US Dollar and Japanese Yen May Offer Further Sell Opportunities

- Dollar and Yen poised to fall further in slow-moving forex markets- Our sentiment-based Momentum2 strategy has done selling and will likely continue going short- Forex volatility prices have tumbled, favoring continued declines in the safe-haven USD

The US Dollar and Japanese Yen seem likely to fall further versus the Euro and other forex counterparts, and our strategies remain well-positioned to sell weakness.

The purely sentiment-based Momentum2 trading system has sold aggressively into US Dollar and Yen declines as both have traded to fresh lows. And indeed, exceedingly one-sided forex crowd positioning favors further USD weakness versus the Euro and other currency counterparts.

One factor that may further hurt the US currency is that forex volatility prices have fallen sharply from recent peaks. The safe-haven USD tends to do poorly during quiet market conditions, and a relatively empty US economic calendar promises few major moves in the week ahead.

A key exception is a handful of scheduled speeches from US Federal Reserve officials in the next two days. Yet it will take significant shifts in rhetoric from upcoming speeches to force major moves in USD pairs.

US Dollar and Japanese Yen May Fall Further as Forex Volatility Tumbles

Source: OTC FX Options Prices from Bloomberg; DailyFX Calculations

We will continue to favor our Momentum2 trading system across most US Dollar and Japanese Yen currency pairs, while the low-volatility Range2 system could do well in certain currency pairs as vols tumble.

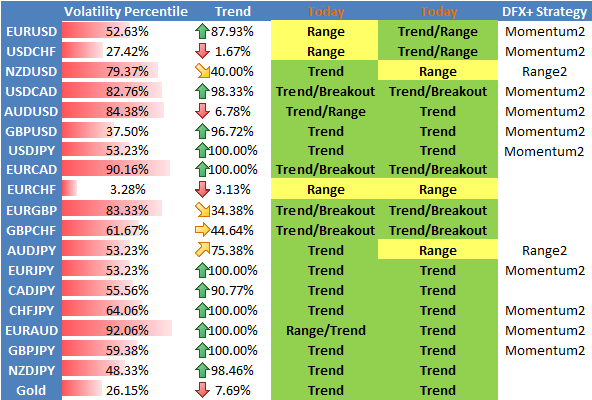

See full detail on our trading biases in the table below, and sign up for e-mail updates via my distribution list for any changes.

DailyFX Individual Currency Pair Conditions and Trading Strategy Bias

Automate our SSI-based trading strategies via Mirror Trader free of charge

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up to David’s e-mail distribution list via this link.

Contact David via

Twitter at http://www.twitter.com/DRodriguezFX

Definitions

Volatility Percentile – The higher the number, the more likely we are to see strong movements in price. This number tells us where current implied volatility levels stand in relation to the past 90 days of trading. We have found that implied volatilities tend to remain very high or very low for extended periods of time. As such, it is helpful to know where the current implied volatility level stands in relation to its medium-term range.

Trend – This indicator measures trend intensity by telling us where price stands in relation to its 90 trading-day range. A very low number tells us that price is currently at or near 90-day lows, while a higher number tells us that we are near the highs. A value at or near 50 percent tells us that we are at the middle of the currency pair’s 90-day range.

Range High – 90-day closing high.

Range Low – 90-day closing low.

Last – Current market price.

Bias – Based on the above criteria, we assign the more likely profitable strategy for any given currency pair. A highly volatile currency pair (Volatility Percentile very high) suggests that we should look to use Breakout strategies. More moderate volatility levels and strong Trend values make Momentum trades more attractive, while the lowest Vol Percentile and Trend indicator figures make Range Trading the more attractive strategy.

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.

ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES IS MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION.

OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS. Any opinions, news, research, analyses, prices, or other information contained on this website is provided as general market commentary, and does not constitute investment advice. The FXCM group will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance contained in the trading signals, or in any accompanying chart analyses.

http://www.fxcm.com/products/specialty-platforms/mirror-trader/dailyfx-trading-signals/?CMP=SFS-70160000000NbT3AAK

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.