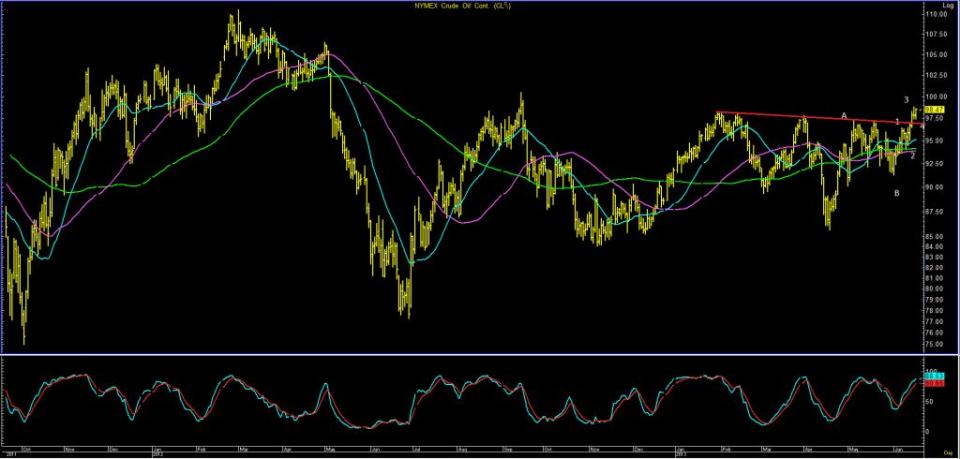

Spotlight on crude: Stanton Analytics is bullish

(Stanton Analytics) Trading has ground to a halt for all intents and purposes as investors await signals from the Fed today. The FOMC convened Tuesday and volume in many of the markets was down considerably. Housing starts were a disappointment, rising 6.8% when 11.4% was expected. Additionally, most of the building was for multifamily housing. The CPI was tame, rising 0.1%, giving the Fed more leeway to continue the bond buying program. Nevertheless, oil was steady to higher in anticipation of the Fed keeping the status quo. The continuation chart closed at a 9-month high. It also appears Obama is not ready to reappoint Ben Bernanke as chairman. When asked, Bernanke said that he has stayed longer than he wished. When Obama was asked about reappointing Bernanke, he sidestepped answering directly.

Expectations for the DOE inventories are as follows: Crude -400K; mogas +1M; dist +700K.

API: crude -4.2 mb; mogas +900 kb; dist -600 kb runs up; Cushing -674 kb

WTI:

Daily Moving Averages: 21, 55, & 100: 95.16, 93.87, 94.16

Weekly Moving Averages: 21, 55, & 100: 94.19, 91.42, 93.44

The bulls are in charge and a charge they shall make.

We have switched to August for comment and prices.

It is an ideal pattern setup for today.

Both the continuation chart and the contract chart needed an inside day to give the graph the right look for higher prices today.

Moreover, both contracts held what amount to be strong corrective patterns. That is, they held price levels that suggest further strength.

Our model calls for August to push higher today.

With the continuation chart settling above the head and shoulders bottom formation, a run to 100.00 is in the offing.

August has a double top at 99.98 and pattern resistance just ahead of that level at 99.80.

The continuation chart ha a key upside pivot at 100.42.

This will be a two-way market for today, but August is rapidly approaching a top.

The short-term cycles turn down Friday into Monday.

The key to today’s bullish price action is for August to respect and hold 97.65 before moving higher.

If it is broken, the immediate downside target is 96.70 to 96.60.

It is likely to be a bottom-up trade early in the day, but afternoon that may change.

Read the entire Stanton Analytics energy products report for Wednesday here

Our view (Danny Riley): The Asian markets were weak overnight and Europe is mixed this morning. From last Thursday’s Globex low at 1591.75 to yesterday’s high of 1648.75, the ESU has rallied 57 handles and nailed the Pit Bull’s call that the S&P was going to trade back to 1650. According to the Ned Davis S&P cash study, today is the weakest day of the week, up 12 / down 17 of the last 29, and according to our stats Wednesdays this year have been up 15 / down 9 of the last 24 occasions with an average gain of +9.9 handles and an average loss of -13.92 handles. Our view is to be cautious; if the Fed is indeed going to say something positive about keeping the current QE program going, it could be a matter of selling the news, and if they come out saying they plan on tapering later in the year, then it’s more than likely the S&P will sell off. The S&P has been up 6 out of the last 9 sessions and up 3 out of the last 4.

There was an old saying that you're supposed to trade up to the event and not the event. I doubt that will be the case today, but if you have done well so far this week there is no reason to get chopped up going into the meeting. We plan on buying the pullbacks in the morning and then will wait to see what the Fed has to say. Initially the next set of buy stops goes from 1649 up to 1656. You take it from there.

As always, please keep an eye on the 10-handle rule and please use stops when trading futures. Learn to live another day.

Ned Davis June Expiration Study (of last 29)

Wednesday up 12 / down 17

Thursday up 18 / down 11

Friday up 20 / down 8

Ned Davis Expiration Study for June: https://www.mr-topstep.com/index.php/equities/3260-expiration-study-for-june

It’s 8 a.m. and the ES is trading 1643.50, down 3 ticks; crude is up 17 cents at 98.84; and the euro is down 5 pips at 1.3406.

In Asia, 8 out of 11 markets quoted closed lower (Shanghai Comp. -0.73%, Nikkei +1.83%).

In Europe, 6 out of 12 markets are trading higher (DAX +0.02%, FTSE -0.37%).

Today’s headline: “S&P 500 Futures Steady Ahead of Fed Meeting”

Total volume: 1.77mil ESU and 40k SPU (38k SPM/U spreads traded)

Economic calendar: MBA purchase applications, EIA petroleum status report (API) , FOMC announcement, Bernanke press conference.

Fair value: S&P +0.29, NASDAQ +3.56

MrTopStep Closing Print Video: https://mr-topstep.com/index.php/multimedia/video/latest/closing-print-6-18-2013

Danny Riley is a 34-year veteran of the trading floor. He has helped run one of the largest S&P desks on the floor of the CME Group since 1985.

_____________________________________________________

Follow us on Twitter @MrTopStep http://twitter.com/mrtopstep

Sign up for our free mailing list at http://mrtopstep.com/ for full report.

DISCLAIMER: The information and data in the above report were obtained from sources considered reliable. Opinions, market data, and recommendations are subject to change at any time. Their accuracy or completeness is not guaranteed and the giving of the same is not to be deemed as an offer or solicitation on our part with respect to the sale or purchase of any commodities or securities.

{jathumbnailoff}