Vanguard Sold Shares in 7 of Top 10 Quarterly Transactions

- By David Goodloe

Seven of Vanguard Health Care Fund (Trades, Portfolio)'s top 10 second-quarter transactions were divestitures or reductions, including its most noteworthy deal of the quarter.

Warning! GuruFocus has detected 7 Warning Sign with PFE. Click here to check it out.

The intrinsic value of PFE

Vanguard's largest transaction of the quarter was its divestiture of Pfizer Inc. (PFE), a New York-based pharmaceutical company. Vanguard sold its 7,267,526-share stake for an average price of $33.58 per share. The divestiture had a -0.48% impact on Vanguard's portfolio.

Barrow, Hanley, Mewhinney & Strauss is Pfizer's leading shareholder among the gurus with a stake of 53,724,766 shares. The stake is 0.89% of Pfizer's outstanding shares and 2.43% of the guru's total assets.

Pfizer has a price-earnings ratio of 29.9, a forward P/E of 15.5, a price-book ratio of 3.7 and a price-sales ratio of 4.6. GuruFocus gives Pfizer a Financial Strength rating of 6/10 and a Profitability and Growth rating of 6/10 with return on equity of 11.56% that is higher than 65% of the companies in the Global Drug Manufacturers - Major industry and return on assets of 4.62% that is higher than 54% of the companies in that industry.

Pfizer, whose quarterly results beat Wall Street expectations, sold for $36.39 per share Tuesday. The DCF Calculator gives Pfizer a fair value of $13.06.

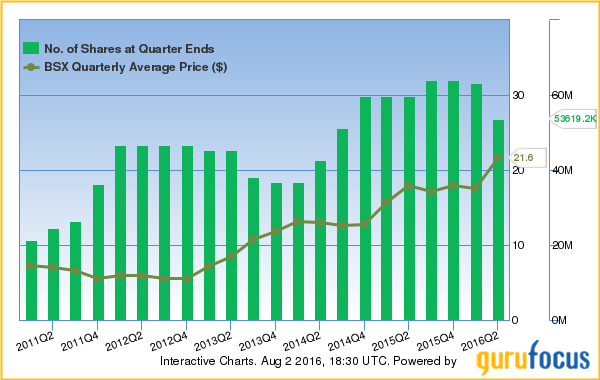

Vanguard trimmed its stake in Boston Scientific Corp. (BSX), a medical equipment company based in Marlborough, Massachusetts, by 9,603,200 shares. Vanguard sold the shares for an average price of $21.59 per share in a deal that had a -0.4% impact on Vanguard's portfolio.

The remaining stake of 53,619,190 shares is 3.95% of Boston Scientific's outstanding shares and 2.65% of Vanguard's total assets. Vanguard remained Boston Scientific's leading shareholder among the gurus.

Boston Scientific has a forward P/E of 22.9, a P/B of 5.3 and a P/S of 4.3. GuruFocus gives Boston Scientific a Financial Strength rating of 4/10 and a Profitability and Growth rating of 5/10 with ROE of -5.39% that is lower than 54% of the companies in the Global Medical Devices industry and ROA of -1.94% that is higher than 50% of the companies in that industry.

Boston Scientific sold for $24.17 per share Tuesday. The DCF Calculator gives Boston Scientific a fair value of $-2.78.

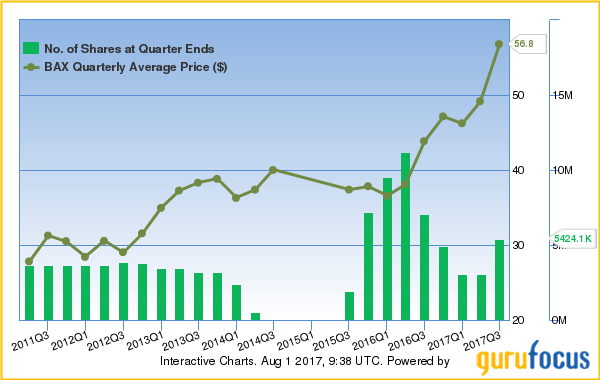

Vanguard sold nearly 37% of its stake in Baxter International Inc. (BAX), a medical equipment company based in Deerfield, Illinois. The guru sold 4,123,500 shares for an average price of $43.82 per share. The deal had a -0.37% impact on Vanguard's portfolio.

Vanguard's remaining stake of 7,053,480 shares is 1.28% of Baxter's outstanding shares and 0.68% of Vanguard's total assets. Daniel Loeb (Trades, Portfolio) is Baxter's leading shareholder among the gurus with a stake of 53.85 million shares. The stake is 9.75% of Baxter's outstanding shares and 20.37% of Loeb's total assets.

Baxter has a P/E of 5.5, a forward P/E of 30.5, a P/B of 3 and a P/S of 2.3. GuruFocus gives Baxter a Financial Strength rating of 7/10 and a Profitability and Growth rating of 7/10 with ROE of 58.61% that is higher than 98% of the companies in the Global Medical Instruments & Supplies industry and ROA of 21.16% that is higher than 96% of the companies in that industry.

Baxter sold for $48.48 per share Tuesday. The DCF Calculator gives Baxter a fair value of $170.18 with a 72% margin of safety.

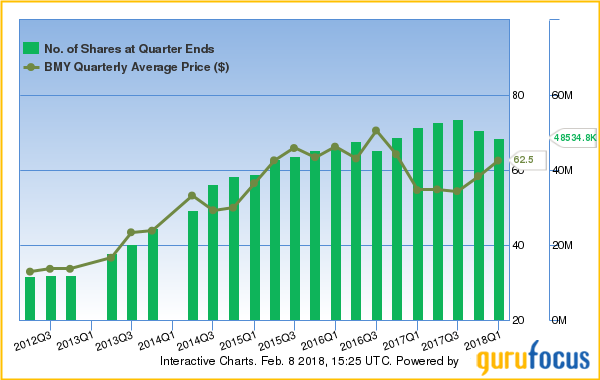

Vanguard pared its stake in Bristol-Myers Squibb Company (BMY), a New York-based pharmaceutical company, by more than 5% with the sale of 2,497,500 shares for an average price of $70.56 per share. The transaction had a -0.35% impact on Vanguard's portfolio.

The remaining stake of 45,257,309 shares is 2.71% of Bristol-Myers' outstanding shares and 7.05% of Vanguard's total assets. Vanguard is Bristol-Myers' leading shareholder among the gurus.

Bristol-Myers has a P/E of 44, a forward P/E of 29.8, a P/B of 8.6 and a P/S of 7.3. GuruFocus gives Bristol-Myers a Financial Strength rating of 6/10 and a Profitability and Growth rating of 4/10 with ROE of 19.45% that is higher than 63% of the companies in the Global Drug Manufacturers - Major industry and ROA of 8.96% that is higher than 57% of the companies in that industry.

Bristol-Myers sold for $75.05 per share Tuesday. The DCF Calculator gives Bristol-Myers a fair value of $18.19.

Vanguard sold nearly 31% of its stake in Becton Dickinson & Co. (BDX), a New Jersey-based medical equipment company. The guru sold 835,000 shares for an average price of $163.71 per share. The deal had a -0.28% impact on Vanguard's portfolio.

The remaining stake of 1,868,387 shares is 0.88% of Becton Dickinson's outstanding shares and 0.67% of Vanguard's total assets. Vanguard is Becton Dickinson's leading shareholder among the gurus.

Becton Dickinson has a P/E of 47.2, a forward P/E of 18.5, a P/B of 4.9 and a P/S of 3.1. GuruFocus gives Becton Dickinson a Financial Strength rating of 5/10 and a Profitability and Growth rating of 7/10 with ROE of 11.11% that is higher than 69% of the companies in the Global Medical Instruments & Supplies industry and ROA of 3.01% that is higher than 57% of the companies in that industry.

Becton Dickinson sold for $176.43 per share Tuesday. The DCF Calculator gives Becton Dickinson a fair value of $40.02.

Becton Dickinson is scheduled to release its third-quarter fiscal 2016 earnings on Aug. 4.

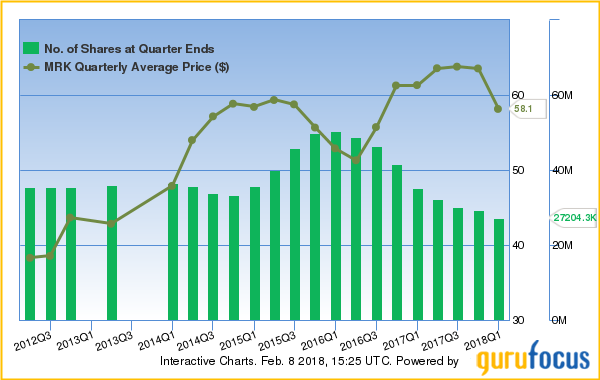

Vanguard trimmed its stake in Merck & Co. Inc. (MRK), a pharmaceutical company based in New Jersey, by nearly 5%. The guru sold 2,228,280 shares for an average price of $55.73 per share. The transaction had a -0.26% impact on Vanguard's portfolio.

The remaining stake of 46,499,820 shares is 1.68% of Merck's outstanding shares and 5.68% of Vanguard's total assets. Vanguard is Merck's leading shareholder among the gurus.

Merck has a P/E of 32.3, a forward P/E of 15.8, a P/B of 3.7 and a P/S of 4.2. GuruFocus gives Merck a Financial Strength rating of 6/10 and a Profitability and Growth rating of 6/10 with ROE of 11.24% that is higher than 61% of the companies in the Global Drug Manufacturers - Major industry and ROA of 5.01% that is higher than 54% of the companies in that industry.

Merck sold for $58.33 per share Tuesday. The DCF Calculator gives Merck a fair value of $19.37.

Vanguard reduced its stake in UnitedHealth Group Inc. (UNH), a Minnesota-based managed health care company, by more than 3% with the sale of 793,800 shares for an average price of $133.27 per share. The deal had a -0.23% impact on Vanguard's portfolio.

The remaining stake of 22,668,200 shares is 2.38% of UnitedHealth's outstanding shares and 6.78% of Vanguard's total assets. Vanguard is UnitedHealth's leading shareholder among the gurus.

UnitedHealth has a P/E of 22.6, a forward P/E of 18.3, a P/B of 3.8 and a P/S of 0.8. GuruFocus gives UnitedHealth a Financial Strength rating of 6/10 and a Profitability and Growth rating of 7/10 with ROE of 18.03% that is higher than 80% of the companies in the Global Health Care Plans industry and ROA of 5.63% that is higher than 78% of the companies in that industry.

UnitedHealth sold for $143.17 per share Tuesday. The DCF Calculator gives UnitedHealth a fair value of $93.65.

Disclosure: I do not own stock in any of the companies mentioned in this article.

Start a free seven-day trial of Premium Membership to GuruFocus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 7 Warning Sign with PFE. Click here to check it out.

The intrinsic value of PFE