What's in Store for Advance Auto Parts' (AAP) Q2 Earnings?

Advance Auto Parts Inc. AAP is expected to report second-quarter fiscal 2016 results on Aug 16. In the last quarter, the company posted a negative earnings surprise of 3.83%. Let’s see how things are shaping up prior to this announcement.

Factors Influencing This Quarter

Advance Auto Parts drives profits through its relentless focus on store expansion. During fiscal 2015, the company opened 121 stores. In the first-quarter fiscal 2016, the company opened 13 stores. The increase in store count ensures higher availability of parts to customers, thereby leading to higher sales volume.

For fiscal 2016, Advance Auto Parts expects comparable store sales growth to be in the range of negative 3% to 5%, lower than the previous forecast of low-single digits growth and flat comparable store sales in fiscal 2015. It no longer expects to achieve its adjusted operating margin target of 12% and free cash flow of $500 million. Weak annual guidance reduces optimism about any improvement in the company’s second-quarter results as well.

In addition, Advance Auto Parts faces challenges from rising new vehicle sales and price competition. This can adversely affect the company’s quarterly results.

Earnings Whispers

Our proven model does not conclusively show that Advance Auto Parts is likely to beat earnings this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. This is not the case here as you will see below:

Zacks ESP: The Earnings ESP represents the difference between the Most Accurate estimate and the Zacks Consensus Estimate. Advance Auto Parts’ Earnings ESP is -0.94% because the Most Accurate estimate stands at $2.12, while the Zacks Consensus Estimate stands higher at $2.14.

Zacks Rank: Advance Auto Parts carries a Zacks Rank #4 (Sell). We caution against stocks with a Zacks Rank #4 or 5 (Sell-rated stocks) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

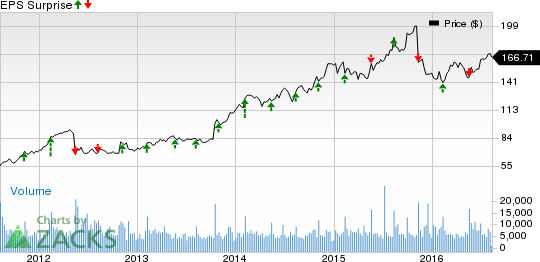

ADVANCE AUTO PT Price and EPS Surprise

ADVANCE AUTO PT Price and EPS Surprise | ADVANCE AUTO PT Quote

Stocks to Consider

CarMax Inc. KMX has an Earnings ESP of +3.45% and a Zacks Rank #3. The company’s second-quarter fiscal 2017 (ended Aug 31, 2016) financial results are expected to release on Sep 21.

AutoZone, Inc. AZO has a Zacks Rank #3 and will report its fourth-quarter fiscal 2016 (ended Aug 27, 2016) financial numbers on Sep 22.

Navistar International Corp. NAV carries a Zacks Rank #3 and is expected to report its third-quarter fiscal 2016 (ended Jul 31, 2016) results on Sep 7.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CARMAX GP (CC) (KMX): Free Stock Analysis Report

ADVANCE AUTO PT (AAP): Free Stock Analysis Report

AUTOZONE INC (AZO): Free Stock Analysis Report

NAVISTAR INTL (NAV): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research