Dell Dealings: Now Microsoft Might Be a Player

Whether Dell (DELL) will be taken private, and at what price if so, continues to produce a variety of angles, and the latest is that one of the buyout participants could be Microsoft (MSFT).

CNBC reported that Microsoft is exploring a contribution of $1 billion to $3 billion toward a deal for Dell. No acquisition has been confirmed, but the pursuit of Dell is said to be led by private-equity firm Silver Lake Partners and Dell founder Michael Dell, reportedly for around $13 to $14 a share.

The key questions here are why would Microsoft do it and whether it would be the most sensible undertaking for the team in Redmond, Wash. Shareholders weren't terribly distressed, but they weren't applauding the notion, either. Microsoft's stock was down 10 cents at $27.15. Dell, meanwhile, was up 2.2% to $13.12.

Without question, Microsoft could afford it, and it knows Dell well, having supplied software to the computer seller for years. Even at the high end of the estimated stake and assuming a worst-case scenario of the investment one day being a total loss, $3 billion isn't going to break the company. As of June 30, Microsoft's balance sheet showed cash, equivalents and short-term investments of $63 billion.

[RELATED: What’s Dell Worth? Let’s Call It $13.61 a Share]

For Microsoft, getting closer to Dell would at a minimum ensure it remains part of whatever shape the company takes in the future without ceding ground to Linux. Like Windows, Linux is run on both Dell PCs and servers. And despite the opinion held by some that Dell is yesterday's news, it still ranks as the No. 3 PC retailer in the world, behind Hewlett-Packard (HPQ) and Lenovo, and it has a sizable position among business users. That means it's important for Microsoft to keep it close and on good terms.

However, desktop PCs aren't as key to Dell as they once were. Revenue from the product line has dropped from $21.6 billion in 2006 to $14.1 billion last year, and during that time, the segment's percent of overall sales has fallen steadily from 39% to 23% over the span. This year, analysts are looking for PC sales of around $13 billion from Dell, according to FactSet. So while it is a large player in personal computers, the tremendous competition in the sector has been making it harder on the division as the years have passed.

Source: SEC filings, FactSet

At Microsoft, of its 2012 revenue of $73.7 billion, some $18.4 billion of that was attributable to the Windows division, about three-quarters of which comes from the Windows OS on PCs. All told, Microsoft estimates that PC sales last year were flat to up 2% compared with 2011.

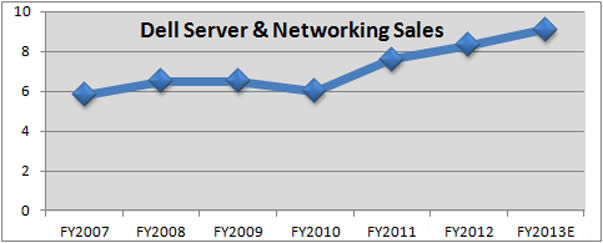

If Microsoft is hoping for actual growth, that may be more likely found on the server side. Dell's servers and networking unit had $8.3 billion in revenue last year, or 13% of the total sales, and as noted, many run Microsoft. Server sales have grown for most of the past few years at Dell, and revenue should reach $9.1 billion this year, analysts surveyed by FactSet project.

Source: SEC filings, FactSet

Microsoft's revenue from its servers and tools group has also been climbing, and last year it was $18.7 billion, up from $16.7 billion the prior year and compared with $13.2 billion in 2008.

Additionally, both Dell and Microsoft have tablet computers, meaning they can team up in that realm, but waiting for any joint effort will be Apple (AAPL), Google (GOOG), Amazon.com (AMZN) and Samsung. Making significant headway in the pad computer arena might be part of the goal here, though again, competition is no less fierce than it is in PCs, and something very special likely would be needed to displace the entrenched names.

Of course, this link-up remains speculation. What is known is that Microsoft gets involved in a lot of things, so even if this is a surprise for the day, it isn't necessarily a shock. Along with its widespread operating system, Microsoft:

Has one of the main game consoles, the Xbox.

Not that long ago paid more than $8 billion for Skype.

Signed a deal around the Nook e-reader.

Several years before Facebook (FB) went public, took a small stake in the social network.

Tried to buy Yahoo! (YHOO), the publisher of this website. After that fell apart, the two companies signed a search agreement.

CEO Steve Ballmer and his executive team stay busy, in other words. Microsoft is one of technology's most important pioneers, and the truth is if you've owned the stock since its initial public offering in 1986, you've collected an astonishing return. Recent times haven't been as good to investors -- the stock has lost 17% in the last five years, and in the past year it shows a decline of 8%. That's partly offset by Microsoft's dividend, but consistent stock appreciation hasn't been there, and neither have a great number of must-have products.

Headlines will keep coming in on Dell's potential buyout, with all manner of rumors. Fox Business reported over the weekend that the momentum had slowed, so it's necessary to remember it's not a done deal yet. In this case of old tech possibly meeting old tech, it's also not certain this would equal a bright future. The hardware Dell has isn't going away in the near term and neither is the software Microsoft builds. That said, their challenge is and will be avoiding stagnation. With PCs and tablets being the battle zone they are, servers could be the best bet.