The world's biggest hedge funds have loaded up on these 10 stocks

During the second quarter, the 50 biggest hedge funds started buying stocks again, increasing their equity exposure by 0.3%, according to a new report from FactSet.

Hedge funds bought consumer stocks, while they sold off financials and healthcare, the FactSet report said. Specifically, the largest funds added $4.2 billion in the consumer discretionary sector and $1.8 billion in consumer staples. Meanwhile, approximately $3.4 billion worth of stock in the financial sector was sold, while $2.1 billion was moved from health care.

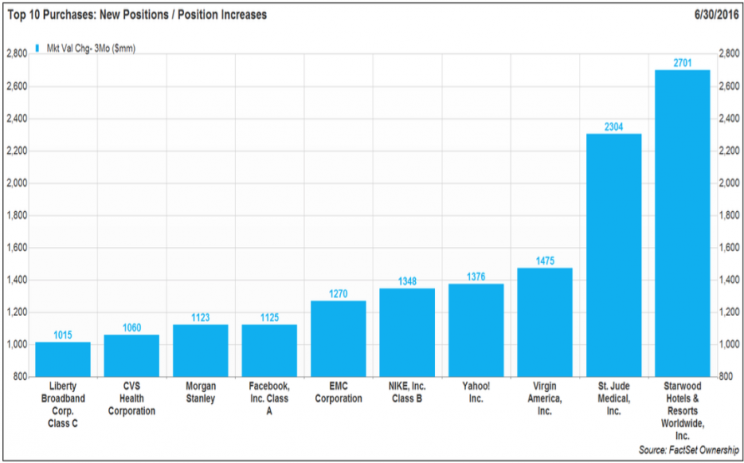

The biggest stock purchases were hotel operator Starwood Hotels & Resorts (HOT) and cardiovascular medical device company St. Jude Medical (STJ).

Of the 50 biggest hedge funds, some of them, in aggregate, purchased just over $2.7 billion worth of Starwood Hotels & Resorts shares. The hotel operator’s stock slumped more than 11% during the second quarter. Since the end of the quarter, shares have gained just over 8%, leaving the stock up just over 13% since the beginning of the year.

Meanwhile, many of the funds—including Omni Partners, Carlson Capital, and Adage Capital—snapped up an aggregate $2.3 billion worth of St. Jude Medical. The cardiovascular medical device company’s stock gained 41% during the second quarter.

Other new positions/position increases include Virgin America (VA), Yahoo! (YHOO), Nike (NKE), EMC Corporation (EMC), Facebook (FB), Morgan Stanley (MS), CVS (CVS), and Liberty Broadband (LBRDK), the report said.

The biggest position sales/decreases were Netflix (NFLX) followed by Apple (AAPL).

Microsoft (MSFT) and Facebook remained the most widely-held among the group.

Here’s a rundown of the stock purchases:

Disclaimer: Yahoo is the parent company of Yahoo Finance.

Julia La Roche is a finance reporter at Yahoo Finance.

Read more:

Legends of finance have big bets on the market going down

Tiger Global ditches its billion-dollar Netflix stake, cuts Apple

Here’s what hedge fund titans have been buying and selling

Hedge fund billionaire Dan Loeb bought a bunch of Facebook

Warren Buffett ramps up his huge bet on Apple, cuts back Walmart