1 Thing Micron Has Going for It

Shares of memory chip manufacturer Micron Technology (NASDAQ: MU) are down roughly 40% since peaking earlier this year. While the company continues to produce blockbuster results, signs of an impending downturn in the memory chip markets have emerged. NAND chip prices have already tumbled, and DRAM prices could follow suit.

Cycles are nothing new for Micron. When demand for memory chips is strong, Micron can make a lot of money. The company enjoyed an operating margin near 50% in fiscal 2018, for example. But when supply outpaces demand, prices drop, and those strong margins can vanish. Micron lost money as recently as fiscal 2016 due to plunging DRAM and NAND prices.

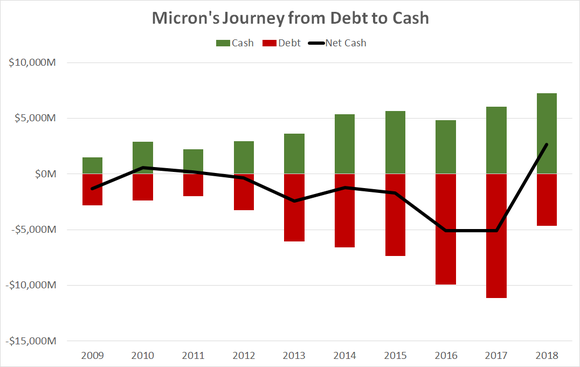

There's no telling how bad the next downturn will be, how long it will last, or even when it will begin in earnest. But there's a silver lining for Micron investors. Record-breaking cash flow over the past year has allowed the company to pay down its debt, putting the balance sheet on a solid footing to weather the coming storm.

Image source: Getty Images.

From debt to cash

Manufacturing memory chips is a capital-intensive business, requiring massive annual investments. Micron poured $8.2 billion into property and equipment in fiscal 2018, a record for the company. And although that spending can be dialed back when demand slumps, keeping up technologically with its peers requires significant investments regardless of the market environment.

Micron finances some of this heavy spending with debt, and debt levels can rise substantially during a downturn as cash flow dries up. Micron's total debt reached nearly $10 billion at the end of fiscal 2016 after the company posted a negative free cash flow of $2.6 billion in that year. The company entered that downturn with more debt than cash, exacerbating the situation.

Because the current cycle has been extremely strong and profitable for Micron, the company's balance sheet today is a completely different story. Micron now has far more cash than debt, which gives the company some breathing room as the market begins to turn.

Data source: Micron.

Micron bought back or converted nearly $7 billion of debt in fiscal 2018, fueled by free cash flow topping $9 billion for the year. The $2.6 billion of net cash on the balance sheet is the highest ever for the company. While a strong balance sheet won't protect Micron from the next downturn, it does buy the company some flexibility.

Earnings are on tap

Micron is scheduled to report its fiscal first-quarter results after the market closes on Dec. 18. The company expects its revenue to come in at the low end of its previous guidance and for its earnings per share to come in at the high end of its guidance. That would put revenue around $7.9 billion and adjusted EPS around $3.02.

Both of those numbers are up from a year ago but down from the fourth quarter, a reflection of softening conditions in the memory markets. Micron's massive share buyback program will likely boost per-share earnings, although it will eat up cash that could have been used to pay down debt further.

Micron's outlook is unlikely to be rosy, and the stock has more room to fall if the market continues to lose faith in the company. But long-term investors can take solace in the fact that Micron is much better positioned today than it was at the start of the last memory chip downturn.

More From The Motley Fool

Timothy Green has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.