McDonald’s Downgrade Making All-Time High a Distant Memory

A Lazard Capital Markets analyst has cut his rating on McDonald's (MCD), saying the stock no longer warrants a buy rating based on an expected drop in same-store sales amid firmer competition from the likes of Burger King (BKW) and Wendy's (WEN).

Matthew DiFrisco now has a neutral rating on the stock, and his comments sent the shares down 1.1% to $86.07 Monday. While that pullback isn't exactly a drubbing, it's another step down for McDonald's, already one of the worst performers on the Dow Jones Industrial Average in terms of its stock price in 2012. With its year-to-date slide of 12.5%, only Intel (INTC) and Hewlett-Packard (HPQ) have dropped further among the index's 30 stocks.

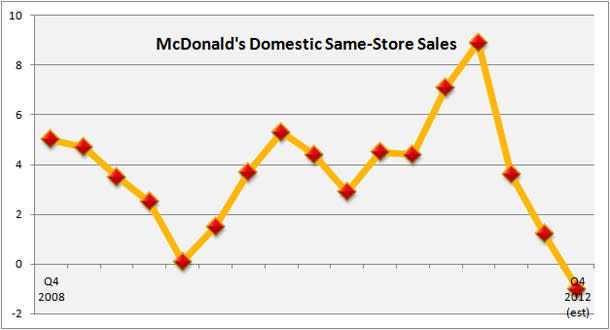

The year started out with considerable promise for McDonald's. Going back to January, the stock reached its all-time high of $102.22, and same-store sales were peaking.

(Quarterly data from FactSet)

Since then, however, the trend for comparable sales has been rapidly downward, as shown in the chart above, and the shares haven't been able to remain aloft.

The concerns DiFrisco has about same-store sales aren't unique. For the fourth quarter, analysts are on average expecting a decline of 1%, a reading that would make for the only negative showing in the past four years.

Earlier this month, McDonald's said its comp sales in October were down 1.8%, the first time it has had a negative monthly number since 2003. Just days later, the hamburger seller announced that Jan Fields, a long-time employee who had been McDonald's U.S. president, was out at the company.

Globally, McDonald's has also seen same-store sales fall of late, while its operating income has been hurt by foreign exchange rates against the dollar, something the company had expected to continue in the final quarter of the year. In the U.S., the problem isn't currencies, but other restaurants such as those named above, leading McDonald's to try to draw in diners with low-priced fare.

With Lazard now at a neutral rating, McDonald's has 13 buy or overweight ratings and 12 neutral-equivalent ratings, according to FactSet. The average price target is $96.67. Shares of McDonald's are trading currently about $3 above their 52-week low of $83.31.

Tell us what you think. Is 2012 a temporary setback for McDonald's, or will same-store sales, and the stock price, continue to struggle?