Tax refund delay means 'a pothole in consumer spending'

Thanks to IRS efforts to prevent fraud, tax refunds will be delayed for households claiming the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC) until the week of Feb. 27.

That means a lot of folks — somewhere on the order of 25 million-30 million households — will have to wait to get their refunds. And according to a Goldman Sachs research note published Wednesday, it also portends “likely cash flow disruptions” in February and March. Why? Mainly because most people who get refunds tend to spend the money right away.

How much the government pays in refunds

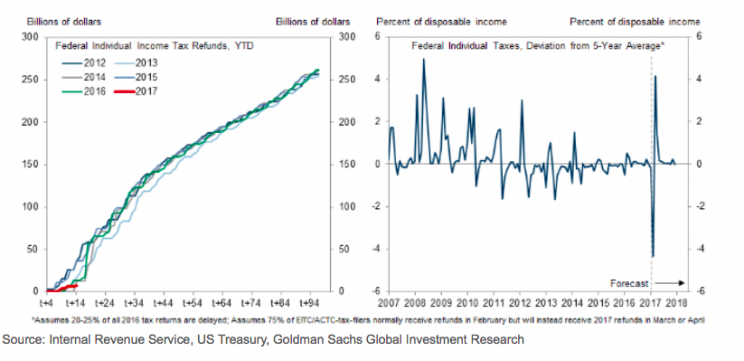

The federal government distributes around $275 billion each year in individual income tax refunds between January and May. And in recent years these refunds have come earlier in the tax season, Goldman says, with a large chunk of refunds paid over the course of a few weeks in February and early March.

This year, though, refunds will be sent out later — tax refunds received by those 25 million-30 million American households constitute about 20% to 25% of the dollar value of all refunds.

Signs of the slowdown are already here: Goldman says tax return statistics from the IRS show a 46% decline in average refund amount compared to 2016 ($1,866 from $3,536). The drop this year “reflects the delay of refunds associated with EITC and ACTC tax credits,” Goldman explains; households claiming the EITC typically get a refund on average of $3,000.

Goldman says assuming three-quarters of filers (those who claim the EITC or ACTC credits) would normally get a refund by the end of February — the peak of tax refund activity — then the delay is “likely to shift about $50-$60 billion of tax refund distributions from February into March or later,” the authors wrote. They expect tax refunds in February to fall by as much as 40% to 50% year over year.

Changes in consumer spending

The steep decline in refunds could be considered a cash flow disruption for a significant number of taxpayers. The Earned Income Tax Credit benefits low- and moderate-income families (workers receive a credit equal to a percentage of their earnings up to a maximum credit).

For many low-income families, a refund represents a significant windfall that they spend immediately — to pay off debt, to make a car repair, or pay bills. (Research has shown that around one-third of all US households live hand-to-mouth.) Which means these families will be forced to curtail their spending — at least temporarily.

Goldman Sachs sees that leading to a $17 billion-$21 billion “pothole in consumer spending” and overall consumption this month. The cash flow disruption, the note says, will be big enough to manifest in February and March consumer spending data, and/or in company results, according to Goldman.

Once the February softness subsides, get ready for a sharp rebound in refunds in March and April — and consumer spending along with it.

Read more:

IBM’s Watson supercomputer wants to help with your taxes

5 changes you need to know about for the 2017 filing season

The best way to spend your tax refund