Strong & Weak: Australian Dollar Rejected at Key Level

Talking Points:

-Extreme SSI reading suggests further losses for USDOLLAR

-USDOLLAR losses may be outpaced by the Australian Dollar

-Sell the Australian Dollar Currency Basket

Forex and equity markets built on their current trends this week. For the past two weeks, the big theme has been broad based “Risk Appetite”. The EUR, GBP, and AUD have been strengthening while the USD and JPY have been weakening.

The USD and JPY are historically seen as safe haven currencies. When we see these currencies occupying the weak side of the analysis that has represented a risk “on” environment in the past. The big question is will this trend continue?

Forex Strategy: Matching Strong versus Weak

Currency | Up Arrows | Down Arrows | Change From Last Report |

EUR | 6 | 0 | Higher 3 rankings |

5 | 0 | Higher 2 rankings | |

AUD | 5 | 1 | Down 1 ranking |

GBP | 3 | 3 | Higher 1 ranking |

JPY | 3 | 3 | Higher 1 ranking |

1 | 5 | Down 5 rankings | |

USD | 1 | 5 | Higher 1 ranking |

0 | 7 | No Change |

Chart created by DailyFX EDU Robert Warensjo

In the last report “US Debt Ceiling Paints USDOLLAR in Corner” revealed a range and to wait for the break of that range. The Greenback did eventually break to the downside triggering our entry. The follow through of the break has been weak which means the prices are comfortable near current levels.

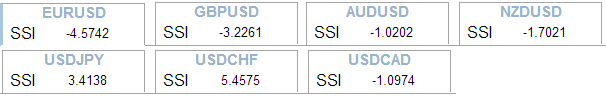

The biggest technical indicator suggesting this Dollar sell off may continue is FXCM’s Speculative Sentiment Index (SSI).

FXCM’s Speculative Sentiment Index (SSI)

The SSI shows the majority of traders are currently long the USDOLLAR. SSI is a contrarian indicator which suggests the Dollar is likely to sustain additional losses.

Since the majority of traders have already bought the Dollar, then they become a future pool of potential sellers when they decide to close out their trade. This emotion is likely accelerated if they are in a losing position.

However, the lack of follow through has me concerned about broad based USDOLLAR weakness. The single currency has several reasons to weaken, yet it remains stubborn. Therefore, be careful that the oversold levels may revert back to the mean and the Buck might actually strengthen.

Forex Education: Australian Dollar Tags 200 Day Simple Moving Average

(Created using FXCM’s Marketscope 2.0 charts)

On the other hand, the Australian Dollar found strong resistance at the 200 Day Simple Moving Average. As we discussed previously in “Australian Dollar Weakness in Focus”, the Australian economy is tied closely to the performance of the Chinese economy. China is important to the worldwide economy. So if weakness begins to erupt in China, it could spill over into other major economies like the United States and Australia negatively affecting their stock markets.

As a result, the Australian Dollar is a good proxy for worldwide stock markets. With the rally we’ve seen in equities for the past couple weeks, the Aussie has enjoyed strength as well.

Now that equities are near the top of their ranges, there is an increased probability of a dip to modestly lower levels. If the stock markets shift sideways to lower in the range, we can reasonably expect the Aussie to move lower. Therefore, the trading opportunity is to sell the Australian Dollar currency basket.

(To learn more about the importance of trading with moving averages, enroll for this free Moving Average course. Learn how to determine trend direction using moving averages. The course will take about 15 minutes to complete.)

Executing the Trade

Since we don’t know which currencies the Aussie is likely to underperform against, so we will take a diversified approach and sell the Australian Dollar against a basket of currencies.

The basket allows us to trade a currency rather than a pair. Therefore, we can boil the performance of the trade down to the Australian Dollar. This trading opportunity can be traded by placing an AUD currency basket sell trade through FXCM’s Mirror Trader platform.

We recommend risking less than 5% on all open trades. As a result, risk less than 1-2% on this basket so you have additional capacity to take on other trades.

Good luck with your trading!

---Written by Jeremy Wagner, Head Trading Instructor, DailyFX Education

Follow me on Twitter at @JWagnerFXTrader.To be added to Jeremy’s e-mail distribution list, click HEREand select SUBSCRIBE then enter in your email information.

See Jeremy’s recent articles at his DailyFX Forex Educators Bio Page.

New to the FX market? Watch this video 3 minute video

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.