GameStop CEO: Our Customers Want Used-Game Option

GameStop's (GME) shares were hit Wednesday as traders latched on to an updated rumor related to the Microsoft (MSFT) Xbox and whether the next version of the console might not allow for the playing of used titles, instead mandating new games and a constant connection to the Internet.

If true, the concern would be that the game seller could suffer because it does a sizable trade in used games, buying them from players and then reselling them in its stores, where they make up a not insignificant part of its revenue. In the well-known Wall Street tradition of panic first, ask questions later, GameStop lost 6% to $25.20 on almost three times the normal daily volume. At its worst, the stock had dropped 11.4% to $23.75 before mounting a partial recovery.

However, GameStop's position is that gamers don't have inordinate interest in an approach that would force them toward online play and away from products on the shelf and in the sales bin.

"We are excited about the potential of new consoles launching this year," GameStop CEO Paul Raines said in a statement. "As far as what features they may or may not have, we will have to wait until the details are officially released from the manufacturers. We do know through our survey of the PowerUp [rewards program] gamer community that a substantial majority of our customers are unlikely to purchase a next-generation console that prohibits the play of pre-owned games, limits portability or does not play new physical discs."

The sell-off started early and appeared to stem from a report on the Edge, stating that "Microsoft's next console will require an Internet connection in order to function, ruling out a second-hand game market for the platform." The article, subsequently noted by sites such as Forbes and Barron's, went on to say that physical games would be available for the new Xbox, but that sources with whom it had communicated believed these games would have activation codes required for access, giving them "no value beyond the initial user." In other words, the games would operate much the way non-game software often does now. Edge is part of Britain's Future PLC publishing group, the owner of a number of properties covering video games.

In response to an emailed request for comment, a Microsoft representative said: "We do not comment on rumors or speculation. We are always thinking about what is next for our platform, but we don't have anything further to share at this time."

The Xbox may go on sale as the holidays near late in 2013, reports have said. Meanwhile, Sony (SNE) is expected to provide details on its next PlayStation console this month. Nintendo (NTDOY), the other member of the big three hardware makers, put out its new system, the Wii U, last year.

At least one industry analyst is skeptical about the notion that a major shift is imminent, in which case game buyers and GameStop alike still have some time before they have to be overly concerned about a radical departure from the existing industry norm. The Barron's piece quoted an analyst from Piper Jaffray who predicted that while digital downloads will become a bigger part of game buying down the road, the practice "will not be a material percentage of game purchases during the next 3 plus years."

It isn't the first time speculation of this nature has emerged with regard to the next Xbox. In January 2012, Kotaku, a Gawker Media site, posted a similar report. That piece referenced an industry contact who said Microsoft probably would "incorporate some sort of anti-used game system" with the next version of the Xbox. The report was then discussed by CNET the following day. That time around, neither session was especially notable for GameStop's shares. The Kotaku report ran Jan. 25, 2012, and GameStop's stock rose 1%. The day of the CNET article, Jan. 26, the shares fell 1.2%, FactSet data show.

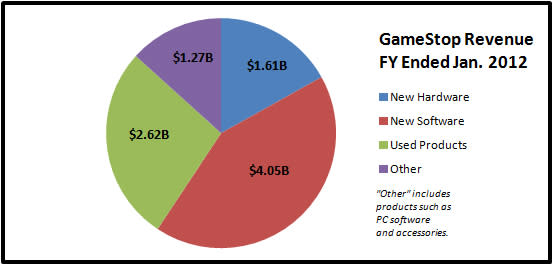

Source: GameStop Form 10-K.

The used market is important for Grapevine, Texas-based GameStop, making up around one-quarter of its sales in recent years, and it has acknowledged as much. The reason for its size is pretty simple: It's popular with game players, even if it's less so with publishers like Activision Blizzard (ATVI) and Electronic Arts (EA). In addition to leading to credit for trade-ins, used games give buyers an opportunity to play what can be very good, popular titles that are maybe a year or two old, for a price well below the original retail point. Used titles, GameStop says, have an average sale price of $18, whereas new games average $39 each.

For the fiscal year that ended in January 2012, used video game products accounted for $2.62 billion of GameStop's total of $9.55 billion in revenue, equating to 27.4% of the overall figure. Gross margins are also high -- 46.6% -- on the used side.

Microsoft's entertainment and devices division, of which the Xbox 360, Xbox Live and related products are part, had revenue of $9.59 billion in fiscal 2012.

GameStop, citing NPD Group data, said in its most recent 10-K that it believes more than 275 million game systems, covering handhelds and consoles, were owned in the U.S. at the end of 2011. In Europe it was another 173 million game platforms, based on IDG data through November of that year, the company says. As for the games themselves, domestic video game software units exceeded 2.2 billion, GameStop estimated at the time. Considering the number of consoles and games out there, it's hard to see the landscape for used titles changing markedly just yet or the demand deteriorating.

Shares of GameStop have traded between $15.32 and $28.35 in the past year. Before the most recent session, the last time they fell further in a single day was a 6.1% decline in March 2012.