10 Cold Weather Stocks to Heat Up Your Returns

One of the perks of living in Southern California is that you don’t occupy the same reality as most Americans. Lately, a winter chill has brought on record-breaking temperatures throughout the midwest and the east coast. From my angle? All I can think about is cold weather stocks to buy.

Well, that’s not true. Over the past few days, I’ve noticed that the temperature has started to rise, necessitating my car’s air-conditioning system. Therefore, it’s also time for me to start thinking about upgrading my wardrobe to something more appropriate for February: T-shirts, board shorts and flip-flops.

For the rest of you, I can only shrug my shoulders and say that life isn’t fair. But that doesn’t mean you have to take Mother Nature — or the polar vortex — lying down. Amid this deep freeze, cold weather stocks provide an opportunity to advantage this otherwise miserable condition.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Moreover, this category is broader than you might think. For instance, several retail stocks perform better in colder temperatures, and I’m not just referring to the holiday season. In addition, some food stocks have an inverse correlation to the thermometer. Apparently, humans adopt hibernation strategies from bears in adverse conditions.

So pull up an easy chair — if you can thaw it from your floor — and let’s discuss some of the best cold weather stocks!

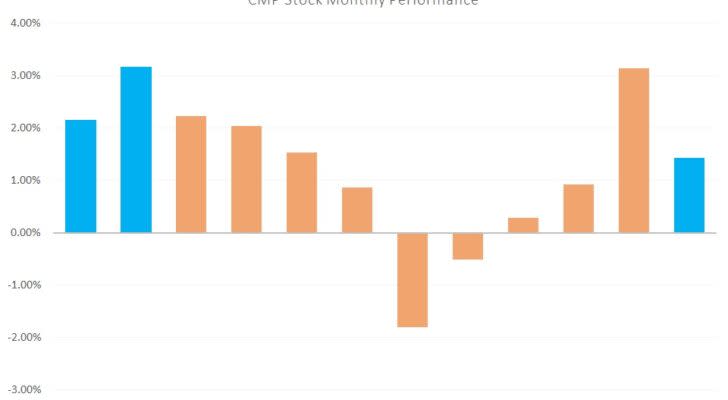

Compass Minerals International (CMP)

For most folks, Compass Minerals International (NYSE:CMP) is hardly what you call a household name. But when the weather turns wintry, you’d be completely lost without this Compass. As one of the largest producers of highway salts, CMP stock represents an indispensable investment for the thermally challenged.

Better yet, Compass is quantifiably one of the best industrial stocks to buy during a morbid chill. On average, CMP stock generates annual returns of 1.3%. However, in the typically cold months of the year (December through February), CMP averages nearly 2.3%.

As you might expect, shares noticeably dip as the seasons turn warmer. Therefore, keep Compass Minerals in mind for the next winter chill.

Toro (TTC)

Another component within industrial stocks, Toro (NYSE:TTC), is a second obvious choice for inclement weather. Specializing in turf-maintenance equipment, Toro offers a fleet of snow-removal equipment. While we have no use for that stuff in my neck of the woods, TTC stock is a lifesaver for most other Americans.

Again, what I love about Toro is the same attribute that I love for Compass Minerals: the company truly lives up to its status as one of the best cold weather stocks to buy. From December through February, TTC stock averages returns of 4.6%. For the entire year, it drops to 2.9%.

If this record-breaking chill lasts longer, you can expect Toro to at least warm up your portfolio.

Public Service Enterprise Group (PEG)

Aside from companies that directly benefit from cold weather, your next best bet is utility stocks. When the thermometer displays ungodly numbers, folks can’t do anything but turn on the heat. Not only that, they’re willing to pay the price.

With such a captive audience, you really need to check out Public Service Enterprise Group (NYSE:PEG). Yes, it’s a cynical play among cold weather stocks, but it’s also an effective one. Throughout the year, PEG stock averages 1.5%. However, in December and January, that average jumps to 2.8%.

Given that the current weather trends appear incessant and international, keep a close eye on PEG stock.

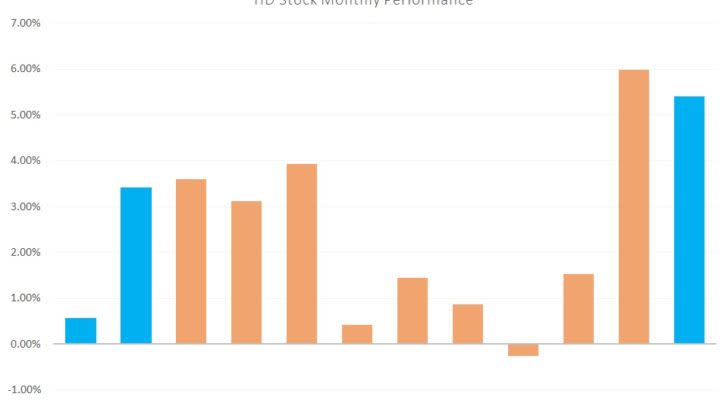

Home Depot (HD)

Among temperate-region dwellers, Home Depot (NYSE:HD) doesn’t strike us as belonging to a list of cold weather stocks. However, when conditions turn brutally inclement, people must stock up on supplies. Fundamentally, that should drive HD stock higher.

Sure enough, the technical data seems to support the thesis. On average, HD stock jumps noticeably higher in November and December as compared to the rest of the year. Plus, February’s haul of 3.4% is notably better than the annual average return of 2.5%.

As a word of caution, I wouldn’t chase Home Depot based on individual natural disasters. However, as a general inclement-weather opportunity among retail stocks, HD simply delivers.

Netflix (NFLX)

Bad weather and freezing temperatures aren’t usually what you associate with tech stocks. However, content-streaming giant Netflix (NASDAQ:NFLX) is simply gold during brutal winter seasons. After all, what better way to wait out the storm than binge-watching your favorite programs?

On average, NFLX stock generates annual returns of around 4.4%. However, the company generates a wild 20.1% in January.

Of course, we must caveat this unusual dynamic. Due to timing issues, Netflix has largely avoided bad news at the beginning of the year. In addition, the company has limited historical data.

That said, the cold weather months generally do better for NFLX stock, so don’t ignore the potential here.

AutoZone (AZO)

For drivers who live in sun-drenched locales, our maintenance requirements are straightforward. So long as we don’t drive like idiots, oil changes and tire replacements will last us quite a while. But during extreme weather, specialized retail stocks like AutoZone (NYSE:AZO) provide a critical service.

Usually, AZO stock generates stronger returns in colder months. For example, November and December average returns of 4.5%. In contrast, the rest of the year averages 1.8%. The anomaly here is January, which loses 2.4%. However, February picks up the slack at 3.1%.

I must say that I’m not the biggest fan of AZO stock at this price point. However, as an opportunity among cold weather stocks, AutoZone offers a fundamentally intriguing case.

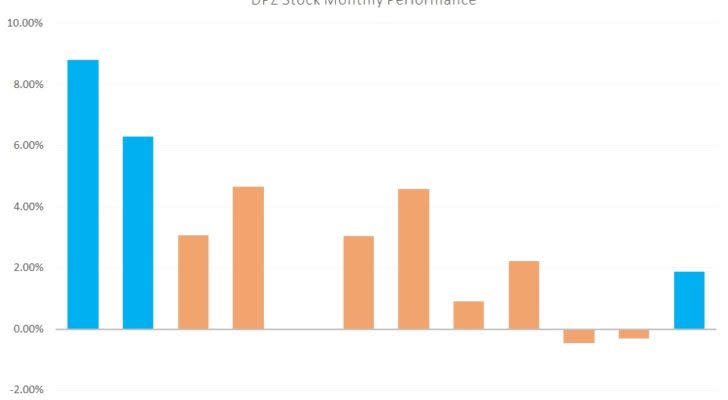

Domino’s Pizza (DPZ)

In my opinion, Domino’s Pizza (NYSE:DPZ) is a feel-good story among cold weather stocks. Most folks recognize DPZ stock as the comeback kid. Certainly, they’ve revamped their entire organization from top to bottom. And with the weather like it is right now, DPZ is sure to fly.

After all, what could be a better during a frigid winter than a piping-hot pepperoni pizza straight from the oven? Indeed, it’s not just my anecdotal offering. Apparently, DPZ stock has a strong inverse correlation with the thermometer. From December through February, shares average 5.7%. For the rest of the year, it’s 2.9%.

Should the winter chill last longer than expected, keep close tabs on Domino’s Pizza. If nothing else, keep their phone number handy should you need to order a pie yourself.

McDonald’s (MCD)

Similar to Domino’s, you want to think about food stocks when the thermometer goes negative. According to scientific research, we often get hungrier during the winter season. That’s great news for fast-food giant McDonald’s (NYSE:MCD).

In fact, the reinvigorated McDonald’s brand has all the right menu items during a cold spell: various burgers, delectable French fries, and of course, one of the most familiar house coffees in the business. Plus, MCD stock generates significantly higher returns during the cooler half of the year.

If that wasn’t enough, McDonald’s also offers a decent dividend yield at 2.6%.

VF Corp (VFC)

Last month, I featured VF Corp (NYSE:VFC) in my list of shares to buy in February. Contrary to many other retail stocks, VF Corp enjoyed strong international sales despite the ongoing U.S.-China trade war. I must give serious props to VFC stock for pulling that trick off.

But as a potential high-flyer among cold weather stocks, VF has plenty to offer. Thanks to its North Face brand, the company will likely report huge sales in the upcoming quarter. In addition, VFC stock historically performs well in bad weather. January and February returns average 4.8%, while the rest of the year sees 2.7%.

And like McDonald’s, VF Corp offers a nice 2.5% dividend to give weary investors some confidence.

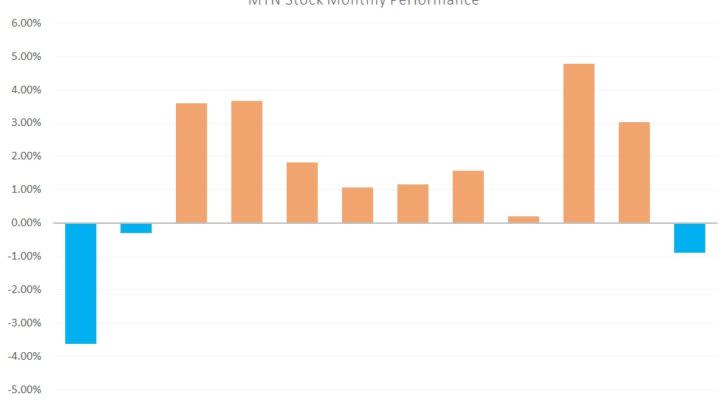

Vail Resorts (MTN)

Rounding out our list of cold weather stocks is Vail Resorts (NYSE:MTN). As the company’s name suggests, MTN stock thrives on winter sports. However, Vail Resorts is an incredibly-risky trade due to last year’s meltdown.

That said, opportunistic folks may want to pay attention here. Unlike the other companies on this list, MTN stock doesn’t usually perform well during the typical cold months. Instead, it sees a huge rise in March and April.

Because Vail has been beaten down so much over the past few months, a substantive turnaround might materialize. That gamble becomes even more tantalizing when you realize that its “sweet spot” is just around the corner.

As of this writing, Josh Enomoto did not hold a position in any of the aforementioned securities.

More From InvestorPlace

The post 10 Cold Weather Stocks to Heat Up Your Returns appeared first on InvestorPlace.