Be Thankful for This Grocer's 18% Year-to-Date Decline

- By Ben Reynolds

(Published Nov. 24 by Bob Ciura)

Supermarket stocks have had a difficult year. Brutally fierce competition and a slow-growth economy have cut into supermarket stocks like Kroger (KR).

Kroger stock is down 18% since the beginning of the year.

But now that Thanksgiving is upon us, it's an opportune time for investors to consider Kroger. It is likely many products that were consumed on Thanksgiving were purchased at Kroger.

Warning! GuruFocus has detected 5 Warning Signs with TSLA. Click here to check it out.

The intrinsic value of KR

And, dividend growth investors can be thankful for Kroger's share price decline. This has pushed up Kroger's dividend yield and given investors the opportunity to buy this best-in-class supermarket stock at a better price.

Kroger has paid increasing dividends every year since reinstating dividend payments in 2006. Prior to 2006, the company hadn't paid a dividend since 1988.

Kroger's consistent dividend growth means it will likely soon join the Dividend Achievers. The Dividend Achievers are a select group of stocks that have raised their dividend payments for 10+ consecutive years. You can see the full list of all 273 Dividend Achievers here.

Business overview

Kroger is an industry giant. In fact, it's the largest supermarket chain in the U.S.

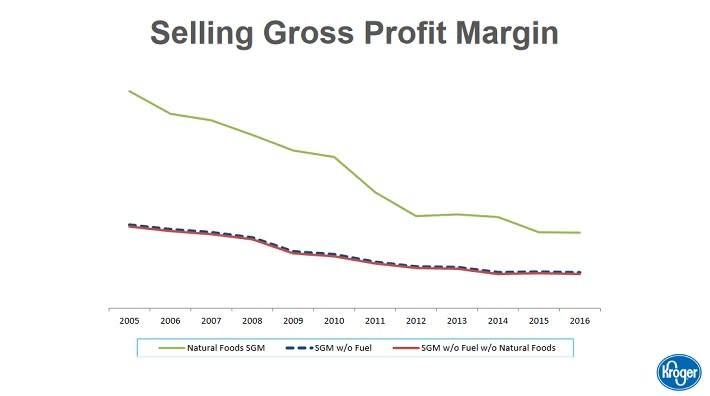

The current business environment is challenging. Kroger is seeing the broader landscape turn from inflationary to deflationary, which is not good for a supermarket chain.

Source: 2016 Kroger Investor Conference, page 17

This has reduced margins across the board. For example, last quarter Kroger saw deflation without pharmacy of 1.25% including 1.5% deflation in the grocery category.

To maintain high rates of profitability, Kroger is cutting costs. Fortunately, it has the financial flexibility to accomplish this. The company has been reducing capital expenditures by $500 million per year.

This allowed Kroger to generate 13.95% return on invested capital last quarter. Total sales, excluding fuel and acquisitions, increased 2.9% in the second quarter. Despite the deflationary grocery environment, earnings per share increased 4.7% over the first half of 2016.

Going forward, Kroger should continue to grow sales and earnings-per-share. It has initiated a new policy called the "Customer First Strategy" which will be key to its future growth.

Growth prospects

Despite heightened competition in the grocery industry, Kroger's growth prospects are still quite good. The company is focusing on new product categories and acquisitions to fuel future growth.

First, Kroger management is paying close attention to the changing consumer landscape. Supermarket shoppers are demanding higher-quality produce. Organics and natural foods are growing at a high rate.

Kroger has invested significantly to boost its organics departments. For example, earlier this year Kroger purchased a stake in Lucky's Market, a specialty natural and organics store. Lucky's Market has more than 20 locations.

As consumer preferences evolve, consumers are also becoming more loyal to those chains that effectively respond to their desires.

Source: 2016 Kroger Investor Conference, page 18

This is why Kroger is so determined to put the customer first.

Another way Kroger is responding to consumer demands is by investing in new digital capabilities. Kroger merged with Harris Tweeter in 2014.

The merger provided Kroger with Harris Tweeter's ClickList online ordering platform. Kroger has expanded ClickList and ExpressLane online ordering to 400 locations.

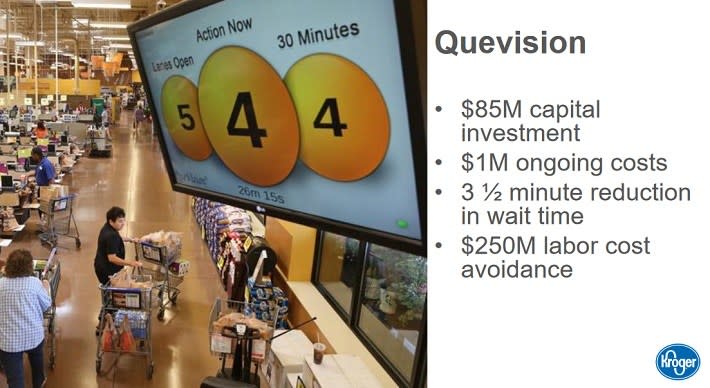

Kroger has also invested in an in-store digital platform called Quevision. This has helped reduce wait times and led to significantly lower labor costs for the company.

Source: 2016 Kroger Investor Conference, page 19

Another way Kroger plans to grow is through acquisitions. In 2016, Kroger acquired Roundy's. Roundy's owns several banners, including Pick 'n Save as well as Mariano's banner, for $866 million.

Mariano's in particular is a hidden gem for the company. It is highly popular in the Midwest, particularly among the premium specialty category.

Competitive advantages and recession performance

The first competitive advantage for Kroger is its scale. It has 2,781 retail food stores under a variety of banners. This allows the company the flexibility to reduce capital expenditures as necessary.

Furthermore, with such a large footprint, Kroger can generate the economies of scale necessary to consistently offer customers low prices. Smaller competitors have a difficult time matching Kroger's low prices.

And, Kroger performs well during recessions. There will always be a certain level of demand for groceries, even when the economy deteriorates. This kept Kroger profitable during the 2007-2009 recession.

Earnings per share through the Great Recession are shown below:

2007 earnings per share of 85 cents.

2008 earnings per share of 95 cents.

2009 earnings per share of 87 cents.

Earnings per share dipped in 2009, but overall were higher in 2009 than in 2007.

Valuation and expected total return

Thanks to Kroger's 18% decline this year, the stock now offers a much better value proposition for investors. Kroger stock trades for a price-earnings (P/E) ratio of 15. By contrast, the Standard & Poor's 500 Index trades for a P/E ratio of 25.

Kroger's significant discount is the result of negative market sentiment. Investors seem to doubt the company's growth potential. But Kroger has a proven track record of strong growth, thanks to its effective management strategies.

Since 2000, Kroger stock has held an average price-to-earnings ratio of 15. The stock had been relatively overvalued over the past year. But the recent decline has brought the stock back to historical norms.

This means, going forward, investors are once again presented with appealing total return potential. A breakdown of Kroger's expected returns is as follows:

3% to 4% internal revenue growth.

2% revenue growth from acquisitions.

1% margin expansion.

2% growth from share repurchases.

1.4% dividend yield.

Thus, future returns could reach 9.4% to 10.4% per year.

Final thoughts

Kroger may not appeal to investors looking for high levels of income. The stock has a current yield of 1.5%. That isn't too shabby and can contribute nicely to total returns. But it is slightly below the 2% average dividend yield of the S&P 500 Index.

Fortunately, Kroger compensates investors for this with high rates of dividend growth and share repurchases.

For example, this year the company delivered a 14% dividend increase and also announced a new $500 million share repurchase authorization.

Continued double-digit dividend growth each year could easily turn Kroger into a compelling dividend stock. Such large share repurchases are a meaningful tailwind to earnings-per-share growth.

As a result, Kroger stock is an attractive investment opportunity for dividend growth investors. Give thanks to the market for Kroger's irrational selloff this year.

Disclosure: I am not long the stocks mentioned in this article.

Start a free seven-day trial of Premium Membership to GuruFocus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 5 Warning Signs with TSLA. Click here to check it out.

The intrinsic value of KR