Steven Cohen Buys Broadcom, Intel, Chipotle

- By Sydnee Gatewood

During the second quarter, Steven Cohen (Trades, Portfolio) of Point72 Asset Management acquired three new holdings. They are Broadcom Ltd. (AVGO), Intel Corp. (INTC) and Chipotle Mexican Grill Inc. (CMG).

Warning! GuruFocus has detected 8 Warning Signs with AVGO. Click here to check it out.

The intrinsic value of AVGO

Cohen founded Point72 in 2014 as the successor to S.A.C. Capital Advisors. The firm holds stock in 705 companies with a total value of $14.7 million. The turnover rate is 41%.

Broadcom

In Broadcom, Cohen purchased 591,610 shares for an average price of $152.31 per share. The transaction had an impact of 0.63% on the portfolio.

Broadcom designs, develops and supplies analog and digital semiconductor connectivity solutions. It has a market cap of $68.6 billion with an enterprise value of $84.7 billion. It has a price-earnings (P/E) ratio of 259.04 with a forward P/E of 13.5. It has a price-book (P/B) ratio of 3.4 and a price-sales (P/S) ratio of 6.3.

GuruFocus ranked the company's financial strength 4 of 10 and its profitability and growth 7 of 10. The company has an operating margin of 3.23% and a net margin of -1.6%. Its Piotroski F-Score is 2, indicating a poor business condition. Its Altman Z-Score is 1.6, placing it in the distress zone, which implies the possibility of bankruptcy in the near future.

Cohen previously sold out of Broadcom in the third quarter of 2015. Among the gurus invested in Broadcom, Andreas Halvorsen (Trades, Portfolio) is the largest shareholder.

Intel

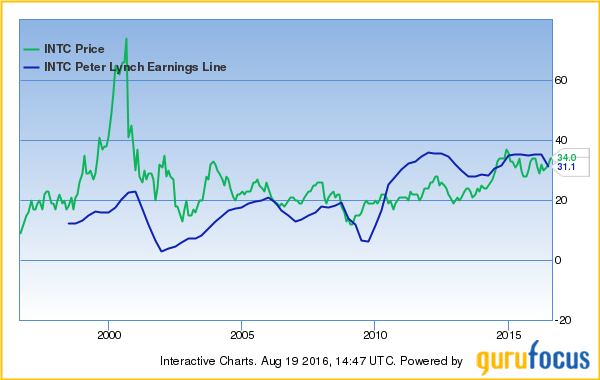

In Intel, Cohen purchased 2,563,197 shares for an average price of $31.33 per share. The transaction had an impact of 0.59% on the portfolio.

Intel produces semiconductor chips for companies in computing and communications. It has a market cap of $165.1 billion with an enterprise value of $176 billion. It has a P/E of 16.8 with a forward P/E of 14.6. Its P/B is 2.7 and its P/S is 3.02.

GuruFocus ranked the company's financial strength 6 of 10 and its profitability and growth 7 of 10. The company has an operating margin of 21.8% and a net margin of 17.8%. Its Piotroski F-Score is 5, indicating a stable business condition. Its Altman Z-Score is 3.5, placing it in the safe zone.

Cohen last sold out of Intel in the second quarter of 2013. Among the gurus invested in Intel, PRIMECAP Management (Trades, Portfolio) is the largest shareholder.

Chipotle

In Chipotle, Cohen purchased 203,018 shares for an average price of $434.69 per share. The transaction had an impact of 0.56% on the portfolio.

Chipotle operates Chipotle Mexican Grill restaurants, which serves burritos, tacos, burrito bowls and salads. It has a market cap of $11.3 billion with an enterprise value of $11.04 billion. It has a P/E of 57.6 with a forward P/E of 90.1. Its P/B is 7.6 and its P/S is 2.9.

GuruFocus ranked its financial strength 9 of 10 and its profitability and growth 9 of 10. The company has an operating margin of 8.2% and a net margin of 5.2%. Its Piotroski F-Score is 5, indicating a stable business condition. Its Altman Z-Score is 15.01, placing it in the safe zone.

Cohen previously sold out of the company in the first quarter. Among the gurus invested in Chipotle, Frank Sands (Trades, Portfolio) is the largest shareholder.

Disclosure: I do not own stock in any companies mentioned in the article.

Start a free 7-day trial of Premium Membership to GuruFocus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 8 Warning Signs with AVGO. Click here to check it out.

The intrinsic value of AVGO