2 Outperforming Homebuilders to Consider as Industry Stumbles

As the market attempts to recover from the beating it has taken over the past several weeks from the Covid-19 outbreak and oil price war, value investors are hunting for opportunities to profit from. One such area could be residential construction, as the monthly measure of homebuilder sentiment emulated the escalating economic effects of the coronavirus.

While sentiment levels have remained in a tight range in the low to mid-70s for the past six months, the National Association of Home Builders/ Wells Fargo Housing Market Index reported on Tuesday that it fell to two points to 72 in March. A year ago, the index stood at 62.

Even though anything above 50 is considered positive, NAHB Chief Economist Robert Dietz said that "half of the builder responses" for the report were collected before March 4, so the full economic impact on the sector "will be reflected more in next month's report."

Consisting of three components, the index found that current sales conditions declined two points to 79, while sales expectations for the next six months fell four points to 75 and traffic of prospective buyers decreased one point to 56.

As a result, investors may want to look for investment opportunities among homebuilding companies that outperformed the Standard & Poor's 500 Index by at least 5% over the past 12 months. As of March 17, the GuruFocus All-in-One Screener, a Premium feature, found several stocks had a higher return relative to the index for the period. It also looked for companies with a business predictability rank of at least one out of five stars and a price-earnings ratio below 15.

Stocks that met these criteria were Cavco Industries Inc. (NASDAQ:CVCO) and PulteGroup Inc. (NYSE:PHM).

Both companies are among the 10 largest homebuilding and construction players in the U.S., according to the GuruFocus Industry Overview page. Other top companies in the space are D.R. Horton Inc. (NYSE:DHI), Lennar Corp. (NYSE:LEN), NVR Inc. (NYSE:NVR), Toll Brothers Inc. (NYSE:TOL), KB Home (NYSE:KBH), Meritage Homes Corp. (NYSE:MTH), M.D.C. Holdings Inc. (NYSE:MDC) and Taylor Morrison Home Corp. (NYSE:TMHC).

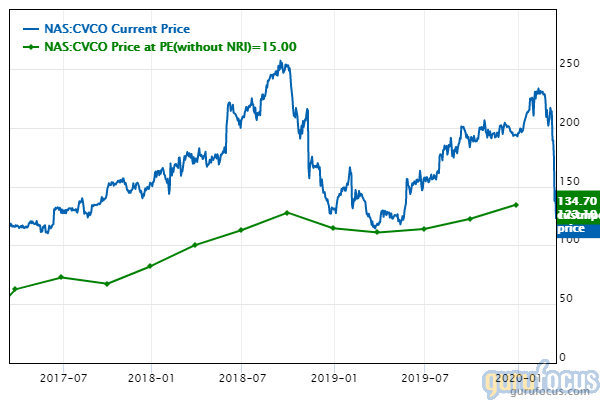

Cavco Industries

Outperforming the index by approximately 13.97% over the past 12 months, Cavco Industries has a $1.15 billion market cap; its shares were trading around $119.24 on Tuesday with a price-earnings ratio of 13.97, a price-book ratio of 1.93 and a price-sales ratio of 1.11.

The Peter Lynch chart shows the stock is trading below its fair value, suggesting it is undervalued. The GuruFocus valuation rank of 4 out of 10, however, leans toward overvaluation even though the share price and price ratios are all near multiyear lows.

The Phoenix-based company, which builds manufactured homes, modular homes, park model RVs, commercial buildings and vacation cabins, has a GuruFocus financial strength rating of 9 out of 10. It is supported by a high cash-debt ratio of 8.37 and comfortable interest coverage. The robust Altman Z-Score of 6.42 also indicates Cavco is in good standing financially.

Cavco's profitability scored a 7 out of 10 rating on the back of an expanding operating margin, strong returns that outperform a majority of competitors and a moderate Piotroski F-Score of 6, which implies business conditions are stable. It also has a one-star business predictability rank. According to GuruFocus, companies with this rank typically post an average return of 1.1% per annum over a 10-year period.

Of the gurus invested in Cavco, Mario Gabelli (Trades, Portfolio) has the largest position with 2.97% of outstanding shares. Jim Simons (Trades, Portfolio)' Renaissance Techonlogies, Ken Fisher (Trades, Portfolio), Chuck Royce (Trades, Portfolio) and Paul Tudor Jones (Trades, Portfolio) are also shareholders.

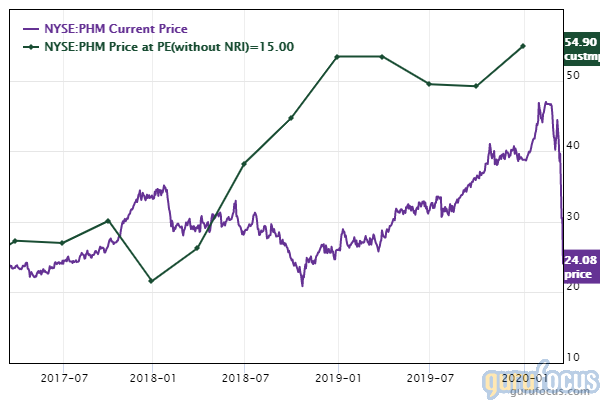

PulteGroup

Beating the benchmark by around 5.99% over the past year, PulteGroup has a market cap of $5.92 billion; its shares were trading around $22.04 on Tuesday with a price-earnings ratio of 6, a price-book ratio of 1.08 and a price-sales ratio of 0.59.

According to the Peter Lynch chart, the stock is undervalued. The GuruFocus valuation rank of 7 out of 10 also supports this assessment as its price ratios are at five-year lows.

The home construction company, which is headquartered in Atlanta, has a GuruFocus financial strength rating of 7 out of 10. Although the cash-debt ratio of 0.54 is low in comparison to its historical performance, it has comfortable interest coverage. The Altman Z-Score of 3.36 also indicates it is in good financial health.

PulteGroup's profitability scored an 8 out of 10 rating, driven by operating margin expansion, strong returns that outperform a majority of industry peers and a high Piotroski F-Score of 7, which implies healthy operations. The company also has a one-star business predictability rank despite recording a slowdown in revenue per share growth over the past year.

With 0.29% of outstanding shares, Simons' firm is the company's largest guru shareholder. Other guru investors are Pioneer Investments (Trades, Portfolio), Richard Snow (Trades, Portfolio), Ray Dalio (Trades, Portfolio), Jeremy Grantham (Trades, Portfolio) and Caxton Associates (Trades, Portfolio).

Disclosure: No positions.

Read more here:

6 Industrial Products Companies to Consider as Coronavirus Shuts Down Operations

Steven Cohen's Top 5 Holdings as of 4th-Quarter 2019

Carl Icahn Ups Stake in Occidental as Turbulent Oil Prices Send Shares Tumbling

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.