Superior Industries (SUP) Beats on Q4 Earnings & Revenues

Superior Industries International, Inc.’s SUP earnings were 31 cents per share in fourth-quarter 2016, which surpassed the Zacks Consensus Estimate of 22 cents. Earnings were flat year over year.

Revenues were $188.3 million in the reported quarter, lower than $194.6 million reported in the year-ago quarter. Revenues however outpaced the Zacks Consensus Estimate of $177 million. Wheel unit shipments fell 3.6% to 3.1 million from 3.2 million units in the prior-year quarter. Value-added sales i.e. net sales less pass-through charges for aluminum increased 3.3% to $106.4 million, driven by favorable product mix and partially offset by lower unit volume and foreign currency fluctuations, mainly the Mexican Peso.

Gross profit fell to $18 million (9.5% of net sales) from $23.6 million (12.1%) in the prior-year quarter. Gross margin, as of value-added sales, declined to 16.9% from 22.9% a year ago owing to higher freight costs.

Selling, general and administrative expenses decreased to $6.9 million in fourth-quarter 2016 from $10.1 million in the prior-year quarter. Operating income was $11.1 million (5.9% of sales) compared with $13.5 million (7% of sales) a year ago. Operating margin, as a percentage of value-added sales, fell to 10.4% from 13.1% in the year-ago quarter.

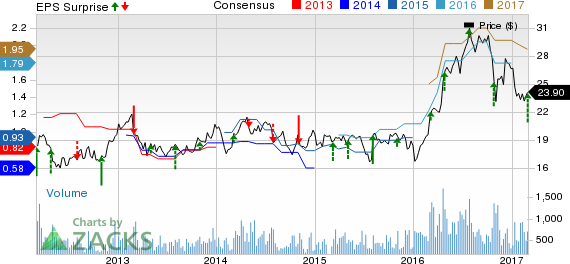

Superior Industries International, Inc. Price, Consensus and EPS Surprise

Superior Industries International, Inc. Price, Consensus and EPS Surprise | Superior Industries International, Inc. Quote

2016 Performance

Superior Industries’ earnings were $1.62 per share for 2016, up 80% from the 2015 level of 90 cents. However, the figure missed the Zacks Consensus Estimate of $1.79.

Revenues for 2016 inched up 0.6% to $732.7 million from $727.9 million in 2015. Revenues also beat the consensus mark of $721 million.

Capital Deployment

In 2016, the company repurchased 1,040,688 shares for $20.7 million. Since the start of this year till Mar 1, the company bought back 194,358 shares for $4.5 million. It has $35 million remaining under its share repurchase authorization of $50 million.

In the reported quarter, the company paid a quarterly dividend of 18 cents per share.

The company expects to pay dividend of roughly $18 million in 2017.

Financial Details

In 2016, Superior Industries’ cash flow from operations was $78.5 million compared with $59.3 million in the year-ago period. The increase in cash flow resulted from better earnings and lower net working capital in 2016.

Outlook

Superior Industries expects net sales for 2017 in the range of $730–$750 million. Unit shipments in the first quarter of 2017 are expected to decline 200,000 to 300,000 year over year.

Superior Industries expects value-added sales in the band of $400–$410 million.

The company expects EBITDA in the range of $97−$105 million.

The company continues to project capital expenditures of around $50 million for 2017. The effective tax rate is estimated in the range of 25−28%.

Price Performance

Superior Industries has underperformed the Zacks categorized Auto/Truck-Original Equipment industry over the last three months. During this period, the company’s share price has increased 4.5%, while the industry added 11.9%. Share price benefitted from a solid capital deployment.

Zacks Rank & Key Picks

Superior Industries currently carries a Zacks Rank #4 (Sell).

Better-ranked companies in the auto space include Lear Corporation LEA, American Axle & Manufacturing Holdings, Inc. AXL and General Motors Company GM. All these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

For the current year, Lear Corporation, American Axle and General Motors expect earnings growth of around 8.9%, 8.1% and 9.4%, respectively.

Zacks' Top Investment Ideas for Long-Term Profit

How would you like to see our best recommendations to help you find today’s most promising long-term stocks? Starting now, you can look inside our portfolios featuring stocks under $10, income stocks, value investments and more. These picks, which have double and triple-digit profit potential, are rarely available to the public. But you can see them now. Click here >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Axle & Manufacturing Holdings, Inc. (AXL): Free Stock Analysis Report

Superior Industries International, Inc. (SUP): Free Stock Analysis Report

Lear Corporation (LEA): Free Stock Analysis Report

General Motors Company (GM): Free Stock Analysis Report

To read this article on Zacks.com click here.