Study reveals why TV networks should support sports betting

Just in time for the new NFL season, the American Gaming Association is promoting a study it commissioned from Nielsen to make the case that big American cable networks ought to jump on board with the effort to legalize sports gambling in America.

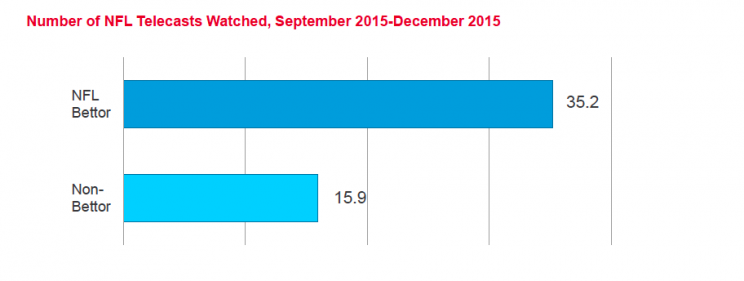

For the study, first shared exclusively with Yahoo Finance, Nielsen surveyed 1,500 American adults, 500 of whom were “pre-qualified NFL bettors.” The highlights from the report are: Adults who placed a bet on the NFL watched 19 more games last season than adults who didn’t bet; those who placed a bet more than doubled the TV ratings of average viewers; bettors make up just 25% of the NFL audience, but watch nearly 50% of all NFL regular season game minutes.

The AGA concludes from the Nielsen data that if sports betting were legalized, the number of regular-season sports viewers betting on games would jump from 40 million to 57 million, or 36% of the NFL audience.

And those bettors would be more engaged. Another example beyond the NFL is NCAA March Madness: those who visited March Madness bracket or fantasy sites or apps during March 2015 watched, on average, 20% more of the games than those who did not.

The appeal to broadcasters isn’t just ratings, but in selling time to advertisers. 65% of sports viewers say they are more likely to talk about a game on social media if they have placed a bet on it; the reasoning here is that legal bettors might buzz about an ad they’ve seen, too.

The debate over legalized sports betting in the US has come to the fore in recent years, spurred on by a 2014 viral op-ed in the New York Times by NBA commissioner Adam Silver, who supports it. The ongoing discussion, says AGA president Geoff Freeman, “shouldn’t just include pro sports leagues and casinos, it should include all those with a stake here, and as this research shows, that’s broadcasters and advertisers too.”

To be sure, there are special interests at play here. The AGA is an advocacy group that counts brick-and-mortar casinos among its members; it has publicly supported the repealing of PASPA, the Professional and Amateur Sports Protection Act of 1992.

“The thought in passing PASPA in 1992 was that if we ban sports betting, we protect the integrity of the game,” says Freeman. “What we now know is that we have access to more data than ever before that can help us detect the bad behavior… and the public attitude toward gaming has improved. I’ve never been more confident that PASPA will be repealed and states will be empowered to regulate sports betting if they so choose.”

Freeman adds that 90% of Americans feel a positive attitude toward the gaming industry… according to the American Gaming Association’s own research.

The explosion of daily fantasy sports has certainly added fuel to the fire about legalizing sports betting. New York, just last month, passed a new law legalizing and protecting DFS, but in Nevada, last year, the state Gaming Control Board deemed DFS to be gambling. It told DFS operators like DraftKings and FanDuel to stop operating in the state unless they apply for gaming licenses—something the companies are loath to do.

According to Freeman, AGA members were in talks to partner up with DFS operators until Nevada put the kibosh on that by effectively banning them from the state. “There were partnerships in development,” he says. “The relationships that were developing were oftentimes marketing relationships, where DraftKings or FanDuel would host a contest or viewing party at a Las Vegas casino.”

Sheldon Adelson, CEO of Las Vegas Sands (LVS), the largest publicly traded gaming company in the US, told Yahoo Finance just last week that he has absolutely no interest in offering any kind of fantasy sports games in his casinos (like the Venetian and Palazzo in Las Vegas). And yet this month, an approved daily fantasy sports company, USFantasy, will launch a walk-up wagering window in other Vegas casinos, including the Wynn (WYNN), MGM (MGM) and Caesars Palace (CZR).

“At the end of the day, the fantasy sports customer is a customer that was already interested in the sport, but wanted to have something on the line,” Freeman reasons. “As they took three hours out of their day, or more, to consume that product, they wanted to feel invested in it.”

If only PASPA were nixed, the AGA argues, more people—both fantasy-sports players and not—would bet on games, and they would watch more games on TV, and broadcasters could sell more advertising.

—

Note: An earlier version of this story said that the AGA itself had been in talks to partner up with daily fantasy sports companies; it is AGA members (like casino companies) that were in the talks, according to the AGA.

Daniel Roberts is a writer at Yahoo Finance, covering sports business and technology. Follow him on Twitter at @readDanwrite.

Read more:

An NFL lawyer hints at the league’s changing stance on gambling

Inside Sheldon Adelson’s plan to build an NFL stadium in Las Vegas

Why Sheldon Adelson is against daily fantasy sports

Here’s where every state now stands on daily fantasy sports

How StubHub and the Yankees are misleading fans about ticket pricing