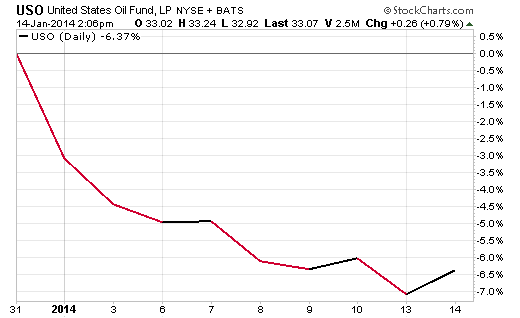

USO Rakes In Assets Despite Slump In 2014

The massive oil fund doubles in size even as it slides in 2014.

[This article previously appeared on IndexUniverse.com and is republished here with permisison.]

The United States Oil Fund (USO | A-100) has seen its assets under management double in the past two weeks, attracting net inflows of more than $500 million despite a slumping price performance.

While it seems investors are seeing USO’s 6.2 percent decline since January as a good buying opportunity, or at least a chance for a “quick trade,” as HardAssetsInvestor.com analyst Sumit Roy told IndexUniverse, the outlook for WTI oil prices remains under pressure.

Rising U.S. oil production and strong gasoline and distillate inventories have recently weighed on WTI prices. In addition, projections for massive supply coming from the U.S., Libya and Iran this year should continue to pressure this market, according to an HAI report.

“A lot of the buying in USO is likely bargain hunting,” Roy told IndexUniverse. “Oil prices are down almost 6 percent in just the first two weeks of the year.”

That decline in the price of WTI crude oil could also be fueling expectations for the narrowing of the WTI-Brent spread, which still remains “substantial” at more than $14, Roy noted.

Chart courtesy of StockCharts.com

The $1.04 billion ETF—the largest and most liquid fund in the segment—invests in near-month Nymex futures contracts on WTI crude oil, offering investors exposure to the price of oil through a basket of derivatives.

That’s to say that USO’s returns can be different from the performance of spot oil prices, but the fund is a good indicator of the oil market’s short-term supply and demand dynamics.

Recommended Stories