Stocks, Oil Rebound as Global Officials Appear Willing to Goose Economy

Crude futures prices were up as much as 5%-6% overnight and early Friday, a move that looked to sweep up stocks in a short-term recovery.

This tough stock and oil trading week, one marked by heavy losses, did at least find some Friday relief amid signals of further central bank stimulus that could support demand for heavy global oil supplies.

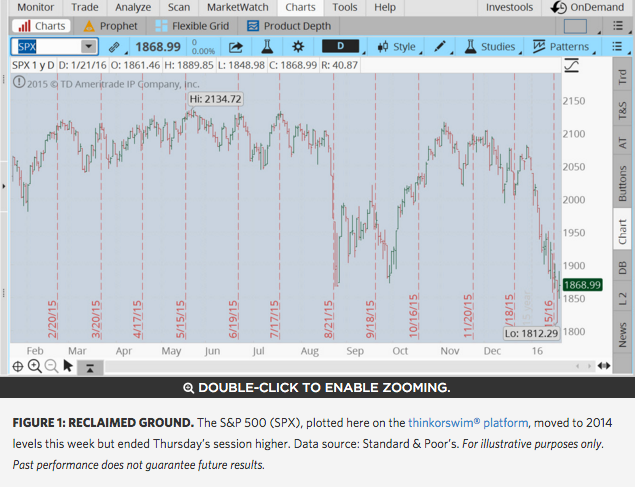

So far this week, the S&P 500 (SPX) is down about 0.6%. January losses through Thursday for both SPX (figure 1) and the Dow Jones Industrial Average ($DJI) are nearly 9%.

“No Limits...” Just to recap European Central Bank (ECB) President Mario Draghi’s stance in his Thursday press conference: The ECB has “no limits” in using tools and monetary instruments to plump up inflation and, ideally, stronger growth. His remarks were part of the catalyst driving a global stock snapback on Thursday.

Japan, Too? Japan’s Nikkei stock average gained after an aide to Prime Minister Shinzo Abe said Thursday that “conditions for additional easing have fallen into place,” according to The Wall Street Journal. The Bank of Japan will meet on Jan. 28-29, and some industry analysts expect the central bank’s asset-purchasing program could be increased.

GE Hit By Oil. Conglomerate General Electric Company (NYSE: GE) reported growth in Q4 core earnings and revenue but its industrials profit was hit by declines in its power and oil-and-gas businesses. Overall, GE, which continues to work through a business transformation, reported a profit of $6.28 billion, or $0.64 a share, compared with a profit of $5.15 billion, or $0.51 a share, a year earlier. GE backed its 2016 earnings outlook. In other news, Schlumberger Limited (NYSE: SLB) gained after beating Street expectations with earnings and cutting 10,000 jobs. Boeing Co (NYSE: BA) said it would cut 747 production by 50%, according to financial media.

Inclusion of specific security names in this commentary does not constitute a recommendation from TD Ameritrade to buy, sell, or hold. Market volatility, volume, and system availability may delay account access and trade executions. Past performance of a security or strategy does not guarantee future results or success. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Options trading subject to TD Ameritrade review and approval. Please read Characteristics and Risks of Standardized Options before investing in options. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The information is not intended to be investment advice or construed as a recommendation or endorsement of any particular investment or investment strategy, and is for illustrative purposes only. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. TD Ameritrade, Inc., member FINRA/SIPC. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company, Inc. and The Toronto-Dominion Bank. © 2016 TD Ameritrade IP Company, Inc. All rights reserved. Used with permission.

See more from Benzinga

© 2016 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.