These states give you the best return for your tax dollars

Do you have a question about your taxes? Email them to us at moneyquestions@yahoo.com

It’s an indisputable fact: no one likes paying taxes. A 2016 Gallup poll found that 57% of Americans believe they pay too much in income taxes (and that figure seems low).

The fact is, much of how people feel about taxes is based on where they live. To a large extent, that’s because, while federal taxes are the same for everyone, state (and local) taxes vary greatly. And that means what taxpayers get in return for the hard-earned money they pay in taxes varies based on geography.

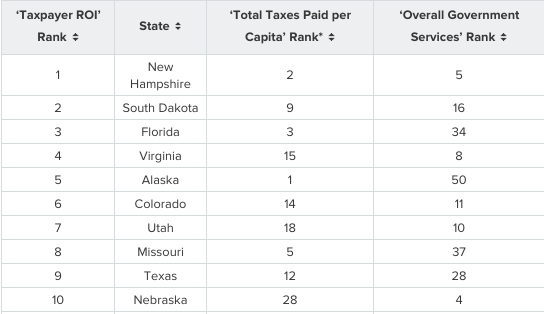

A new report from WalletHub determines which state gives its taxpayers the highest return on investment (ROI), factoring in how much they collect from residents and how much they pay out in services. In other words, where do taxpayers get the most for their tax dollars?

According to Wallethub, taxpayers in New Hampshire get the biggest return on their investment – meaning they receive equal benefits for the taxes they pay. New Hampshire’s impressive ROI stems, in part, from the fact that the state has the lowest number of residents in poverty and the fourth-lowest violent crime rate in the nation.

To calculate the ROI for each place, Wallethub compared state and local tax collections against five government-service categories: education, health, safety, economy and infrastructure and pollution.

South Dakota ranks second as the state with the best ROI for taxpayers. To earn this position, The Mount Rushmore state ranked 16th in overall government services, and its hospital system ranked as the fourth best in the nation. Snagging the third spot is Florida, where citizens pay the third-lowest amount taxes per capita. (Neither South Dakota nor Florida has a state income tax). Florida is also the fourth-best state for roads and bridges.

There are handful of reasons why the ROI varies from state to state. For one, some states receive more federal funding than others. This might sound like a boon, but according to Keith Boeckelman, professor of political science at Western Illinois University, it doesn’t always mean they get better services. “Some states, like Minnesota, have high taxes but also provide excellent services,” he said. “Other states with lower-quality government may have relatively high taxes, but provide less in return.”

Boeckelman says one way governments try to balance the tax burden on citizens is to contract out certain government services. Still, he warns that this can be can be wasteful if the contracts are not competitive or mismanaged.

Regional differences in ideology can also impact a state’s ROI. Local taxation can vary greatly in a state that chooses to focus more on certain social services than its neighbors. Perhaps that’s why Wallethub found that red, Republican-voting states, which usually favor smaller government, have a better ROI than blue states. (In the study, the states were designated as red or blue based on how they voted in the 2016 presidential election.)

While most of us aren’t likely to pick and move because of tax ROI, there are a few places that taxpayers looking to get a good return on their investment should avoid. North Dakota came in at the bottom of the list, followed by Hawaii, New Mexico, California, and New York.

Brittany is a reporter at Yahoo Finance.

What happens if you don’t file your tax return?

The best way to spend your 2017 tax refund

5 tax changes you need to know about for the 2017 filing season