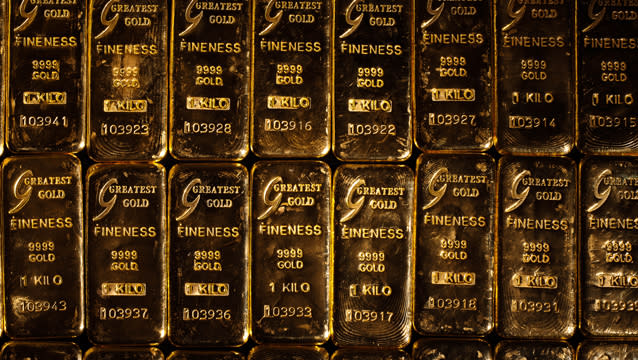

Jim Rogers: Gold Could Fall to $900 in Next 1-2 Years

The Fed may just have delivered an early Christmas present to the financial markets. After the Fed announced it would not taper its asset purchases, as many investors had expected, financial markets rallied, from stocks to bonds and even gold. While the S&P 500 surged 1.2% to a record high yesterday, gold prices have soared 5% and are at $1,367 an ounce in early morning trading Thursday.

In a statement following its meeting the Fed said it "decided to await more evidence that [economic] progress will be sustained before adjusting the pace of purchases." Fed Chairman Ben Bernanke explained in a press conference, “Conditions in the job market today still are far from what all of us would like to see," and “the tightening of financial conditions observed in recent months, if sustained, could slow the pace of improvement in the economy and the labor market.”

In response to Bernanke's comments, gold – which had been retreating in part because of expectations of tapering – is on a tear this morning.

Related: Another Gold Rally Bites the Dust

But hold on a moment.

Commodities investor Jim Rogers tells The Daily Ticker that gold, having lost its luster as a safe haven, could drop to $900 or $1,000 in the next 1-2 years. Longer term, he has a very different forecast. Gold will soar to “well beyond $1,900 an ounce,” topping its record $1,920 high reached in September 2011, says Rogers, author of Street Smarts: Adventures on the Road and in the Markets. The reason: “massive currency debasement” around the world. “Every major central bank in the world is printing a lot of money plus war, chaos, riots in the street, governments failing,” says Rogers.

Despite that forecast, Rogers warns investments not to consider gold – or any other investment — safe. “I would never use the word ‘safe’ when I’m speaking about investing.”

Watch the video above for more investment advice from Rogers.

Tell Us What You Think

Send an email to: thedailyticker@yahoo.com.

You can also look us up on Twitter and Facebook.

More from The Daily Ticker

Government Shutdown Risk is Real As Republican Minority 'Blackmails' the House: Holtz-Eakin

Will the Fed Fail Again? "Money for Nothing" Filmmaker is Worried