WisdomTree: Interest Rate Differentials Imply the British Pound May Weaken

In assessing the fair value of a currency, interest rate differentials play a significant role in determining a currency’s valuations. The trend in interest rate movements in the United States and the United Kingdom suggests that recent strength in the British pound (GBP) cannot be explained by the change in interest rates and thus may be considered unwarranted.

What’s the Link?

Interest rates impact currencies because a rise in domestic real interest rates will attract foreign capital inflows, thereby bringing on an appreciation of the domestic currency. This implies that the relative movements matter—and as interest rates rise, the currency theoretically should move in the same direction.

Creating a Model to Explain Currency Moves

In order to quantify the impact of interest rate differentials on the British Pound, we ran a regression model that relates interest rate differentials to currency moves. This model can potentially help us determine if the currency is over- or undervalued relative to what the interest rate differentials imply.

This model is based on the historical relationships between the British pound and its interest rate differentials 1 and is no guarantee of future performance. However, this type of model analysis can provide a quantifiable framework to assess whether a currency’s current valuations appear to be stretched based on past trends.

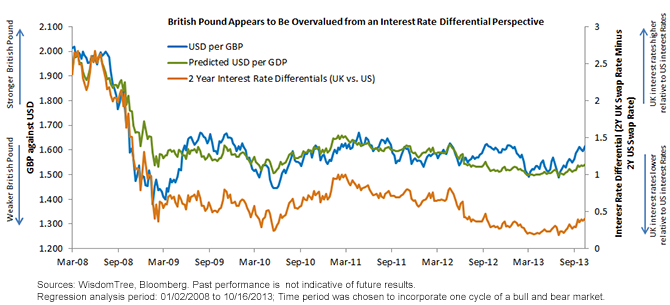

Below is a chart of the GBP exchange rate along with interest rate differentials and what the model implies the level of the GBP would be based on the changes in interest rate differentials. The model shows a substantial link between interest rate differentials and the currency, as will be discussed below.

• The two-year interest rate differentials are a significant factor explaining currency changes with a positive relationship—i.e., that when two-year rates rise in the UK compared to the U.S., the British pound tends to strengthen against the USD. The two-year interest rate differentials (orange line) have been on a downward trend, implying that two-year rates in the UK, while higher than those of the U.S., have been on a decline since 2011.