With UK Inflation Expectations Rising, GBP/JPY Catches a Lift

Talking Points:

- BoE/GfK 12-month CPI Expectation: +3.6% versus +3.2% expected (y/y).

- Euro best performer in wake of ECB policy meeting.

- All eyes on US NFPs at 08:30 EST/13:30 GMT.

To keep up with the European data and news as the week goes forward, be sure to sign up for my distribution list.

Intraday Price Perspective

A scan of this morning’s best and worst performers via the Strong/Weak app shows that the Euro has emerged as the top performer, although its European counterparts, the Euro and the Swiss Franc, are not far behind. Price action today very much resembles that which we saw the past few weeks: the rotation from the commodity currencies into European FX.

The Euro’s place as a top performer in recent weeks gives confidence to the idea that today’s price action may not be a one-off event; rather, a continuation of recent trends with respect to a pause in price action the past several days. It is thus fitting that the currency pair highlighed today is EURAUD, which we’ve been examining from the long side since A$1.4510. A push through 1.5000 may be around the corner:

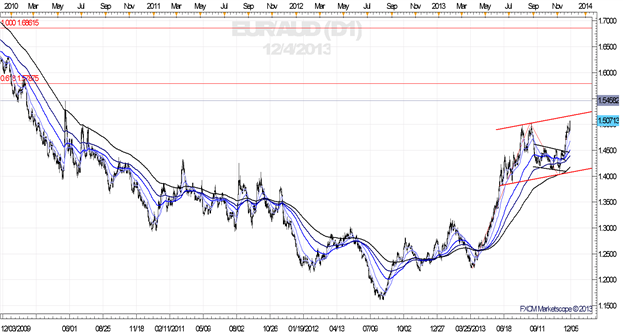

TECHNICAL ANALYSIS – CHART OF THE DAY

GBPJPY H2 Chart: December 2009 to Present

Want to automate your trading or trade baskets of currencies? Try Mirror Trader.

- A retest of the yearly high produced a small selloff, but bullish full timeframe continuity (H1, H4, daily) has developed, suggesting that momentum is firming to the upside.

- With respect to the rally seen from the 2012 and 2013 low, we view the recent consolidation in price the past four months as a flagging pattern.

- The current consolidation runs up to 1.5160/80; a weekly close above this level would suggest an extension could develop through early-2014.- Targets higher are 1.5440/80 (January 2010 low/May 2010 high) and 1.5785/90 (61.8% extension).

Here’s the other data influencing and that will influence European FX price action today:

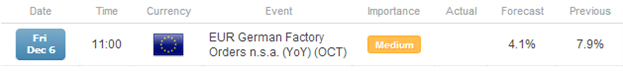

EURO-ZONE ECONOMIC CALENDAR

UK ECONOMIC CALENDAR

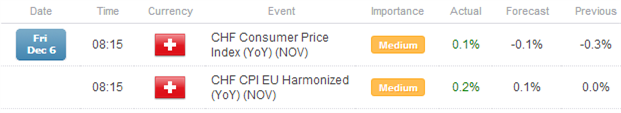

SWISS ECONOMIC CALENDAR

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.