These 2 Oil Stocks Are Built to Survive Bear Markets

Oil is a volatile commodity prone to frequent and dramatic price swings. That was made clear in 2018, when oil plunged into a bear market in just a matter of weeks in the back half of the year. Despite near-term ups and downs, though, oil remains a vital source of energy. If you are looking at the sector, you should make sure to include at least one energy company in your portfolio that can ride the highs and lows in stride. That basically means you should buy either ExxonMobil Corporation (NYSE: XOM) or Chevron Corporation (NYSE: CVX), two U.S. energy giants with real staying power.

Structure counts

In 2012, ConocoPhillips (NYSE: COP) enacted a major corporate overhaul. It spun off its downstream assets (which is what refining and chemicals businesses are called in industry lingo) so it could focus on its upstream (or drilling) business. This shift meant oil and natural gas prices were the main factor driving the company's top and bottom lines. When oil prices plummeted in mid-2014, going from over $100 a barrel to the $30 range, it wasn't long before ConocoPhillips was forced to cut its dividend.

Image source: Getty Images.

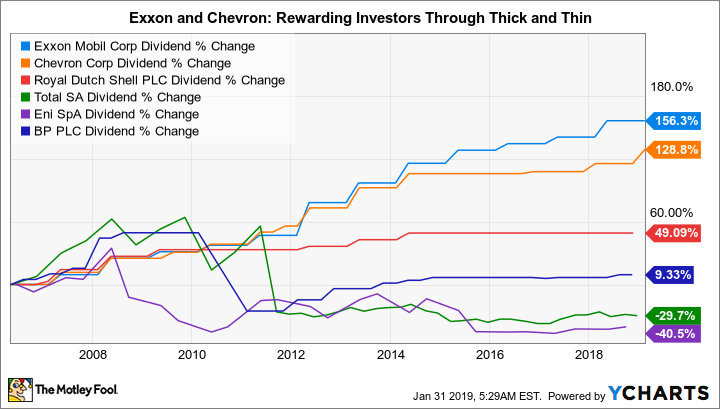

The 66% dividend cut in 2016 was a painful hit for income investors. And while ConocoPhillips has been increasing its dividend lately, that dividend cut should always be in the back of your mind, because the next oil downturn could lead to a repeat. Neither Exxon nor Chevron cut their dividends during that rough spot for the oil market.

One key reason why is that Exxon and Chevron have diversified operations encompassing both the upstream and downstream sides of the energy business. This is important because the refining and chemicals businesses they operate use oil and natural gas as key inputs. Low prices, then, are a net benefit because they lead to lower operating costs on the chemicals and refining side.

To put a number on that, Exxon's upstream earnings declined nearly 75% in 2015. But the company's downstream earnings roughly doubled, helping to offset the hit from low oil prices and limit the company's overall earnings decline to just 50% or so. And in 2014, 2015, and 2016, Exxon was able to raise its dividend. Chevon, which is a little more heavily weighted toward oil drilling, hiked its dividend at the end of 2014, held its dividend steady throughout 2015, and increased it again at the end of 2016.

The foundation is vital

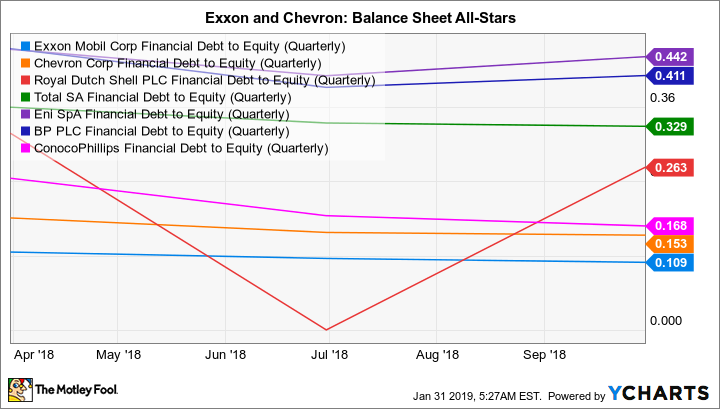

The inherent balance in these companies' business models is important, but there's another key factor to consider with Exxon and Chevron: rock-solid balance sheets. One of the best ways to see this is looking at financial debt to equity. Both Exxon and Chevron sit at the low end of their closest peers on this metric, which examines how much leverage a company uses. That's pretty much where this pair always sits when it comes to debt.

XOM Financial Debt to Equity (Quarterly) data by YCharts.

That gives Exxon and Chevron more leeway to use debt to maintain operations when energy prices inevitably fall. For example, going into the 2014 downturn, Chevron's long-term debt stood at around $20 billion, or about 12% of the capital structure. That's a very low number for any industry. To maintain its capital spending and support its dividend during that deep energy bear market, the company increased its leverage, upping long-term debt to around $35.2 billion by the end of 2016.

That 75% increase in long-term debt only pushed Chevron's long-term debt to around 20% of the capital structure -- a still reasonable, perhaps even conservative number. With oil prices up off their lows, Chevron has started to reduce its debt again. The picture at Exxon, by the way, is roughly similar, only Exxon has historically been even more conservative on the debt front.

The mixture of balanced business models and industry-leading balance sheets is what makes Exxon and Chevron so resilient to oil downturns. It helps explain why their streaks of annual dividend increases are at 36 years and 31 years, respectively. It's rare for any company in any industry to achieve a dividend record like that, let alone companies that operate in a highly volatile commodity sector.

XOM Dividend data by YCharts.

Here's the thing: Even though ConocoPhillips' financial debt to equity is similarly low today, it doesn't have the portfolio balance provided by downstream operations. And while Italy's Eni S.p.A. has a diversified business, its heavy use of leverage makes it harder for the company to get through oil price swings without taking drastic actions (like cutting the dividend during the 2014 oil downturn). One or the other isn't really enough -- a company needs a balanced business and a strong balance sheet.

Oil is volatile again, but who cares?

The steep drop in oil in the back half of 2018 is a reminder that the energy industry is volatile. Unless you are attempting to time the ups and downs of oil and natural gas (not a great long-term investment tactic for most investors), you are better off sticking to a company with a balanced business model and a conservative balance sheet. On that score, two names stand out: ExxonMobil and Chevron. If you are interested in the energy sector, one of these two stocks should be in your portfolio.

More From The Motley Fool

Reuben Gregg Brewer owns shares of ExxonMobil. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.