Yacktman Fund Trims Media and Technology Empire in 1st Quarter

- By James Li

Jason Subotky and Donald Yacktman (Trades, Portfolio)'s son Stephen, current portfolio managers of the AMG Yacktman Fund (Trades, Portfolio), invest in growth companies at low prices. During first-quarter 2017, the fund managers trimmed their positions in seven media and technology companies: Viacom Inc. (VIAB), Oracle Corp. (ORCL), Twenty-First Century Fox Inc. (FOXA), Microsoft Corp. (MSFT), Cisco Systems Inc. (CSCO) and Corning Inc. (GLW).

Warning! GuruFocus has detected 4 Warning Sign with VIAB. Click here to check it out.

The intrinsic value of VIAB

Viacom

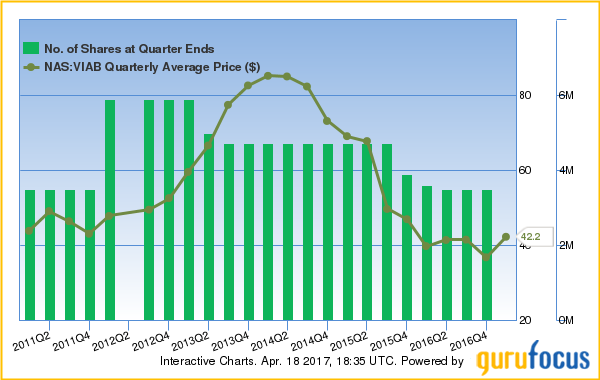

Subotky and Yacktman eliminated their 3.5 million-share stake in Viacom, a global media company with leading cable networks like Nickelodeon and MTV. The stock averaged $42.21 during the quarter, and the managers pared 1.85% of their portfolio with this transaction.

Although the company has a profitability rank of 8, Viacom's operating margin and return on assets are near a 10-year low. The company's operating margin has declined 4.2% per year on average during the past five years.

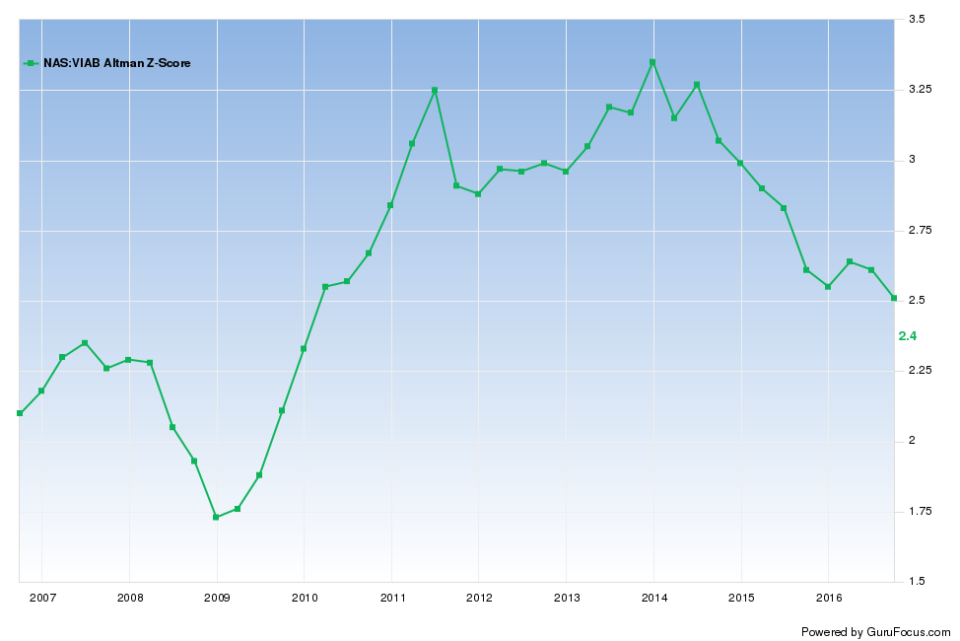

Viacom's financial strength ranks a poor 4 out of 10, suggesting a weak financial outlook. The company's cash-debt ratio and interest coverage suggest that Viacom has moderate to severe financial distress even with an Altman Z-score of 2.47. Additionally, Viacom's cash-debt ratio underperforms 94% of competitors.

Oracle

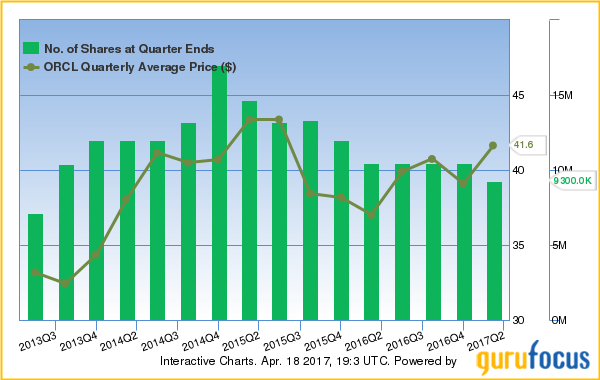

The fund managers trimmed 11.43% of their Oracle position, selling 1.2 million shares at an average price of $41.64.

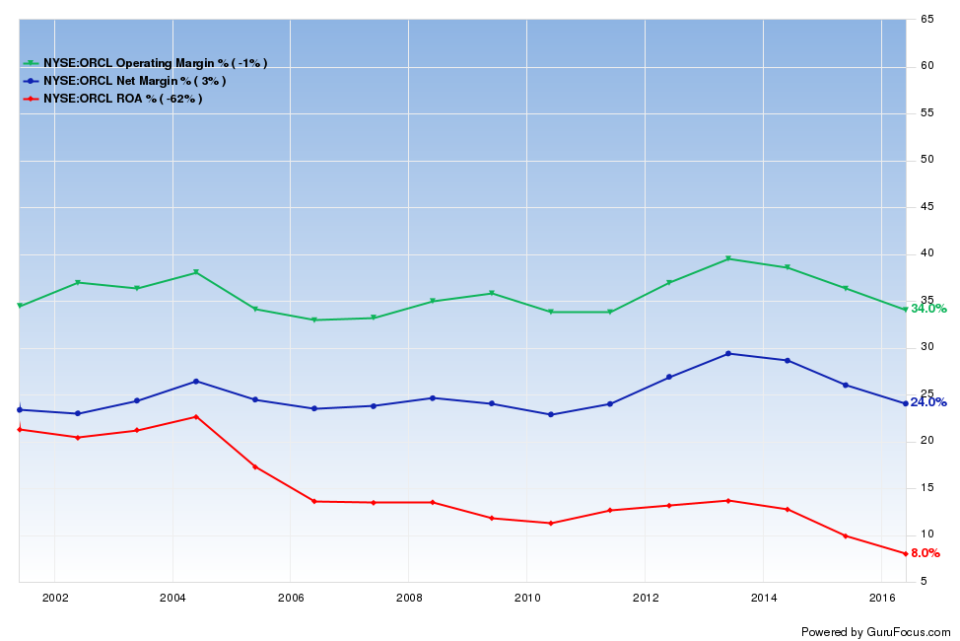

Oracle has a profitability rank of 7, suggesting good growth potential. The company's operating margin and net margin outperform over 93% of competitors. Although the company has consistent revenue per share growth, Oracle's GuruFocus business predictability rank is just 2.5 stars as its EBITDA per share declined during the past two years.

While the company has high profitability, Oracle's share price is near a 10-year high. Additionally, the company's price-sales (P/S) ratio is near a five-year high of 5.41 and ranks lower than 73% of competitors.

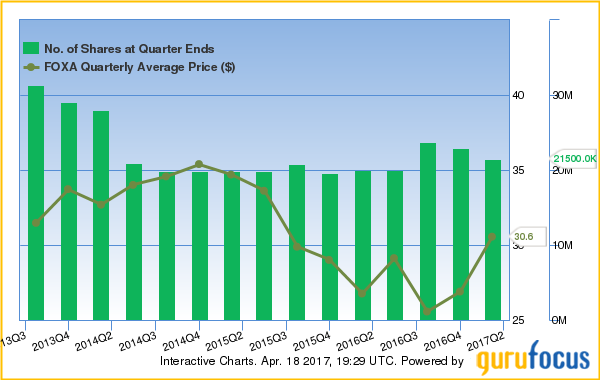

Twenty-First Century Fox

Subotky and Yacktman sold 1.465 million shares of Twenty-First Century Fox, 6.38% of their stake. During the quarter, Twenty-First Century Fox averaged $30.56 per share.

Although the media conglomerate has a profitability rank of 9, Fox's financial strength ranks a modest 5 out of 10. The company's interest coverage is barely above Ben Graham's required threshold of 5. Worse, Fox only has 23 cents in cash per $1 in debt and an Altman Z-score of 2.27.

Fox is moderately overvalued based on its Peter Lynch chart and price-book (P/B) valuations. The company's P/B ratio ranks lower than 74% of competitors and its share price is near a 52-week high.

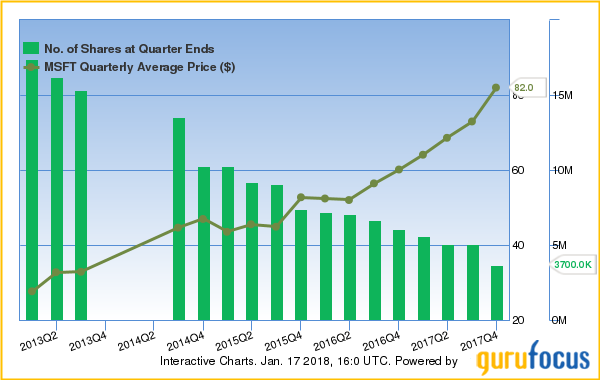

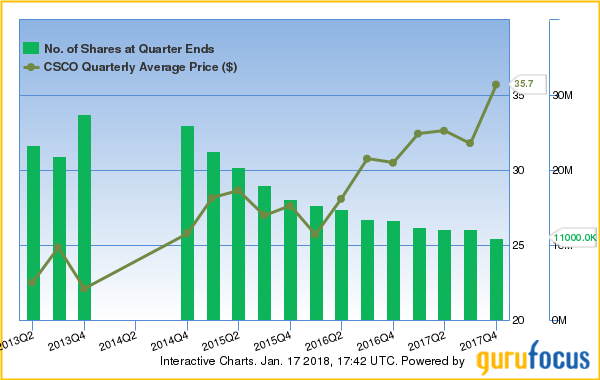

Microsoft and Cisco Systems

Yacktman's fund managers chopped 8.20% of their Microsoft stake, selling 500,000 shares at an average price of $64.09. Subotky and Yacktman also pared 6.77% of their Cisco Systems stake, selling 900,000 shares at an average price of $32.43.

Microsoft has three severe warning signs, including a five-year operating margin decline rate of 10.3% and a five-year gross margin decline rate of 4.8%. The Washington state application software company also has valuations, including a share price and a P/S ratio both near a 10-year high.

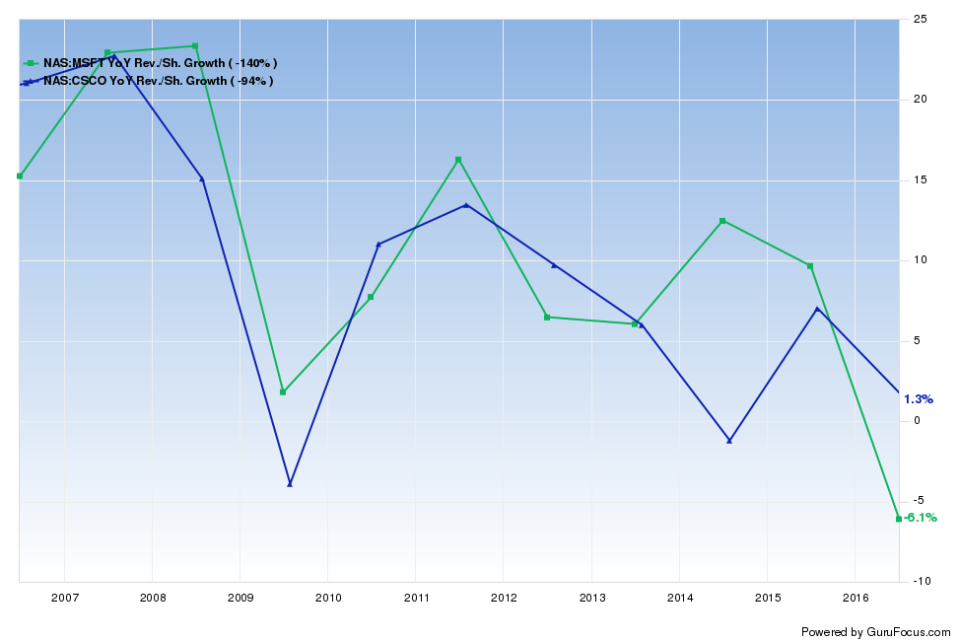

Both Microsoft and Cisco have year-over-year revenue per share growth, suggesting low growth potential for 2017. While Cisco does not trade near its 10-year maximum P/S ratio, the company's share price is still near a 10-year high.

Corning

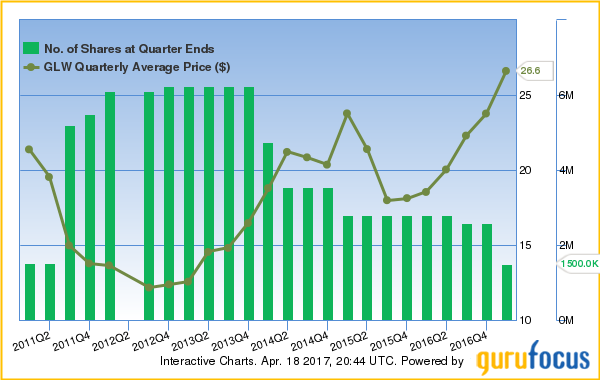

Subotky and Yacktman axed 42.31% of their stake in Corning, selling 1.1 million shares at an average price of $26.61.

While the science tech company has high financial strength and profitability, Corning's P/S ratio is near a two-year high and ranks lower than 79% of competitors. The company's forward price-earnings (P/E) ratio is higher than its trailing P/E ratio, suggesting that earnings are projected to decline in the next 12 months.

Disclosure: No positions.

Start a free seven-day trial of Premium Membership to GuruFocus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 4 Warning Sign with VIAB. Click here to check it out.

The intrinsic value of VIAB