USDOLLAR Longs Favored Ahead of NFP- AUD at Risk for Fresh Lows

Talking Points:

- USDOLLAR to Target Higher High in February; NFP to Grow 185K in January

- Australian Dollar Searching for Support Ahead of RBA Meeting

Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

DJ-FXCM Dollar Index | 10720.99 | 10725.14 | 10688.94 | 0.24 | 87.38% |

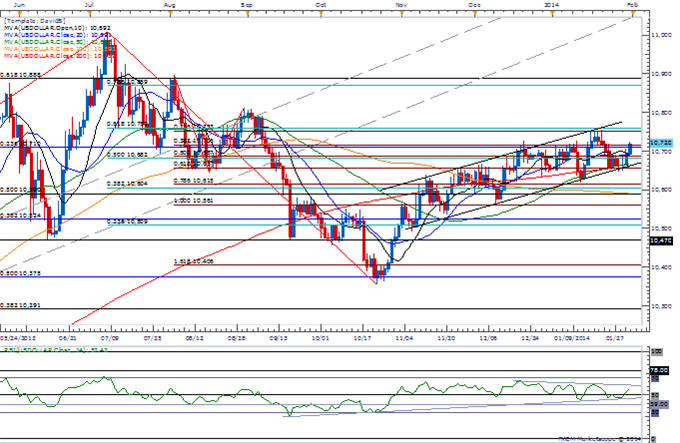

USDOLLAR Daily

Chart - Created Using FXCM Marketscope 2.0

Higher Low in Place- Poised for Higher High as Bullish Trend Remains Intact

Topside Break in Relative Strength Index to Provide Confirmation/Conviction

Interim Resistance: 10,753 (23.6 expansion) to 10,759 (61.8 retracement)

Interim Support: 10,561 (100.0 extension)- Closing Basis

Release | GMT | Expected | Actual |

Employment Cost Index (4Q) | 13:30 | 0.4% | 0.5% |

Personal Income (DEC) | 13:30 | 0.2% | 0.0% |

Personal Spending (DEC) | 13:30 | 0.2% | 0.4% |

PCE Deflator (MoM) (DEC) | 13:30 | 0.2% | 0.2% |

PCE Deflator (YoY) (DEC) | 13:30 | 1.1% | 1.1% |

PCE Core (MoM) (DEC) | 13:30 | 0.1% | 0.1% |

PCE Core (YoY) (DEC) | 13:30 | 1.2% | 1.2% |

Chicago Purchasing Manager Index (JAN) | 14:45 | 59.0 | 59.6 |

U. of Michigan Confidence (JAN F) | 14:55 | 81.0 | 81.2 |

Fed’s Esther George Speaks on Financial Stability | 15:00 | ||

Fed’s Richard Fisher Speaks on Fed Operations | 18:15 |

The Dow Jones-FXCM U.S. Dollar Index (Ticker: USDollar) looks poised for a higher high in February as price and the RSI retains the bullish trend carried over from the previous year.

Indeed, the Non-Farm Payrolls (NFP) report highlights the biggest event for the week ahead as the U.S. economy is expected to add another 185K jobs in January, but we will also need to keep a close eye on the dismal December print as Fed officials anticipate an upward revision from the initial 74K clip.

Nevertheless, the technical outlook favors ‘buying dips’ in the USD as we have a near-term base around the 10,657 region (61.8 percent Fibonacci expansion), and we will eye the topside targets going into the month ahead as the bullish sentiment surrounding the greenback gathers pace.

Join DailyFX on Demandto Cover Current U.S. Dollar Trade Setups

AUDUSD Daily

Bearish RSI Momentum Remains Intact; Carving Another Lower High?

Interim Resistance: 0.8980 (38.2 expansion) to 0.9000 (1.618 expansion)

Interim Support: 0.8670 (100.0 expansion) to 0.8700 (78.6 expansion)

The greenback strengthened against three of the four components, led by a 0.89 percent decline in the Australian dollar, and the AUDUSD may test fresh lows next week should the Reserve Bank of Australia (RBA) adopt a more dovish tone for monetary policy.

There’s growing speculation that the RBA will move away from its easing cycle amid the growing threat of an asset-bubble, but Governor Glenn Stevens may sounds more cautious this time around amid the growing concerns surrounding China – Australia’s largest trading partner.

With that said, the AUDUSD may target lows as it carves a series of lower highs in January, and the higher-yielding currency may face additional headwinds from the shift in market sentiment as global investors scale back their appetite for risk.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.