US Dollar Clings onto Key Support Levels - Bounce Seems Likely

DailyFX.com -

- US Dollar testing critical support versus the Euro, Yen, British Pound

- A larger breakdown seems less likely given low FX volatility prices, suggests USD is a buy

- See more information on DailyFX on the Real Volume and Transactions indicators

Receive the Weekly Volume at Price report via David’s e-mail distribution list.

The US Dollar trades at critical support versus the Euro, Sterling, and Japanese Yen. Low forex volatility prices suggest that a larger breakdown remains unlikely.

EURUSD

Total Buy Volume Executed, Total Sell Volume Executed, Net Volume Executed (Buy-Sell)

Length of bar indicates the sum of Buy and Sell volume.

Data source: FXCM Real Directional Volume Indicator, Chart source: R. Prepared by David Rodriguez

The Euro has surged above major congestion at the $1.10 mark, but similarly substantial resistance starting at $1.12 marks another important test. Failure here would make $1.10 the next near-term target, while a break above $1.12 targets a move towards $1.14.

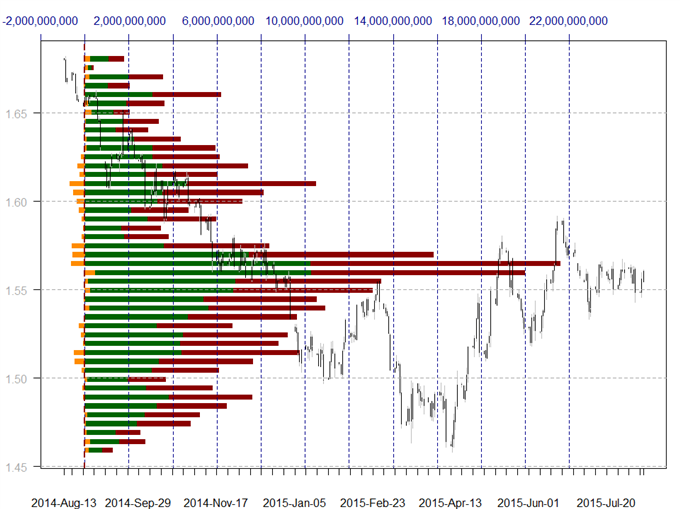

GBPUSD

Total Buy Volume Executed, Total Sell Volume Executed, Net Volume Executed (Buy-Sell)

Length of bar indicates the sum of Buy and Sell volume.

Data source: FXCM Real Directional Volume Indicator, Chart source: R. Prepared by David Rodriguez

The British Pound once again trades at substantial volume-based resistance at the $1.5650, and another failure would keep short-term focus on congestion support in the $1.54-1.55 range. Of course resistance can only hold so many times when consistently tested. A break above $1.5650 would likely lead the pair towards the June highs near $1.5800.

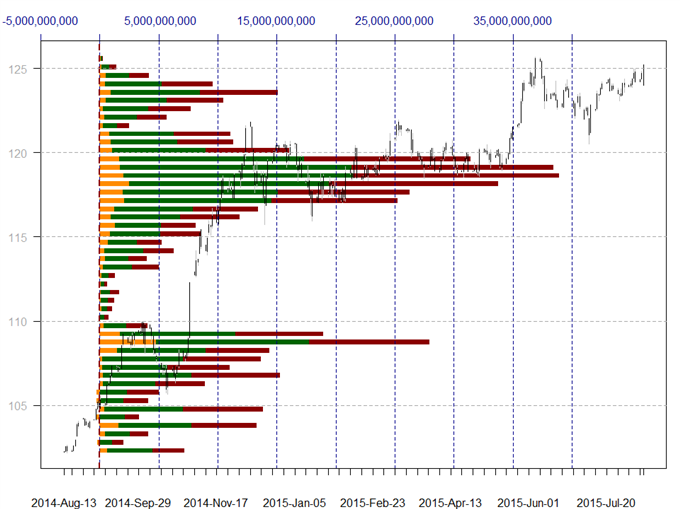

USDJPY

Total Buy Volume Executed, Total Sell Volume Executed, Net Volume Executed (Buy-Sell)

Length of bar indicates the sum of Buy and Sell volume.

Data source: FXCM Real Directional Volume Indicator, Chart source: R. Prepared by David Rodriguez

The Japanese Yen has rallied sharply against the US Dollar, and the USD/JPY now trades almost squarely at the top of a key volume-based congestion range near ¥123.50. Failure to hold above would leave near-term targets closer to major lows at ¥120.50. A hold above ¥123.50 would instead make continued gains towards ¥126.00 more likely.

AUDUSD

Total Buy Volume Executed, Total Sell Volume Executed, Net Volume Executed (Buy-Sell)

Length of bar indicates the sum of Buy and Sell volume.

Data source: FXCM Real Directional Volume Indicator, Chart source: R. Prepared by David Rodriguez

The Australian Dollar briefly broke to fresh lows versus the US Dollar before bouncing sharply, and the AUD/USD now trades at major volume-based resistance levels near $0.7400. Failure to close above would nonetheless leave focus on recent lows near $0.7250. A break above $0.7400 would instead target the bottom of a major volume-based congestion range near $0.7600.

GBPJPY

Total Buy Volume Executed, Total Sell Volume Executed, Net Volume Executed (Buy-Sell)

Length of bar indicates the sum of Buy and Sell volume.

Data source: FXCM Real Directional Volume Indicator, Chart source: R. Prepared by David Rodriguez

A sharp British Pound rally versus the Japanese Yen leaves it just short of key volume-based congestion levels near ¥195, and trading above said level makes major highs at ¥196 the next logical target. A failure to finish above volume-based resistance would shift our attention towards similar support at the top of a congestion range near ¥193.

EURJPY

Total Buy Volume Executed, Total Sell Volume Executed, Net Volume Executed (Buy-Sell)

Length of bar indicates the sum of Buy and Sell volume.

Data source: FXCM Real Directional Volume Indicator, Chart source: R. Prepared by David Rodriguez

The Euro broken sharply above major volume-based resistance versus the Yen at ¥137, and the move opens up a larger rally towards modest volume-based resistance at ¥140. Support is now former resistance at ¥137.

USDCHF

Total Buy Volume Executed, Total Sell Volume Executed, Net Volume Executed (Buy-Sell)

Length of bar indicates the sum of Buy and Sell volume.

Data source: FXCM Real Directional Volume Indicator, Chart source: R. Prepared by David Rodriguez

The US Dollar has pulled back sharply versus the Swiss Franc, and the sudden downturn leaves it almost squarely at major volume-based support near SFr0.9650. Failure to hold above here offers little in the way of comparable volume-based support until SFr0.9300. A successful hold above turns attention towards recent highs near SFr0.9900.

USDCAD

Total Buy Volume Executed, Total Sell Volume Executed, Net Volume Executed (Buy-Sell)

Length of bar indicates the sum of Buy and Sell volume.

Data source: FXCM Real Directional Volume Indicator, Chart source: R. Prepared by David Rodriguez

A notable pullback in the US Dollar leaves it at significant volume-based support versus the Canadian Dollar near the C$1.2900-1.2950 zone, and a failure to hold above would shift focus towards major congestion starting near C$1.2700. A successful rebound here would leave recent spike-highs near C$1.3200 as the logical short-term target.

NZDUSD

Total Buy Volume Executed, Total Sell Volume Executed, Net Volume Executed (Buy-Sell)

Length of bar indicates the sum of Buy and Sell volume.

Data source: FXCM Real Directional Volume Indicator, Chart source: R. Prepared by David Rodriguez

The New Zealand Dollar trades almost squarely at major volume-based congestion in the $0.6600-$0.6700 zone, and failure here keeps our focus on major lows closer to $0.6500.

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

Receive the Weekly Volume at Price via David’s e-mail distribution list.

Contact David via

Twitter at http://www.twitter.com/DRodriguezFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.