Vanguard: ETF Investors Pay Higher Fees than Mutual Fund Investors

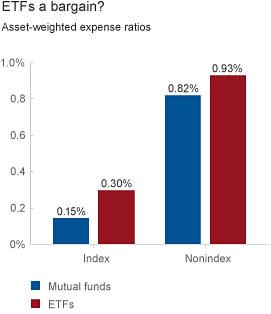

One of the oft-cited “value propositions” of ETFs is that they are lower cost than traditional mutual funds. While this may be true when you use simple averages for all ETFs and all mutual funds, the opposite picture emerges when you asset-weight the averages, showing what investors are actually paying.

In fact, investors in index ETFs pay an expense ratio that is twic eas high as investors in traditional index mutual funds.

How is that possible? First, it’s important to understand that the vast majority of ETFs (97%) are indexed, while only 13% of traditional mutual funds are indexed (Morningstar, Inc., as of February 28, 2013).

The chart below separates index and active strategies and shows asset-weighted expenses (as a percentage of assets) paid by investors. ETFs, the supposed bastion of lower costs, are more costly in both categories—by significant margins.

Source: Morningstar, Inc., as of February 28, 2013.

Given the pervasive marketing pitch about ETFs being lower cost than traditional mutual funds, this may be a surprise. There are a few reasons that help explain this result:

Traditional mutual funds offer lower-cost share classes for accounts with larger minimum balances, bringing down the average.

The index ETF category includes a larger proportion of assets in alternatively weighted index strategies, which generally charge higher fees than traditional indexing.

The index ETF category also includes many strategies based on physical commodities, which are generally not available in traditional mutual funds and tend to charge higher fees.

The missing link: ETF sponsors’ profits paid by investors

Even so, I can hear the shouting now. “But … but … but … ETFs are lower cost than mutual funds because the sponsor doesn’t have to interact with thousands or millions of individual shareholders.” Or: “Traditional funds are lower simply because Vanguard, with its at-cost management structure, currently has a larger market share in index mutual funds than among ETFs.”

Yep … that’s the point.

Even though a fund sponsor’s operating costs for managing an ETF may, indeed, be lower than those for managing a similar traditional mutual fund, that doesn’t necessarily translate into lower costs for ETF investors. As my high school English teacher liked to scrawl in red ink across my paper, “can” (as in “can” charge less) and “will” have very different meanings.

Most ETF sponsors need to generate a profit for their own investors. As a result, the expense ratios they charge will include both the cost of managing the fund and a profit margin for the management company’s owners.

In Vanguard’s case, the management company is owned by its funds. After operating costs, all other profits are returned to the funds’ shareholders through lower costs. The result: Vanguard’s ETF dollar-weighted expense ratio is 0.12% as of February 28, 2013, compared with the 0.30% industry average shown above.

Even though many may argue the ETF structure leads to lower costs than mutual funds, it’s really the structure of the investment and the ETF provider’s pricing strategy that determine the costs that investors may pay. The debate of ETFs versus mutual funds is quite often simply a debate about the costs of indexing versus active. When looked at on a more apples-to-apples basis, ETFs and mutual funds can both provide access to low-cost index strategies. Further cost differences can be potentially explained by higher expense ratios used to pay additional profits to investors in the management company.

Joel M. Dickson, Ph.D., is a senior investment strategist and a principal in Vanguard Investment Strategy Group, where he analyzes trends and developments in the ETF market and provides research and commentary on issues related to ETFs.