2 Marijuana Stocks to Watch This Winter and Into 2019

Investor interest in marijuana stocks is flying high, thanks largely to the recent strong performance of some of the group, the legalization of recreational marijuana in Canada on Oct. 17, and the sector's rosy projected growth dynamics.

It's early in the game, so it's best to keep an open mind about which of the many marijuana companies are likely to emerge as long-term winners. That said, two cannabis stocks that are worth putting on your watchlist are Canada-based grower Canopy Growth (NYSE: CGC) and cannabis industry-focused real estate investment trust (REIT) Innovative Industrial Properties (NYSE: IIPR).

Image source: Getty Images.

Overview

Before we dig in, here's a broad overview of the two marijuana companies and their stocks.

Company | Country | Market Cap | Profitable? | Dividend | YTD 2018 / Nearly 2-Year Performance* |

|---|---|---|---|---|---|

Canopy Growth | Canada | $11.0 billion | No | N/A | 39.5% / 286% |

Innovative Industrial Properties | U.S. (San Diego) | $487 million | Yes | 2.7% | 57.9% / 173% |

S&P 500 | -- | -- | -- | 1.9% | 4.2% / 30% |

Data sources: Yahoo! Finance and YCharts. Data to 11/29/18. *Since Innovative Industrial Properties' IPO in early Dec. 2016.

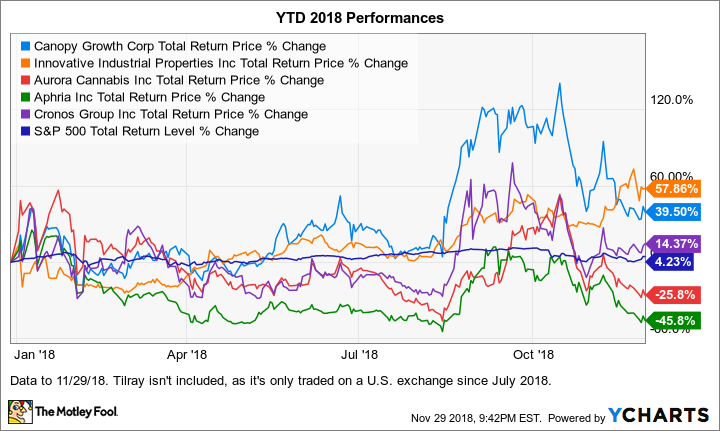

For context, the following chart shows how Canopy and Innovative Industrial Properties stocks have performed in 2018 relative to the four next largest (behind Canopy) marijuana stocks that have traded on a U.S. exchange since the beginning of the year. These are Aurora Cannabis (market cap $5.4 billion), GW Pharmaceuticals ($3.7 billion), Aphria ($1.8 billion), and Cronos ($1.6 billion). GW Pharmaceuticals is a U.K.-based biopharmaceutical company focused on cannabis-based medicines, while the other three are Canopy's Canadian peers.

Data by YCharts.

Canopy Growth: The cash and big partnership king

Canopy Growth's main operation is growing, processing, and selling medical and recreational cannabis in Canada, though it also has a growing medical marijuana operation in various other countries. It's worth watching for many reasons, with several top ones including that it's an early mover in the space, has a ton of cash, and has an enviable partnership with a Fortune 500 company.

Let's expound on these points. An important early-mover advantage the company, which was founded in 2013, enjoys is that its Tweed brand is reportedly the most recognized marijuana brand in the world. Moreover, Canopy is on track to be the first mover among marijuana companies to offer cannabis-infused beverages with a major player in the beverage market. The company is working on developing such drinks -- which are expected to get the green light in Canada next year -- with its strategic partner, Constellation Brands, maker of Corona and Modelo beers.

Canopy Growth recently received $3.8 billion from Constellation when the alcoholic beverage giant increased its ownership stake in Canopy to 38%. Even before receiving all this green, Canopy had more cash on its balance sheet at the end of its most recent quarter ($332 million) than any of its peers. Its two largest peers by market cap, Tilray and Aurora, had $104 million and $114 million in cash, respectively, at the end of their most recently reported quarters.

Innovative Industrial Properties: A less risky marijuana play

Innovative Industrial Properties is a REIT focused exclusively on specialized properties used for growing and processing marijuana. The company is small, but growing fast. It currently owns 10 fully leased properties in U.S. states where medical marijuana is legal.

IIP stock offers investors a less risky way to invest in the marijuana sector. The company is profitable and pays a dividend -- two things that make it unique among players in the marijuana sector, most of which are bleeding money. Like most REITs, its dividend is quite generous -- currently yielding 2.7% -- because companies organized as REITs are required to pay out at least 90% of their income as dividends.

Innovative Industrial Properties' income stream is very predictable, thanks to the company's use of long-term, triple-net leases (tenants pay the variable expenses of property taxes, insurance, and maintenance), with built-in annual rent increases.

More From The Motley Fool

Beth McKenna has no position in any of the stocks mentioned. The Motley Fool recommends Constellation Brands and Innovative Industrial Properties. The Motley Fool has a disclosure policy.