SSgA: Bond ETFs Lead January Inflows

Equity-based exchange traded funds were inflows darlings last year, occupying eight of the top 10 spots among asset-gathering ETFs. Fixed income funds impressed as well as 2014 was a record for inflows to bond ETFs.

Half of that theme is prevailing again in 2015 following a volatile January that brought an unexpected bout of volatility for equities and declines for the S&P 500. What was bad news for equity ETFs last month was good news for their fixed income counterparts.

“As such, while equities were the shining star in the last month of 2014, the same cannot be said about their start to the 2015 campaign as investors pulled nearly $15.8 billion in January. Taking charge was fixed income with over $7.9 billion of inflows as yields continued to fall. If the first month of flows is any indication for the fixed income universe of ETFs, 2015 could be even better than 2014. At this current pace, the yearly total would be $96 billion, which would be $41 billion more than the 2014 total,” said State Street Vice President and Head of Research Dave Mazza in a new research note.

While investors yanked $15.77 billion from equity ETFs last month, $7.97 billion poured into bond funds. Currently, five bond ETFs rank among the top 10 asset-gathering ETFs on a year-to-date basis. Through Feb. 5, the leader of that quintet was the iShares Short Treasury Bond ETF (SHV) with $2.5 billion of 2015 inflows, $2 billion of which arrived in just one day. [Big Inflows to Short-Term Bond ETF]

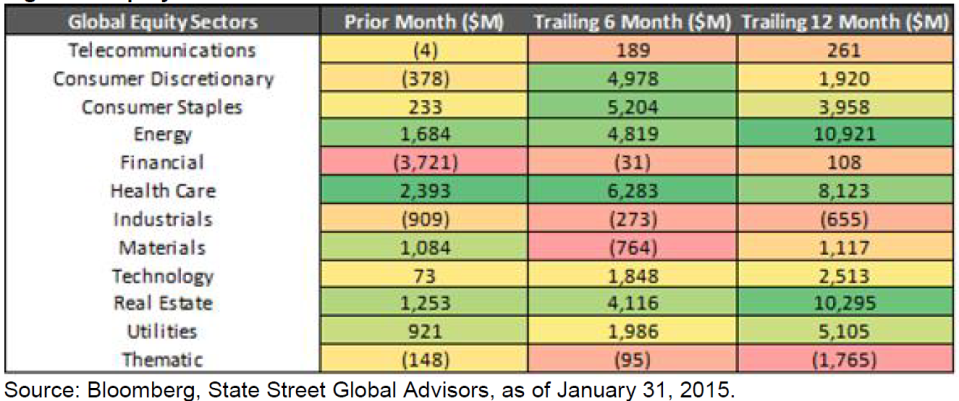

All was not lost of equity ETFs last month. Sector funds remain favored destinations for advisors and investors. ETFs tracking eight of 11 sectors (counting real estate as its own sector) saw inflows last month with financial services, industrials and consumer discretionary the only groups to see outflows.

“At the sector level, health care continued to be top of mind for investors. Late-cycle sectors like energy and materials were in favor as well. The financial sector fell the most out of favor with investors as the flattening of the yield curve and the prospects for higher rates being kicked further down the road have weighed on this market segment,” adds Mazza.

Investors were arguably hasty in their departures from discretionary ETFs. The Consumer Discretionary Select Sector SPDR (XLY) hit an all-time high on Thursday and is up 3% over the past month. [Opportunity With Discretionary ETFs]

Sector ETFs are increasingly popular with advisors and investors, but with that growth has come intense competition. At the end of last year, there was over $310 billion allocated to sector ETFs. Over the trailing 12 months, ETFs for 11 sectors (when breaking real estate out as its own sector) have gained assets, according to State Street data.

State Street, the largest purveyor of sector ETFs, recently lowered the fees on the nine sector SPDRs to 0.15% per year from 0.16%. Last week, the issuer said it trimmed fees on 41 of its other ETFs across multiple asset classes, including fixed income, emerging markets and low volatility funds. That announcement featured some notable expense ratio reductions with several of the ETFs seeing their fees cut by 50% or more. Ten other ETFs affected by that announcement now have annual fees of 0.4%, down from 0.5%. [SSgA Pares Fees on 41 ETFs]

Table Courtesy: State Street Global Advisors

ETF Trends editorial team contributed to this post.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.