WisdomTree: Identifying the Best Opportunities on Earnings Yield Basis

Historically, one way to view the attractiveness of equities is to compare them to another major asset class: bonds. One model for gauging equity valuations—dubbed the “Fed Model”—compares the earnings yield (E/P ratio, or the inverse of the P/E ratio) to a long-term bond yield.

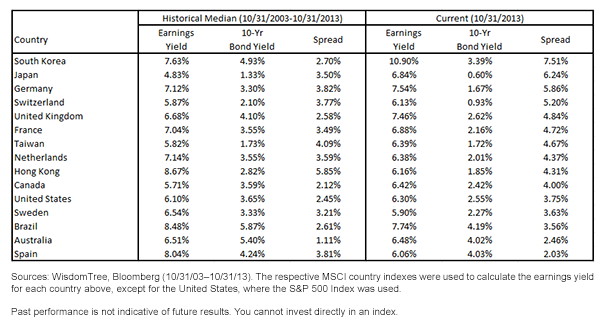

There are clearly different risks associated with equities and bonds, but essentially one is judging the relative value of one security against another. In the table below, I will look at the current earnings yield, bond yield and the spread for the world’s 15 largest countries by market capitalization 1 to get a sense of relative valuation.

• A higher earnings yield indicates a lower valuation because investors are essentially getting more earnings per share, so countries that exhibit a higher earnings yield are more attractively priced compared to their own history.

• The same can be said about countries that have a higher earnings yield to bond yield spread; these countries are currently selling at lower relative valuations compared to their own history in terms of asset classes.

Figure 1: Earnings Yields vs. Bond Yields

For definitions of indexes in the chart, please visit our Glossary.

• South Korea Had Highest Earnings Yield – With an earnings yield over 10%, South Korea had the highest earning yield and the highest spread of all the countries listed above. It is also impressive that the current spread is almost three times larger than its own 10-year historical median spread. The equities are currently selling at lower valuations (higher earnings yield), and the bonds at higher valuations (lower yield), compared to their own history. For those looking to accentuate a focus on the earnings yield as a potential indicator of a valuation opportunity for South Korean firms, an earnings-weighted approach could be of particular interest when considering different ways to build an Index of these stocks.