ETFs Making a Comeback as China Boosts Capacity

I do the “ETF of the Week” for MarketWatch every Thursday on Chuck Jaffe’s MoneyLife Show where I highlight big movers and disappointments within the exchange traded fund market.

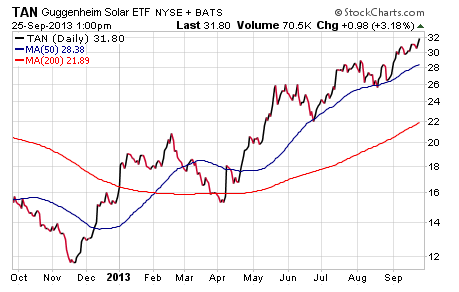

This week, I looked at the Guggenheim Solar ETF (TAN) . The alternative energy sector will continue to receive government support after dodging the Congressional budget cuts at the start of the year. Trading volume in the solar ETF has been picking up lately.

Click here to listen.

Solar energy ETFs were crushed during the 2008 financial crisis and have remained depressed for years. However, the beaten-down sector is starting to show some signs of life.

China, the world’s biggest supplier of solar power panels, plans to add 10 gigawatts of solar power capacity this year, more than double its current level, Bloomberg News reports.

Also, a Chinese company recently acquired MiaSole, a California producer of thin-film solar panels, the Associated Press reports.

Guggenheim Solar ETF

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.