USD/JPY Rebounds Off Lows After ADP Employment, Claims Data Beat

THE TAKEAWAY: Secondary US labor market data suggest modest NFP growth in June > USDJPY BULLISH

The US Dollar has seen a bit of a turnaround this morning after falling sharply against the Japanese Yen overnight, as global risk aversion has begun to set in following the Euro-Zone crisis reigniting in Greece and Portugal, while the prospect for domestic and international strife has intensified around Egypt and Syria, respectfully. The important data fueling the USDJPY bounce:

- ADP Employment Change (JUN): +188K versus +160K expected, from +134K (revised lower from +135K)

- Initial Jobless Claims (JUN 29): 343K versus 345K expected, from 348K (revised higher from 346K)

- Trade Balance (MAY): -$45.0B versus -$40.1B expected, from -$40.1B (revised higher from -$40.3B)

The labor market data released today, while secondary in nature, maintains significance with respect to Friday’s June US labor market report, the much-ballyhooed NFP report. Accordingly, in light of today’s modest improvements in the monthly private jobs tracker and in the weekly claims report, we suspect that the consensus forecast for Friday’s NFP report at +165K (from +175K in May) remains reasonable.

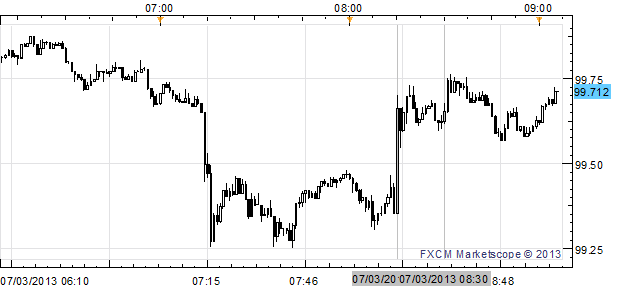

USDJPY 1-minute Chart: July 3, 2013

Charts Created using Marketscope – prepared by Christopher Vecchio

Following the releases, the USDJPY maintained its bounce off of the lows, trading up from ¥99.46 to as high as 99.76, before falling back to 99.71, at the time this report was written. The USDJPY had fallen by over -1% overnight, and daily technicals suggest that a close below 99.49 would result in a Bearish Key Reversal, a topping sign.

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.