2 Cheap Dividend Stocks You Shouldn’t Miss

The technology sector's average dividend yield is just 1.2% because companies in this sector try to stay ahead of the curve by reinvesting earnings into their business, with top-line growth and market share gains as their top priorities. In fact, industrial goods and healthcare are the only two sectors that rank below tech when it comes to yields. But there are certain names in the tech sector that could be an income investor's dream.

In this article, I look at two such tech stocks -- Cisco Systems (NASDAQ: CSCO) and Seagate Technology (NASDAQ: STX) -- that carry nice dividend yields. What's more, both companies are cheaply valued, so investors don't have to pay outrageously to take advantage of their fat yields.

Image Source: Getty Images.

Cisco Systems

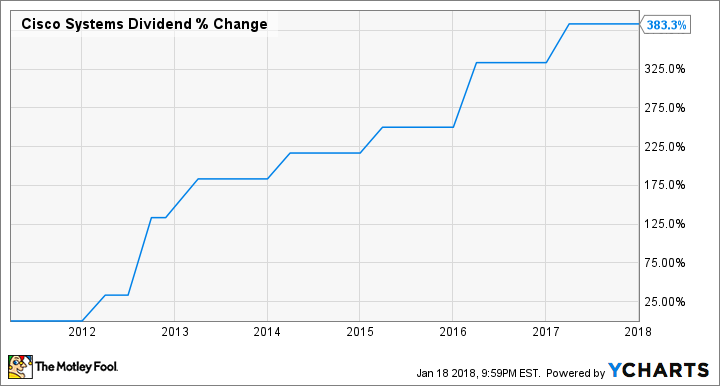

Cisco has been paying a dividend since 2011, and has raised it every year.

CSCO Dividend data by YCharts

The stock currently sports a forward annual dividend yield of 2.8%, significantly higher than the technology sector's average. More important, its payout ratio of 52.5% isn't too aggressive, either, so it shouldn't have much difficulty in sustaining its dividend.

But investors need to know that Cisco is in the midst of a transformation. The company has realized that it needs to change its business model from selling devices such as routers and switches to software-centric offerings, so it has become more flexible and has started software sales independent of the underlying hardware.

This transformation hasn't been without pain for Cisco. In the last reported quarter, its net income grew 3% year over year to $2.4 billion even though revenue dropped 2%. But the outlook for the second quarter calls for year-over-year revenue growth between 1% and 3%, indicating that things are gradually getting better.

The good news is that Cisco's switch toward software is gaining traction. It got 32% of its revenue from recurring sources in the last-reported quarter, an increase of 3 percentage points from the year-ago period. A higher proportion of recurring revenue bodes well for Cisco, because its spending on customer acquisition and servicing will ideally drop. This is probably why the company's earnings increased despite a shaky top-line performance last quarter.

More important, the contribution of recurring revenue sources to Cisco's top line will keep increasing given the growth in its deferred revenue. Last quarter, the company's deferred revenue related to software and subscription sales increased 37%, outpacing the 10% jump in overall deferred revenue.

Analysts expect Cisco's bottom line to grow at almost 9% a year over the next five years, which is substantially higher than the 4.8% growth it has clocked over the last five. So Cisco looks well positioned to keep raising its dividend in the long run as the shift in its business model will accelerate bottom-line growth, making the stock an enticing pick considering its valuation.

Cisco trades at 21.5 times last year's earnings, significantly below the 34.9 industry average. The stock's forward earnings multiple of 16.8 makes it even more attractive, since it points toward a stronger earnings performance going forward.

In all, Cisco's business is moving in the right direction, making it a top pick for investors looking for a cheap dividend-paying stock.

Seagate Technology

Storage specialist Seagate Technology sports a really fat dividend yield of 4.9%. It has been paying a dividend for 15 years now, though its last dividend hike came almost three years ago. Still, investors shouldn't be complaining, because the size of the company's dividend is quite substantial.

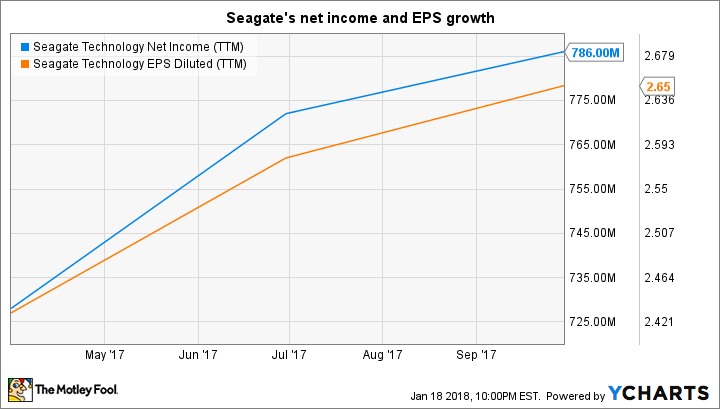

Its payout ratio of 58.3% looks very aggressive when compared to rival Western Digital, which has a 16.4% payout ratio. But Seagate seems quite capable of maintaining its impressive payout, or even increasing it down the line because of its focus on earnings growth.

STX Net Income (TTM) data by YCharts

Seagate's net income rose 8.3% year over year during the first quarter of fiscal 2018, with its gross margin coming in at 28%. The company's gross margin during the second quarter will rise to 30%, while its operating expenses will drop in the ballpark of 3% to 5% sequentially. So Seagate looks set for stronger earnings growth once again, a trend that it should be able to maintain for a long time.

Seagate is benefiting from the broader industry trend of an increase in the average storage capacity of drives, which is helping it push down costs. The company shipped 88 exabytes of hard-disk drive (HDD) capacity during the recently concluded second quarter, a jump of 29% from the prior-year period.

But at the same time, HDD unit shipments were almost flat year over year at 40 million units, pushing the average capacity per HDD to 2.2 terabytes from 1.7 terabytes in the year-ago period. So Seagate is packing more memory into each hard drive to meet the rising enterprise demand, improving its cost profile.

This is because the cost per gigabyte of a drive declines as the size of the HDD increases, raising Seagate's profitability in the process. Data storage demand is expected to rise fourfold by 2025, so the average capacity of an HDD should keep rising. In fact, the possibility of a 100 terabyte HDD by 2025 cannot be ruled out as storage density increases.

Seagate, therefore, looks primed for strong earnings growth, with analysts estimating a 15% compound annual earnings growth for the next five years as compared to an annual earnings erosion of 13% during the last half-decade.

Finally, Seagate is cheaply valued. It trades at 11.9 times forward earnings, compared to the 25.5 industry average, making it an ideal pick for investors looking for a combination of earnings growth and a fat dividend at an attractive price.

More From The Motley Fool

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool recommends Cisco Systems. The Motley Fool has a disclosure policy.